The double-dip housing plunge: 5 theories

After bouncing off their recession-time lows, home prices are sinking again. Whose fault is it?

Home prices have fallen below the bottom they hit in 2009 after the housing market collapsed, erasing a moderate bounce that had followed the recession. The S&P/Case-Shiller house price index fell by 4.2 percent in the first quarter of 2011 — to the lowest level since 2002. Economists warn that the "double dip" in home prices could force many families to slash their spending, increasing the danger that the economy could sink into recession again. What's to blame for this sputtering economy? Here, five theories:

1. Obama's stimulus did not work

The poor housing market isn't the only sign the recovery is crumbling, says Mike Brownfield at The Foundry. The economy's growth is stuck at 1.8 percent, consumer spending is slow, wages are stagnant, consumer confidence is flagging, and a surprisingly large number of people are requesting jobless benefits. This is what happens when the administration ignores free ways to fuel economic growth — like business deregulation and tort reform — and elects to instead spend $1 trillion doing "too much of the wrong things to get the economy moving again."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. Actually, politicians soured on stimulus spending too soon

Economic growth is weak, and the housing market is plagued with a glut of homes and a dearth of buyers, says Steve Benen at Washington Monthly. "Under sane circumstances, policymakers would see all of this and respond with a renewed focus on improving the economy, giving it a much-needed boost." But sanity is in short supply in Washington, and Republicans would rather use grim figures to beat up on Democrats than actually do something, such as stimulus spending, to stop the pain.

3. People bought homes they couldn't afford

Even cities that dodged the first crash are suffering now, say Derek Kravitz and Alex Veiga for the Associated Press. That's largely because so many people bought homes they couldn't afford, or lost their jobs and could no longer pay the mortgage. "Foreclosures have forced prices down so much that some middle-class neighborhoods have turned into lower-income areas within months." Prices fell less sharply during the Great Depression.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Rents are so low that people would rather lease than buy

Prices aren't falling because houses are more expensive than they should be, says Stephen Gandel at TIME. "Buying a home is more affordable than it has been in decades." The problem is that renting is even cheaper, so people would rather sign a lease than a deed. And the pain could get worse, as many economists think mortgage rates are about to go higher, which will only increase the cost of buying.

5. The bounce was never real in the first place

There was no real reason for prices to have recovered to the extent that they did, says Dina ElBoghdady in The Washington Post. "Flawed paperwork prompted some of the nation's largest banks to temporarily halt foreclosures in September, creating what many analysts called an artificial lull." Now there's a fresh wave of foreclosures, and more could be on the way, as there are roughly as many mortgages that are 90 days overdue as there are already in foreclosure. So if you think this is bad, you'd better hope we don't face a "triple dip."

-

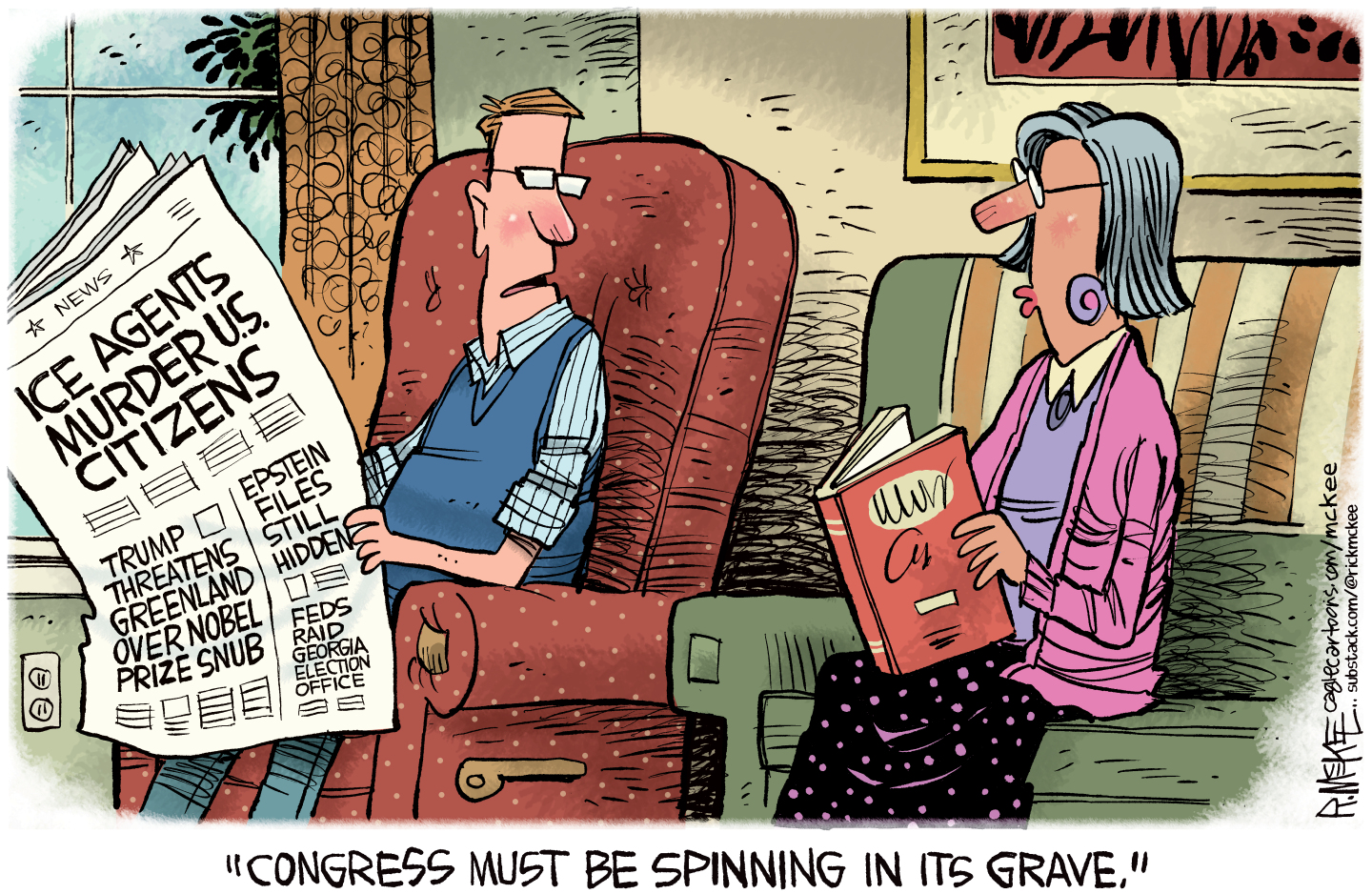

31 political cartoons for January 2026

31 political cartoons for January 2026Cartoons Editorial cartoonists take on Donald Trump, ICE, the World Economic Forum in Davos, Greenland and more

-

Political cartoons for January 31

Political cartoons for January 31Cartoons Saturday's political cartoons include congressional spin, Obamacare subsidies, and more

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities