The daily business briefing: July 30, 2021

Biden urges Congress to extend eviction moratorium, GDP returns to pre-pandemic levels but falls short of expectations, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

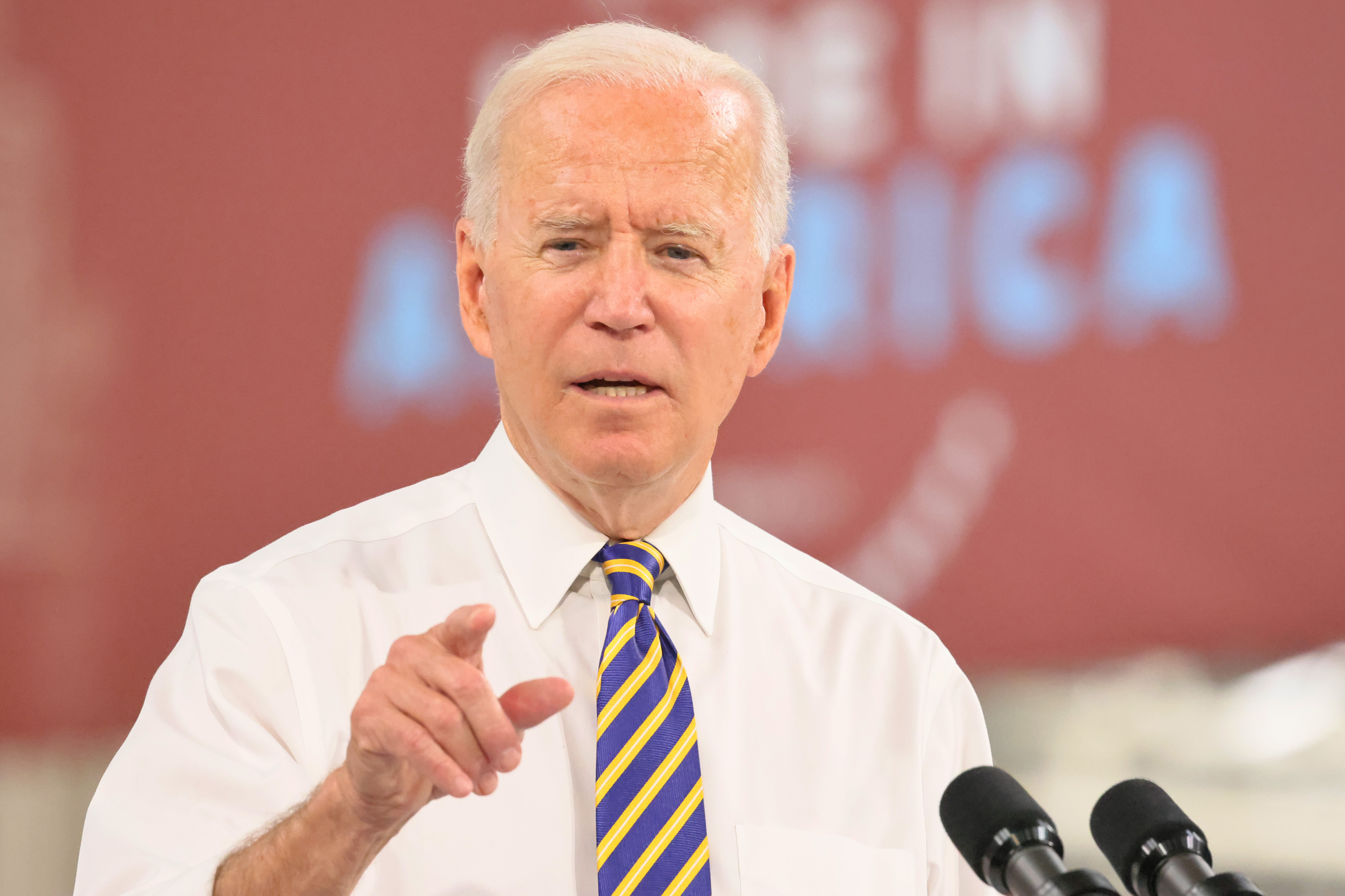

1. Biden urges Congress to extend eviction moratorium

President Biden on Thursday called on Congress to extend a nationwide moratorium on evictions that is set to expire Saturday. Biden extended the moratorium through July and supported keeping it going longer, but said a Supreme Court ruling prevented him from acting alone. The freeze was initiated by the Centers for Disease Control and Prevention to keep Americans who fell behind on rent due to the coronavirus pandemic from losing their homes. Housing advocates warned that ending the nationwide ban would threaten millions of people with eviction and cause increased homelessness. "These rollbacks of lifesaving protections are premature and will lead to the worst eviction crisis in U.S. history," said Jaboa Lake, senior policy analyst with the left-leaning Center for American Progress.

2. GDP rises above pre-pandemic levels but falls short of expectations

U.S. gross domestic product grew by 1.6 percent in the second quarter of 2021, a 6.5 percent annual rate, the Commerce Department reported on Thursday. The growth marked a slight improvement over the 1.5 percent figure for the first quarter, and put the economy above pre-pandemic levels, demonstrating the positive impact of vaccinations and federal aid intended to boost the recovery. Despite the improvement, the second quarter fell well short of economists' expectations, partly due to supply-chain disruptions. The data raised concerns that the recovery could be disrupted by surging coronavirus cases driven by the virulent Delta variant, as well as the renewal of mask mandates and the end of federal pandemic aid programs.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The New York Times Business Insider

3. Robinhood falls by 8 percent in market debut

