Why finance apps are having a moment

And more of the week's best financial insight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three of the week's top pieces of financial insight, gathered from around the web:

No guarantee of forgiveness

Federal loans offered to small businesses affected by the pandemic might not be as easily forgivable as many business owners believe, said Alan Rappeport and Emily Flitter at The New York Times. Paycheck Protection Program loans don't need to be paid back if "businesses allocate 75 percent of the money to cover payroll costs," with 25 percent for rent and other overhead expenses. As the crisis drags on, however, "some businesses are facing small payroll expenses because workers have opted for more generous unemployment benefits." With many stores still under lockdown orders, business owners are growing concerned that they could be saddled with debt. And the process for having the loans forgiven is still unclear. For all the hurdles in getting loans approved, "the forgiveness phase could be 10 times more complex."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Insurers cut rates as profits rise

After an unexpected windfall from the postponement of elective surgeries, some of the biggest health insurers will rebate premiums to some commercial customers, said John Tozzi and Emma Court at Bloomberg. UnitedHealth Group said it "would credit between 5 and 20 percent of a plan's premium cost for June" for employer and individual health plans. The move satisfies an Affordable Care Act requirement that insurers rebate "some premiums to their customers if medical claims fall short of expectations." The insurer has also waived cost sharing for primary and specialist care visits for members. The insurance industry has been one of the few not hurt by the pandemic. Insurers "have maintained their profit outlooks for the year as economic damage accrues all around them."

Young investors see opportunity

"Having been conditioned for years by financial pundits to see the next recession as their opportunity to get rich," young people are rushing to open brokerage accounts, said Dion Rabouin at Axios. Finance apps "have seen a 55 percent growth in usage" since the end of 2019. Sign-ups at regular brokerages have also surged, and these are not the usual brokerage clients. TD Ameritrade says that its new customers are looking at investing courses and other educational parts of the site "at a rate that is three to four times what we'd normally see." The rush to invest has been so strong that it's even lifted the Millennial-focused Robinhood, despite the app's "embarrassing outages on critical trading days."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

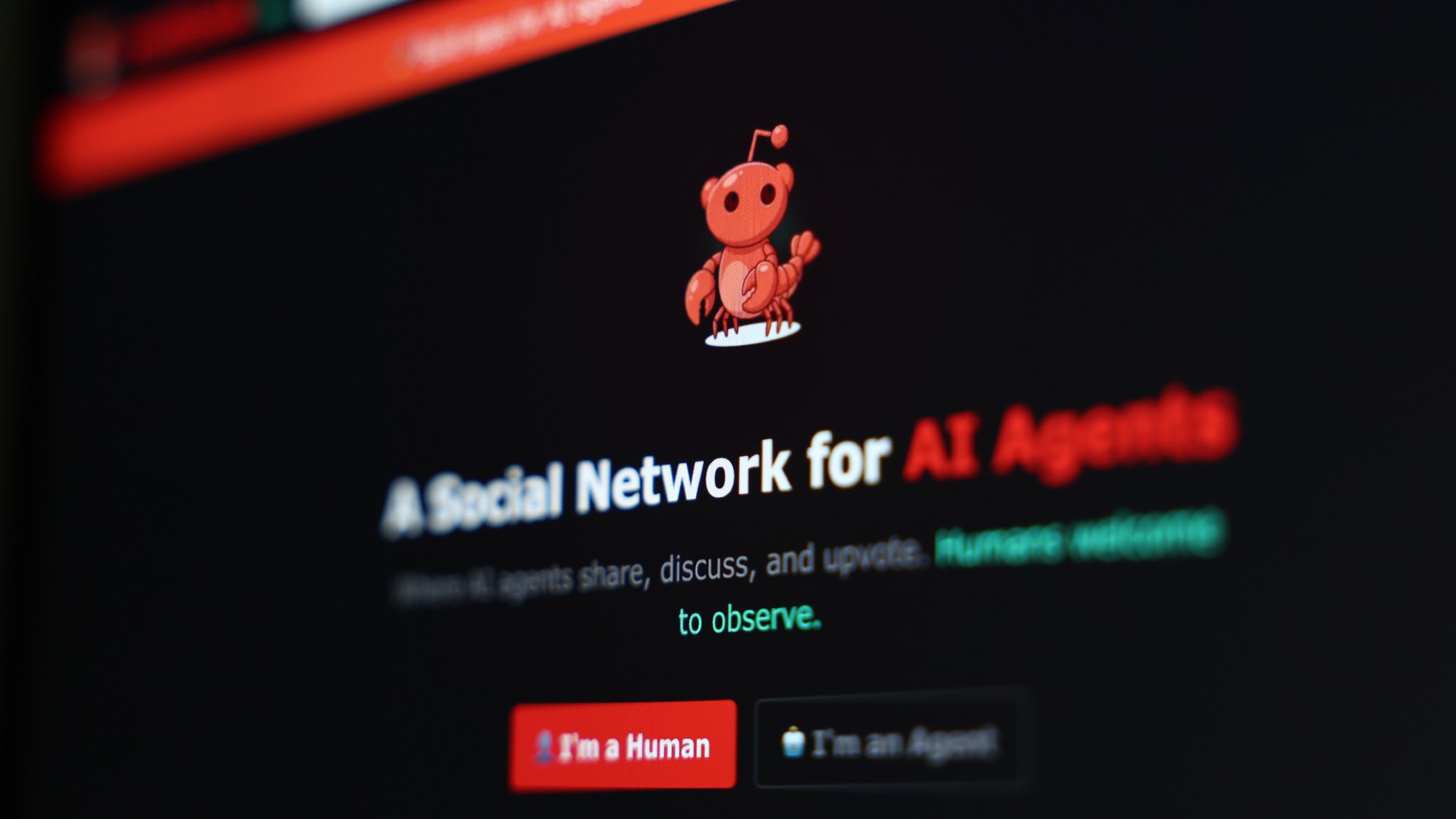

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg