America's economy is doing much better than you think

What if we're measuring GDP all wrong?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

You could be forgiven for thinking that America's disappointing economic recovery is even worse than we thought.

After all, GDP growth, adjusted for inflation, increased at an annual average of just 2 percent over the past two years, according to revised government figures released Thursday. That's down from the prior 2.3 percent estimate, which itself was pretty lousy. And so far this year, growth has been even weaker, just a 1.5 percent pace.

By comparison, average GDP growth since World War II has been just over 3 percent, and 4 percent for the average post-1960 recovery. No wonder some economists think the Great Recession has given way to the Great Stagnation.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Unless it hasn't. What if things are actually a lot better than we think — or at least better than GDP figures suggest?

Think about it: Month after month, the economy is generating about a quarter million net new jobs. The unemployment rate is close to 5 percent. Corporate profit margins are at record highs, with stock values not far behind. And Silicon Valley is on fire. A new TechCrunch analysis finds that the number of unicorns — technology startups valued at over $1 billion — has more than doubled since 2013. Europe would love to have a "stagnant" economy like America's.

So why then do the all-important GDP numbers — the broadest measures of economic activity — show a perpetual funk? As The Week's Ryan Cooper explained earlier this week, measured U.S. productivity growth has been terrible during the recovery. And if output per worker isn't rising much, if at all, GDP growth is bound to be weak, too. Even worse, productivity growth has been subpar since 2004, giving little sign that the supposed IT revolution — apps, big data, digital content, social networks — is having much economic impact.

It's a puzzle for which Goldman Sachs has a simple answer: We are measuring productivity wrong, and therefore we are measuring GDP wrong. A metric devised for America's 1930s "steel-and-wheat" economy, in the words of economic historian Joel Mokyr, doesn't work so well for a rapidly growing digital economy. In a recent report, Goldman economist Jan Hatzius and Kris Dawsey note that prices of tech hardware — adjusted for quality improvements — have fallen a lot faster than those for software. This suggests software isn't improving much.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But Goldman thinks this gap is a "statistical mirage" reflecting the "amorphous" nature of software improvements. Hatzius and Dawsey ask: "How much better are the inventory management systems that retail companies contract out or develop for their own account compared with those of 20 years ago? How much better is Grand Theft Auto V than Grand Theft Auto IV? And how much more value do we now derive from our internet connection compared with a decade ago?"

As the Goldman economists reckon, then, U.S. inflation is lower than we think due to sharply falling, "quality adjusted" IT hardware and software prices — and thus real economic growth and productivity are higher. GDP growth might actually be close to 3 percent right now, which would be more in sync with what's happening in labor markets and the tech sector. Oh, and it also means real incomes are growing faster than we think, which is why the economists are "skeptical of confident pronouncements" that American living standards aren't improving as fast as they used to. By the way, new analysis by the Peterson Institute suggests worker incomes have pretty much been keeping up with productivity gains. So perhaps more good news for the 99 percent.

Now, even if Goldman's analysis is dead on, it doesn't mean policymakers should sit on their hands. For the U.S. economy to grow as fast in the future as it did in the past, it will require even faster productivity growth to offset slowing population growth. That means deep reform of our tax, regulatory, and education systems. It means more public investment in infrastructure and science. And a lot more of those unicorns.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

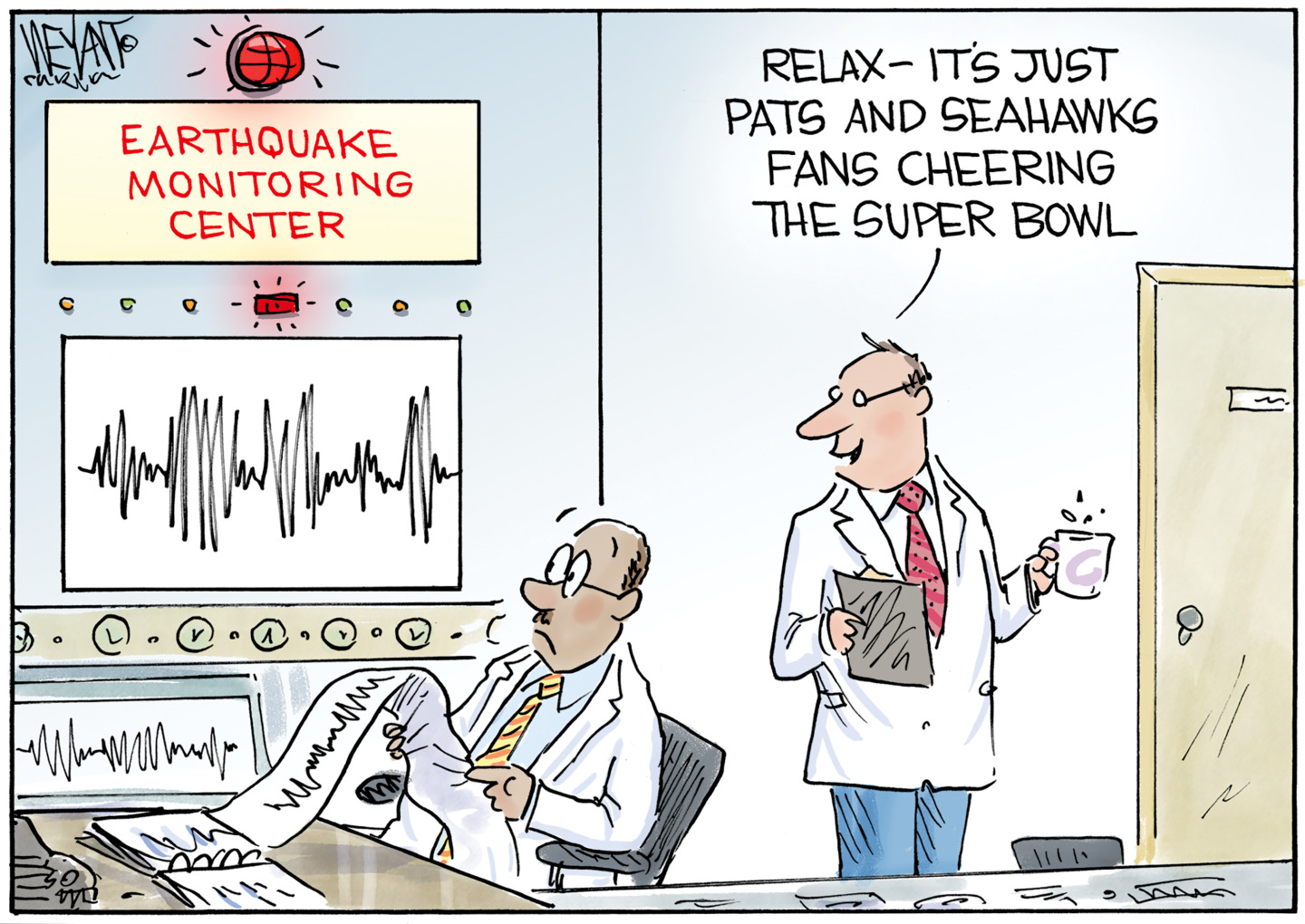

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions