Is it finally time for an internet sales tax?

States are increasingly requiring online retailers to collect sales tax. Should the federal government make it official?

The days of tax-free internet shopping may be numbered. More and more states are beginning to bristle over online sales tax avoidance, which costs them more than $8 billion in lost revenue every year. New York, Illinois, and Rhode Island have passed legislation forcing out-of-state retailers to charge an "e-commerce" tax on online purchases, while Massachusetts and California are considering similar laws. Some even want the federal government to force internet retailers like Amazon to collect sales tax on purchases. Is it time for a nationwide internet sales tax?

Yes, the time has come: Asking internet retailers to charge customers sales tax is a perfectly "reasonable request," says the Los Angeles Daily News in an editorial. It would fix a "basic unfairness" that penalizes local businesses while giving out-of-state retailers a free ride. The latter group won't like it, of course, but they will "still have healthy thriving businesses," even if sales tax is levied.

"Online retailers need to pony up, pay their share for sales in state."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But federal legislation is the only way to do it: Retailers have shown they won't simply roll over and pay sales tax because state legislatures say so, says the Macomb Daily in an editorial. Amazon, for example, has responded to state legislation requiring it to pay taxes by "severing ties with [its] affiliates" in those states. "The better answer is federal legislation."

"Federal law needed to collect state taxes from online sales"

States should band together to make this happen: The problem with asking retailers to pay sales tax is it's terribly complicated, says Daniel Indiviglio at The Atlantic. Their systems would have to take state and local taxes into account for all 50 states. But if states join forces to "put together a concise listing of taxes that can be provided to online retailers," they could help the process along. And at a time when states "teeter on insolvency due to budgetary woes," this is long overdue.

"Why aren't more states pursuing online sales tax?"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Dive right into these 8 underwater adventures

Dive right into these 8 underwater adventuresThe Week Recommends It’s time to make a splash

-

The world’s oldest rock art reveals hints about human migration

The world’s oldest rock art reveals hints about human migrationUnder the Radar The art is believed to be over 67,000 years old

-

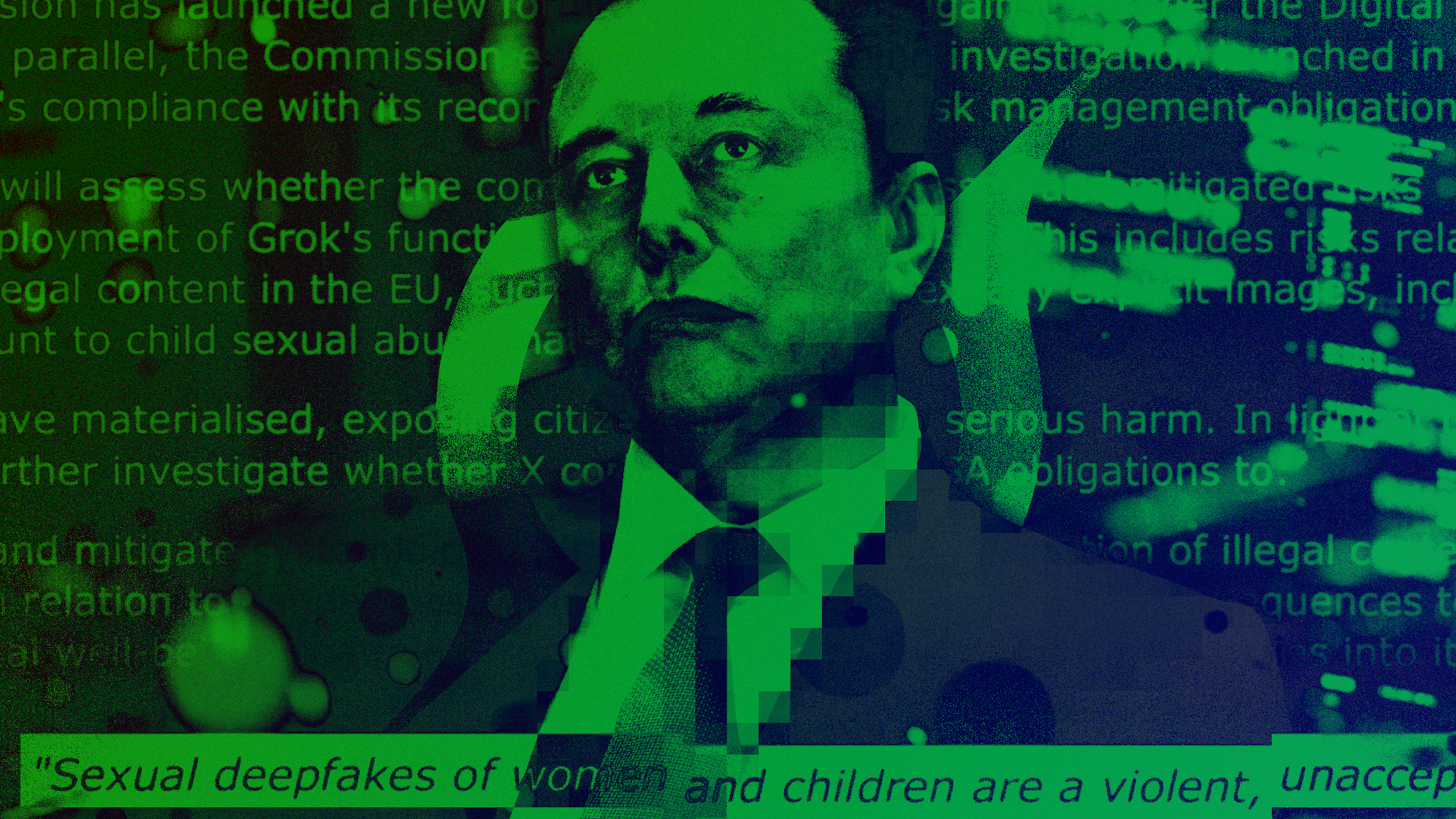

Grok in the crosshairs as EU launches deepfake porn probe

Grok in the crosshairs as EU launches deepfake porn probeIN THE SPOTLIGHT The European Union has officially begun investigating Elon Musk’s proprietary AI, as regulators zero in on Grok’s porn problem and its impact continent-wide