What the experts say

A new take on indexing; Convert your 401(k) to a Roth?; Buyers duke it out

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A new take on indexing

Index funds have made investing cheaper and easier than ever, but the best may be yet to come, said Jason Zweig in The Wall Street Journal. Next year, the University of Chicago’s Center for Research in Security Prices (CRSP) will roll out new indexes that could alleviate index funds’ “Achilles’ heel”—compulsory trading. Currently, most indexes use hard-and-fast rules about what size companies belong, and they often oust the noncomformists in “one fell swoop.” Because funds tracking the indexes must do the same, such drastic makeovers drive up trading costs and make it easy for “sharp traders” to buy into hot stocks just before the funds do. CRSP’s new line of indexes will cut down poaching and costly bulk sales by adding or eliminating companies gradually and on random days.

Convert your 401(k) to a Roth?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

With all the hoopla surrounding Roth conversions this year, you may be feeling shortchanged if most of your savings are tied up in an employer-run savings plan, said Mary Beth Franklin in Kiplinger’s Personal Finance. Don’t plan your pity party just yet. A new law lets participants in 401(k) and 403(b) plans transfer funds directly into a Roth 401(k), assuming that your employer’s plan allows for such a maneuver. If you’re 59½ or older, you can transfer everything in the account; if you’re younger, only your employer’s contributions to the account are transferable. You’ll owe taxes on the pretax money you convert, but if you make the switch before year-end, you can put the bill on layaway, paying half with your 2011 taxes and half a year later.

Buyers duke it out

Homebuyers in some parts of the country are finding that bidding wars have made a comeback, said AnnaMaria Andriotis in SmartMoney. Competition never disappeared in a few crash-resistant markets, but it’s heating up most in areas where prices appear to have hit bottom. Buyers shouldn’t be scared off by the prospect of a bidding war where prices still haven’t regained 2007 levels. A more rational approach: Research the neighborhood to see if a glut of houses for sale has squelched prices, in which case buyers could bid up the price on any one house, and it “could still sell for less than it’s worth.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

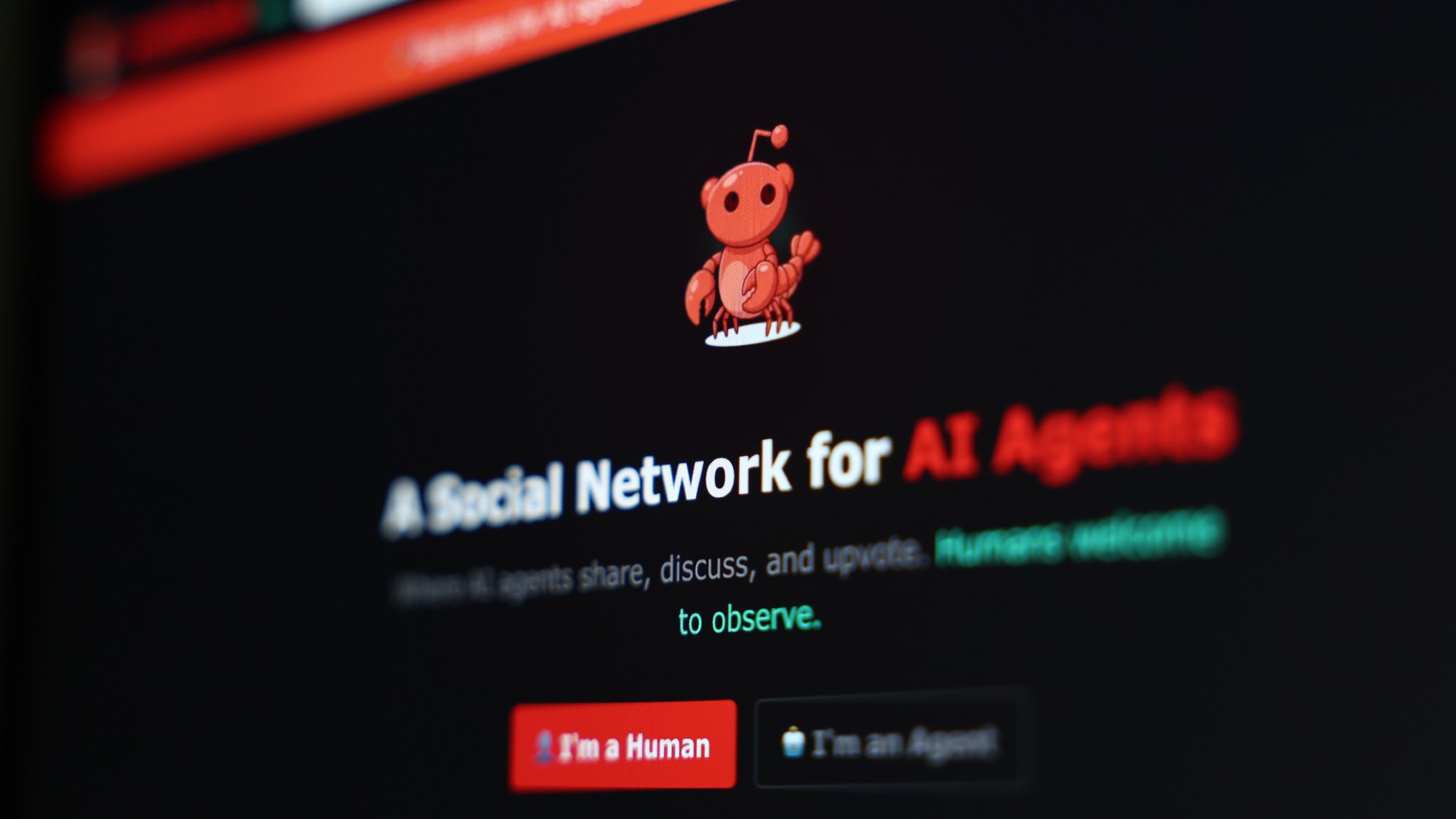

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg