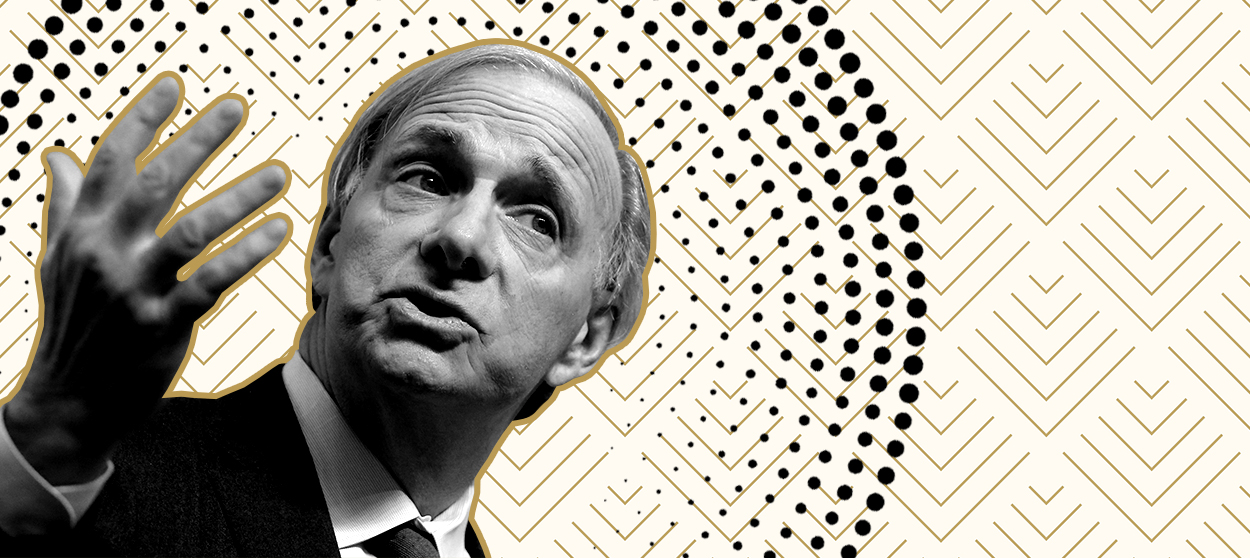

Ray Dalio is wrong about capitalism

The hedge fund billionaire's critique of capitalism is a one-stop shop of dodgy, exaggerated, and incomplete economic claims that only embrace the most pessimistic interpretation of the evidence

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

"Man Bites Dog" stories are tough for journalists to resist. Or in the case of Ray Dalio, "Billionaire Bites Capitalism." The founder of hedge fund giant Bridgewater has been receiving massive media attention — including a 60 Minutes segment last Sunday — for claiming inequality is a "national emergency" in a 7,500-word LinkedIn essay. It's one thing for a waitress-turn-politician to talk about the failings of capitalism, quite another for a famous Wall Streeter worth $17 billion. Dalio, one might think, has the receipts showing capitalism is broken.

But Dalio's concern is as much alarmist ("capitalism," he writes, "must evolve or die") as it is novel coming from a superrich dude. And his essay is a sort of one-stop shopping site of dodgy, exaggerated, and incomplete economic claims that embrace the most pessimistic interpretation of the evidence. Right off the bat Dalio writes, "There has been little or no real income growth for most people for decades." It's a gloomy statistic that many policymakers on the left and right accept as inarguable fact.

But they shouldn't, and neither should Dalio. If you use an inflation adjustment like the one preferred by the Federal Reserve — it assumes consumers alter their buying habits in response to changing prices — then it turns out that real wages for production and nonsupervisory workers have risen by a quarter since the mid-1970s, according to 2017 research by Dartmouth University economist Bruce Sacerdote. (Or maybe even twice as much.) And if you broaden things out to income rather than just wages, then the stagnation argument looks even weaker. According to the Congressional Budget Office, middle-class incomes after government transfers and federal taxes rose by 46 percent from 1979 to 2015. And incomes in the bottom fifth did even better, rising 79 percent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And if those numbers seem too abstract, there's the simple reality that lower income folks are living better today than decades ago. For instance: The number of cars per household with below median income has doubled since 1980, notes Sacerdote, and the number of bedrooms per household has grown 10 percent despite decreases in household size.

Dalio also cites research that finds that only half of 30-year-olds today earn more than their parents at the same age. Or to be more specific, half of Americans born in 1984 grew up to earn more than their parents did at age 30, adjusting for inflation, vs. 92 percent of children born in 1940. So clearly upward mobility isn't what it used to be. But, again, Dalio offers the worst possible interpretation of the data. If you adjust that 50 percent stat for all sorts of reasonable tweaks — changes in family size, a better inflation measure, increasing employer and federal benefits — researcher Scott Winship concludes, "roughly three in four adults — and the overwhelming majority of poor children — live better off than their parents after taking the rising cost of living into account."

I could do this all day. If you going to write about the inequality crisis, maybe it's worth mentioning income inequality seems to have stabilized over the past decade and that wages are now rising fastest for those workers at the bottom. Likewise, maybe it's worth a sentence or two to explain the idea of the "consumption poverty rate," which looks at what people actually consume rather than just their pre-tax money income. Using the standard of living of the poor in 1980, the consumption poverty rate fell from 13.0 percent in 1980 to 2.8 percent in 2017.

Dalio's solutions are no stronger than his diagnosis. If you're concerned about wealth inequality, then one obvious reform — given the paramount role of housing value inequality in the wealth gap — would be to attack the land-use regulations that deter homebuilding. But no mention of this from Dalio. Instead he suggests: "Raise more from the top via taxes" that would be "engineered" to avoid wrecking the economy's innovation potential. Indeed, one sign that wealth inequality isn't a crisis is that so much American wealth is generated by entrepreneurs.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Those who worry about inequality often complain that the opinions of billionaires are given too much weight in American society. Certainly this is one case in which they should heed their own criticism.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day