Clear Channel Settles, Sony Likes Games

Clear Channel agrees to be bought out at a reduced price, after a legal settlement with the financiers. Sony sees profits ahead for its struggling PlayStation 3 unit. And studying in Paris is going the way of the slumping greenback . . .

NEWS AT A GLANCE

Clear Channel agrees to lowered buyout price

Clear Channel Communication agreed to a buyout at the reduced price of $17.9 billion, or $36 a share, after the banks financing the deal reached a legal settlement with buyout firms Bain Capital and Thomas H. Lee Partners. When the deal was announced almost two years ago, the price for Clear Channel, the top U.S. radio broadcaster, was $39.20 a share. (AP in Yahoo! Finance) The lawsuit settled yesterday accused the six banks of reneging on providing $22.1 billion in financing, after the credit crunch made such financing more expensive. The agreement still requires shareholder approval. But Highfields Capital Partners, which owns 7.7 percent of Clear Channel, already backed the new terms. (Bloomberg)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sony returns to profit

Sony Corp., the world’s No. 2 consumer electronics maker, reported a quarterly profit of $277 million, after a loss a year ago, as it trimmed losses from its PlayStation 3 video game business. For the full fiscal 2007, Sony posted a better-than-expected profit of $3.5 billion, a record for the company. (AP in CNNMoney.com) However, Sony had an unexpected operating loss of $45 million in the quarter, amid losses in its financial services unit. (Reuters) A forecast of 20 percent growth in operating income this year, including profitability at its PS3 division, sent its stock up early today. “I don’t think we have to worry about Sony’s game business anymore,” said Naoki Fujiwara at Shinkin Asset Management. (Bloomberg)

Icahn looks at Yahoo! intervention

Billionaire investor Carl Icahn has acquired about 50 million shares of Yahoo! in the past week, and is reportedly leaning toward launching a proxy fight to replace some members of Yahoo! board. The share purchase, which gives him about 3.6 percent of Yahoo!, is designed to pressure the board into reopening merger talks with Microsoft. (Reuters) The deadline for nominating a proxy slate is tomorrow. The move carries some risk for Icahn, especially since Microsoft might not be willing to come back to the negotiating table. “We think Icahn has the resources, reputation, relationships, and mettle needed to be potentially successful,” said Standard & Poor’s analyst Scott Kessler. (Los Angeles Times, free registration)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Studying abroad shifts to emerging markets

With the dollar especially weak against the euro, the British pound, and other currencies in Western Europe, U.S. college students are increasingly opting to study abroad in Latin America, Asia, and Africa. Almost 250,000 students studied abroad in 2005-06, and the shift away from Western Europe started before the dollar’s slide. This is due largely to the increasing importance of Asia, the Middle East, and other regions in the global economy. But the weak dollar has turned the trickle into a stream. “We used to be able to say the cost of a semester abroad was the same as a semester here,” said Syracuse study-abroad spokeswoman Daeya Malboeuf. “We don’t say that anymore.” (The Wall Street Journal)

-

The best dark romance books to gingerly embrace right now

The best dark romance books to gingerly embrace right nowThe Week Recommends Steamy romances with a dark twist are gaining popularity with readers

-

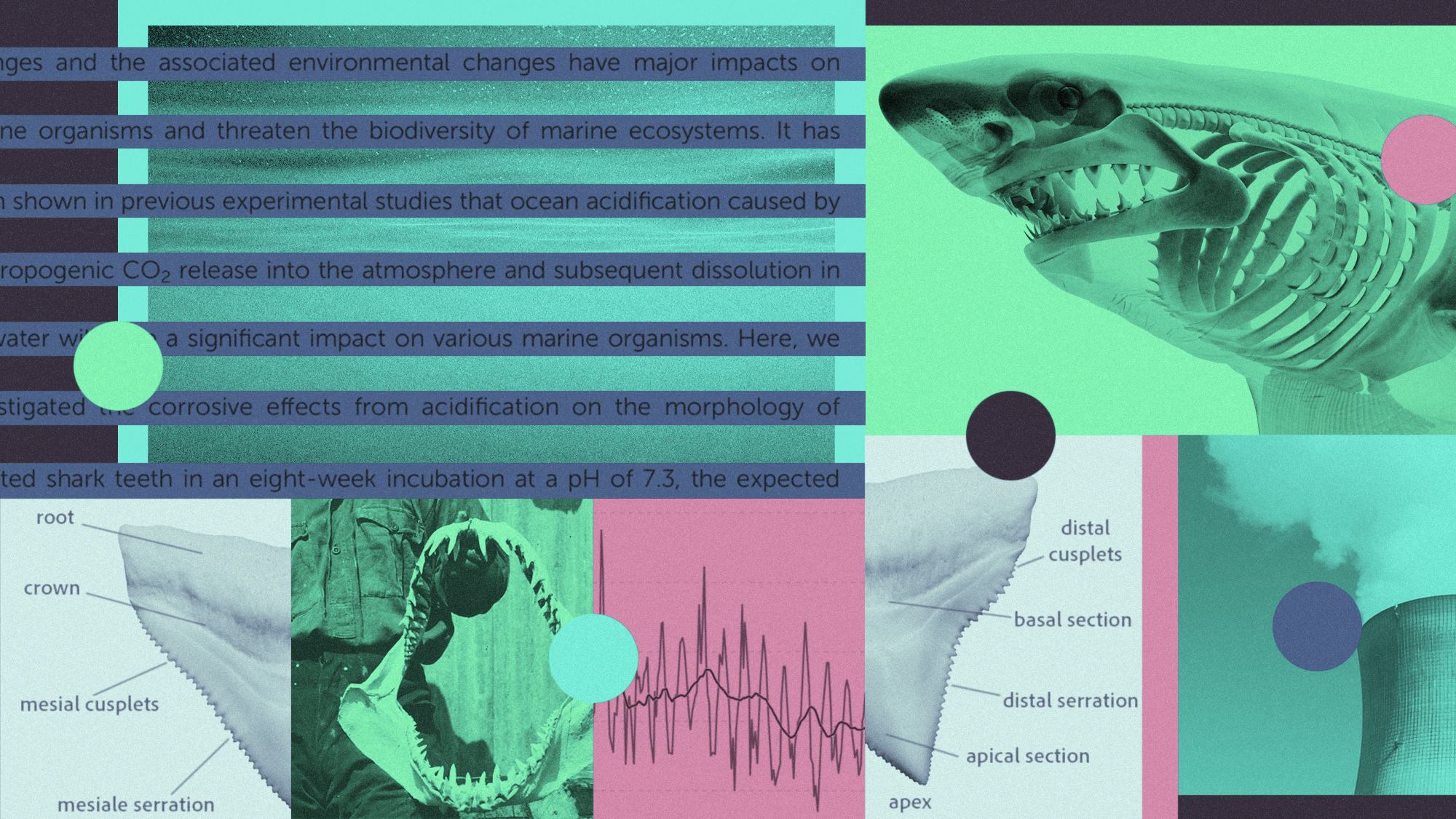

The ocean is getting more acidic — and harming sharks’ teeth

The ocean is getting more acidic — and harming sharks’ teethUnder the Radar ‘There is a corrosion effect on sharks’ teeth,’ a study’s author said

-

6 exquisite homes for skiers

6 exquisite homes for skiersFeature Featuring a Scandinavian-style retreat in Southern California and a Utah abode with a designated ski room