America is borrowing like crazy. Don't worry.

We've got the world's largest credit limit

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Trump tax cuts are doing exactly what anyone with two synapses to rub together could have predicted: blowing up the national debt. To cover expenses in November, the United States government had to borrow $205 billion — up from $139 billion a year previously.

The centrist media is almost certainly going to start howling bloody murder about this as soon as Democrats take control of the House of Representatives next year. The implication will be that we need immediate austerity — particularly in the form of cuts to Medicare, Medicaid, and Social Security, to get the debt "under control."

This is an absolute crock. Borrowing money is not a priori a bad thing, it is a necessary tool of economic management — and one in which the error of borrowing too little is just as dangerous as borrowing too much.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

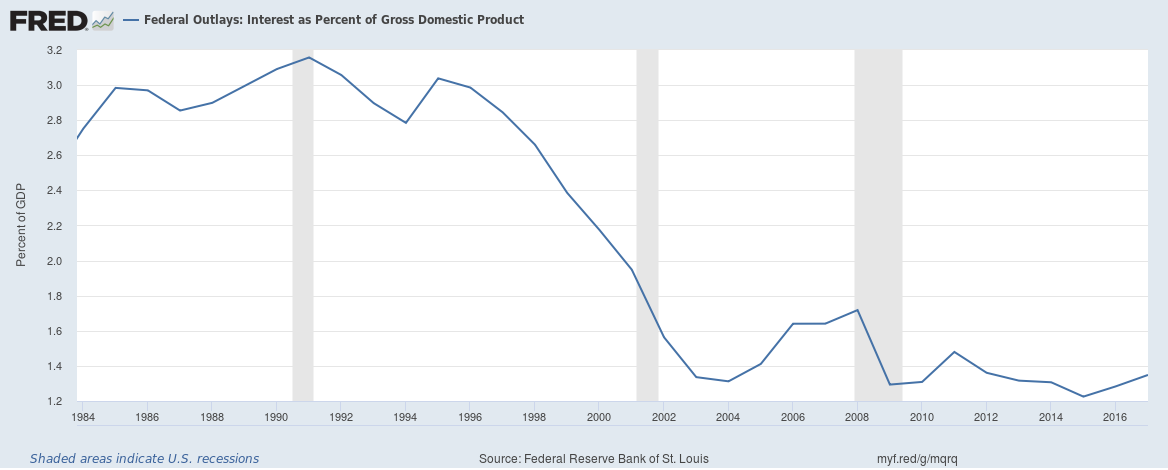

Mainstream budget reporting typically covers the national debt like this: It brings up the fact of large borrowing, asserts through a worried tone that this is bad, and implies that spending should be cut to be responsible. To see why this is wrong, let's start with the fraction of the economy going to interest payments. It has fallen by over half since the 1980s:

This is strong evidence that as an empirical matter, the United States has enormous running room to borrow. That is because it is a huge and wealthy country that borrows in a currency it can print, with a large internal market — and it controls the global reserve currency plus the key world financial center. All that means there is consistent huge demand for U.S. debt — and thus modest interest rates. We could run up trillions more in debt without risking even slight negative consequences. No need to panic.

Indeed, under the current world trade regime, slashing borrowing to zero and starving the world of dollars could easily create an economic crisis. Foreign countries need dollars to settle their international accounts, and if they aren't readily available, then they might strangle their domestic economies with high interest rates to attract what dollar-denominated assets they can, sparking a worldwide recession.

But this raises an important question: Why were debt service payments so high in the 1980s? Many blame Reagan's tax cuts — but as economist J.W. Mason explains, the major culprit was actually interest rates. And interest rates in turn were high because then-Federal Reserve Chair Paul Volcker jacked them through the roof to bring down inflation.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In other words, price increases were regarded as so harmful that the federal government ate huge extra borrowing costs to bring them down. The Fed could have stabilized borrowing costs by printing money and buying up government bonds, but that would have just pushed even more money into the economy, further fueling inflation. (Though this could have been controlled better, as I will explain below.) Again, the first priorities in economic policy should always be full employment, maximum production, and price stability. Borrowing is useful or dangerous only insofar as it bears on those things.

This reality is never internalized in mainstream budget reporting, which almost always assumes that austerity — that is, spending cuts or tax increases — will cut one's debt burden. In reality, austerity can make a debt burden heavier, by cutting output and thus a nation's ability to pay. Countries like Greece have strangled their economies half to death with austerity, only to see their debt-to-GDP ratio increase because of the recession caused by the austerity. Even granting the dubious premise of debt paranoiacs, in times of economic weakness the "responsible" thing to do is borrow and spend.

Indeed, grasping the reality of debt leads to a very counterintuitive conclusion: The greater the amount of outstanding debt, the more important borrowing and spending becomes to hitting output, employment, and price targets. The reason, as Mason and Arjun Jadayev point out, is that if one has a giant quantity of debt, even a small change in the underlying interest rate can hugely increase the necessary interest payments — just as happened to the U.S. under Reagan. Therefore, under such circumstances the central bank should ideally print money to keep borrowing costs down, and the rest of the government should use borrowing and spending (or austerity) to keep the economy in fighting trim. And as Jadayev and Mason write, this is exactly what happened after 1945: "In response to the very high debt ratio in the immediate post World War II-period U.S. … the Fed explicitly committed itself to holding down federal borrowing costs, while the fiscal balance was used to stabilize demand."

Now, in general it is probably a better idea to rely on taxation rather than borrowing to fund government programs (especially permanent ones). Most government debt ends up owned by the wealthy, and so a huge outstanding debt can end up being a sort of subsidy of the rich. Similarly, the current debt explosion is objectionable insofar as it represents a giant transfer of income to the top 1 percent. But that is a tactical issue, and one that could be corrected through progressive taxation.

At bottom, the American national debt is no big deal, and insofar as it can be a problem, it has nothing to do with how mainstream budget reporting presents the issue.

Silly propaganda (like the national debt clock) deserves nothing but a snicker.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.