Don't let financial pundits shame you

And more of the week's best financial insight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three of the week's top pieces of financial insight, gathered from around the web:

Don't let financial pundits shame you

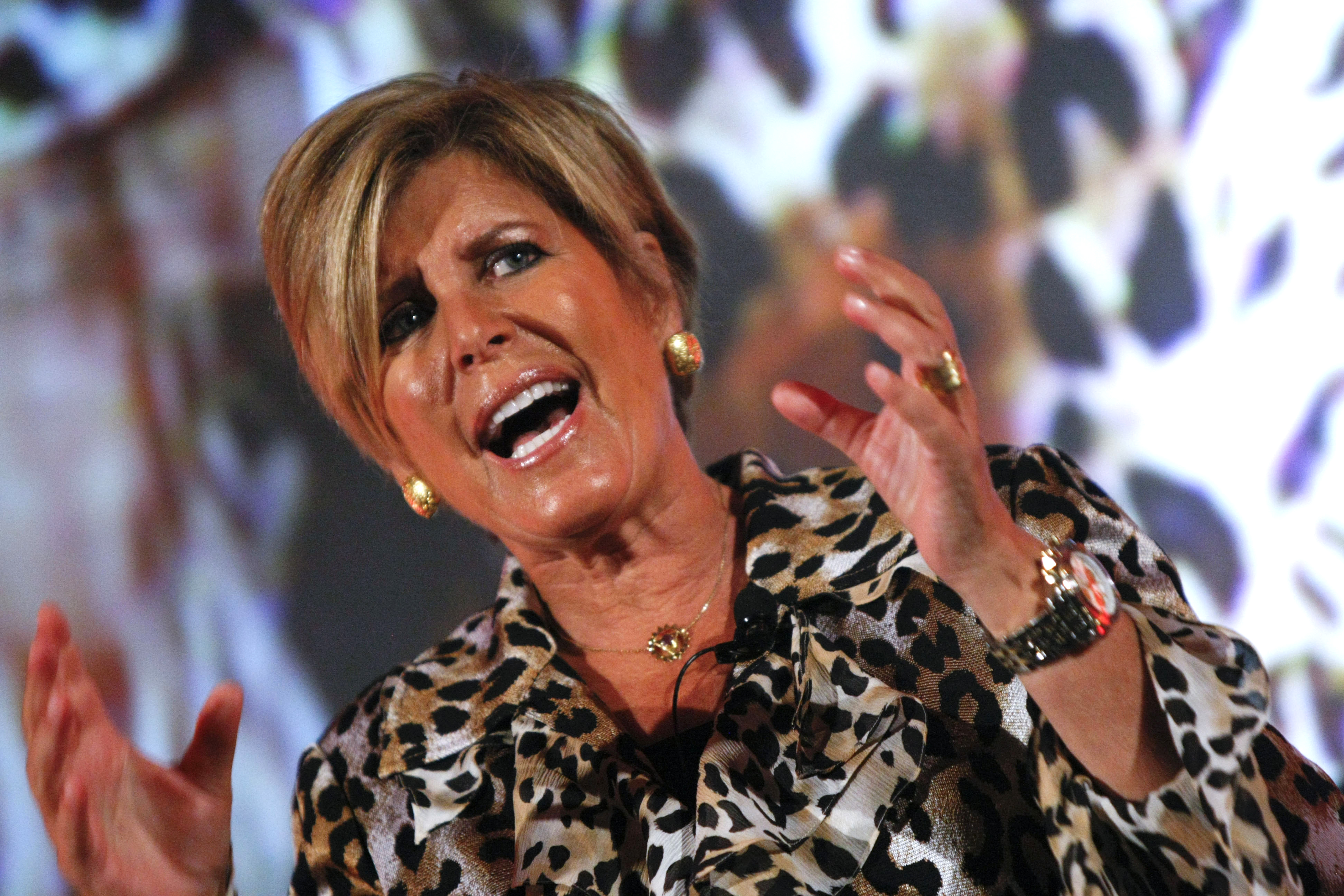

The message around obtaining financial stability is traditionally "built on shame, often packaged as tough love," said Emma Pattee and Stefanie O'Connell at CNBC. "From the oversimplified math of David Bach's The Latte Factor to Dave Ramsey's condemnation of nearly all debt," people who ask for financial advice are often shamed for it. Don't fall for that. When a young doctor with $240,000 in medical-school debt went on the Suze Orman Show in 2012, "Orman started off by telling her that she shouldn't have gone to medical school" and questioned "if she should buy her children Christmas presents." This kind of shaming "ignores the reality of a shifting financial landscape" and typically backfires. Fortunately, that young doctor ignored Orman's advice to declare bankruptcy, and eight years later has a thriving medical practice.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A manager's very honest goodbye

A $10 billion fund manager has decided to call it quits because "our return sucks," said Mark DeCambre at MarketWatch. Ted Aronson is planning to close his firm, AJO Partners, after 36 years, saying that his company's strategy has been "at odds with the forces driving the market" over the past five years. AJO's largest fund was down 15.5 percent through September. Aronson said his firm's steadfast pursuit of stocks that "were undervalued by some metric" has been "at the heart of our challenge," leading AJO to miss high-flying growth stocks in "e-commerce, software, and other tech-related ventures." Aronson said the firm's funds had fallen so far behind that "it makes it look like we've been buying our selling list and selling our buy list."

Watch out for Medicare premiums

Even a little "extra income in retirement can mean much higher Medicare premiums," said Neal Templin at The Wall Street Journal. The Medicare math is tricky. "If you're a single person with modified adjusted gross income up to $87,000, or a married couple with income up to $174,000, you will pay the basic premium this year of $144.60 monthly." But if you're a single person earning more than $163,000, or a couple filing jointly earning above $326,000, the premium soars to $462.70 a month. One way to cushion the blow: If you're over 70½, a qualified charitable deduction from a tax-deferred account can reduce your required minimal distribution to keep you in a lower-income Medicare bracket.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’