What the experts say

Income investors, cheer up; Midyear tax tweaks; Sliding scale for student loans

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Income investors, cheer up

Falling interest rates have put the squeeze on “yield-hungry investors” for years, said Tom Lauricella in The Wall Street Journal. The financial crisis seemed only to make matters worse, as companies slashed or suspended dividends. But income investors are actually better off than they may think. With inflation at a mere 2 percent, yields of 4 percent now seem relatively good. And though dividends have plunged, they at least ensure a consistent return, while the market for the stocks themselves may stay depressed for some time. Diversified funds that favor dividend-paying stocks, balanced funds, and pure bond funds also promise a steady payout. Another good place to look for income is in utility funds, which recently yielded an average of 3.8 percent. Stocks in this sector “held up relatively well during the downturn,” but were passed over by the recent rally. Just don’t get so hung up on maximizing income that you neglect to make sure the fund fits your “underlying strategy.”

Midyear tax tweaks

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Taxes are probably the last thing you want to think about right now, said Eileen AJ Connelly in the Associated Press. But it’s the “perfect time” to see where you stand and make any adjustments. Start by looking at your tax withholding—or, in the case of self-employed workers, estimated taxes—to make sure you’re not paying too much or too little. This may also be a good time to brush up on new tax provisions. “The $8,000 tax credit for first-time home buyers in the stimulus bill has gotten a lot of attention,” but other newly deductible expenses include new-vehicle purchases and energy-efficient home improvements. If you haven’t already, make a point of saving receipts and begin organizing your deductions. A little work now may save you money and grief next spring.

Sliding scale for student loans

Finally there’s some good news for people struggling to pay back their college loans, said Jonathan Glater in The New York Times. This month the Education Department introduced a new program that caps borrowers’ monthly payments at 15 percent of their discretionary income—defined by the government as the difference between one’s gross income and 150 percent of the federal poverty guidelines. This “income-based repayment” plan will be available to borrowers who have federal loans or federal consolidated loans. If borrowers can’t pay after 25 years, the balance of the loan will be forgiven. Workers in public-interest jobs get an even sweeter deal. If they agree to shift their loans to the federal Direct Loan program, and make payments regularly, their student loan debt will be forgiven after just 10 years.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

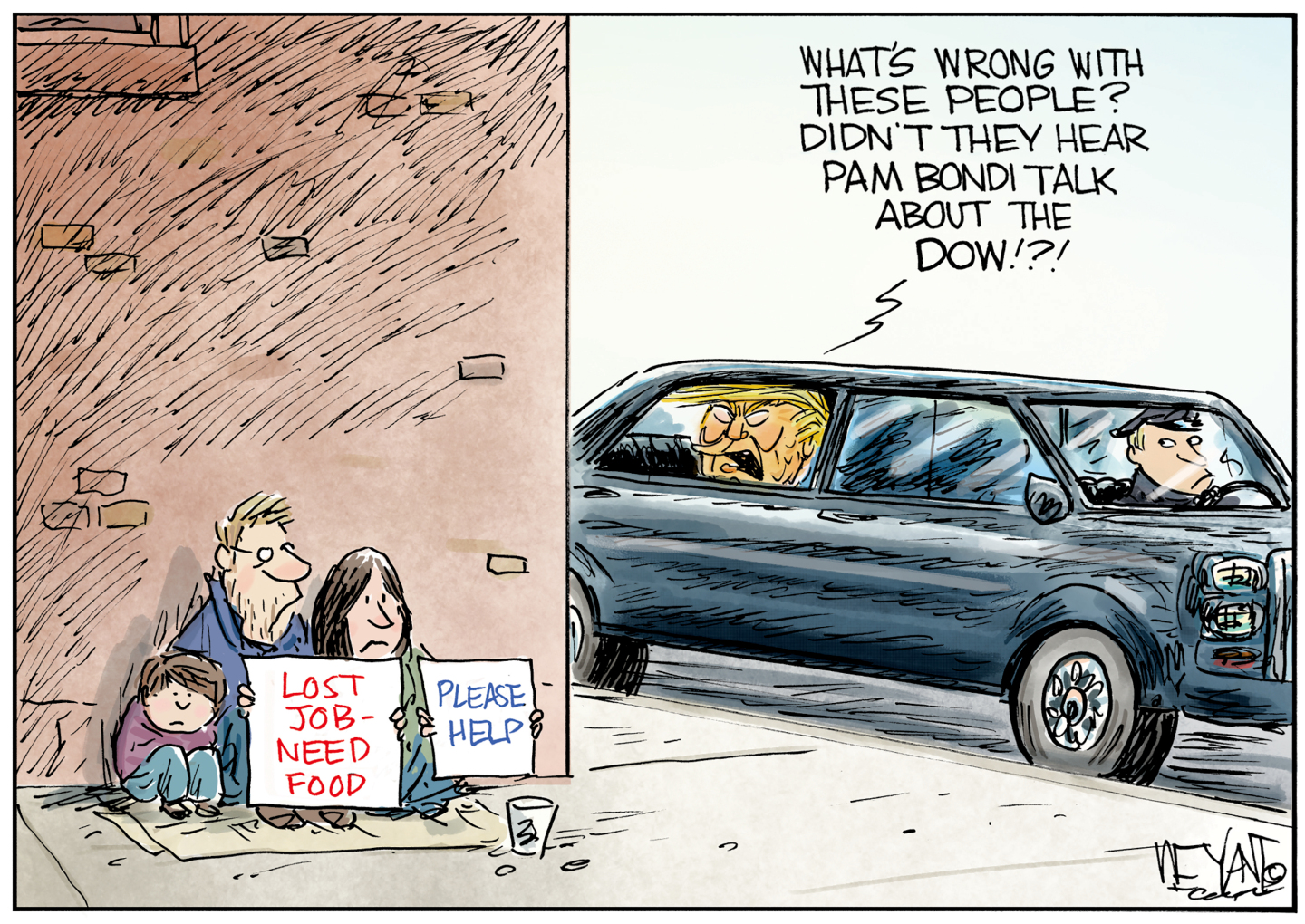

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ read

Gisèle Pelicot’s ‘extraordinarily courageous’ memoir is a ‘compelling’ readIn the Spotlight A Hymn to Life is a ‘riveting’ account of Pelicot’s ordeal and a ‘rousing feminist manifesto’