Robinhood fell by 8.4 percent on Thursday in the online broker's first day of trading on the Nasdaq. The stock started out at $38 per share, giving the company a valuation of nearly $32 billion. Robinhood already has demonstrated strong growth, with its revenue rising by 245 percent last year to $959 million. But the trading debut will provide a real-time measure of investors' view of its value. Robinhood's free stock-trading service has contributed to wild trading swings in meme stocks. Its IPO was among the biggest in a busy year for market debuts, but the decline suggested that the scrutiny it has attracted from regulators and the market's volatility turned away some investors.

The Associated Press The New York Times

4. Stock futures fall after Amazon revenue falls short

U.S. stock index futures fell early Friday after Amazon reported quarterly earnings that fell short of expectations. Futures tied to the tech-heavy Nasdaq were down by 1.3 percent several hours before the opening bell. Futures for the S&P 500 and the Dow Jones Industrial Average fell by 0.8 percent and 0.3 percent, respectively. Amazon's quarterly report after the bell on Thursday was part of a big week for corporate earnings. The online retail giant reported quarterly revenue that fell short of expectations for the first time in three years. It also lowered its guidance. The company's stock fell by 7.4 percent in after-hours trading, dragging down Nasdaq futures. Pinterest shares plunged by 19 percent after it said it lost monthly users last quarter.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Scarlett Johansson sues Disney over Black Widow streaming release

Scarlett Johansson filed a lawsuit against Disney in Los Angeles Superior Court Thursday, accusing Disney of breaching her contract by releasing the Marvel film Black Widow on Disney+ at the same time that it hit theaters, The Wall Street Journal reported Thursday. The lawsuit reportedly says Johansson had an agreement with Marvel that the superhero film would be released exclusively in movie theaters and that the change cost her millions in backend compensation based on box-office performance. "Disney intentionally induced Marvel's breach of the agreement ... to prevent Ms. Johansson from realizing the full benefit of her bargain with Marvel," the lawsuit says. Disney said the lawsuit had "no merit whatsoever" and was "especially sad and distressing in its callous disregard for the horrific and prolonged global effects of the COVID-19 pandemic."

The Wall Street Journal The Associated Press

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.