The daily business briefing: October 5, 2022

Musk renews offer to buy Twitter at original price after trying to back out, the U.S. national debt hits $31 trillion, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Musk renews offer to buy Twitter in reversal

Billionaire entrepreneur Elon Musk has renewed his $44 billion offer to buy Twitter, just weeks before the social media company is scheduled to try to force him in court not to abandon the deal. Musk sent a letter to Twitter offering to buy it at his original price, $54.20 per share, Bloomberg reported Tuesday. Twitter shares shot up 22 percent to close at $52 a share in New York after the news broke. Twitter confirmed it had received the letter and will go through with the deal. Musk, the CEO of Tesla and SpaceX, told Twitter in July he was backing out of the deal because it had failed to provide adequate data on how many of its accounts are fake. Twitter promptly filed a lawsuit seeking to force him to go through with the purchase.

2. U.S. national debt hits $31 trillion

The U.S. national debt has risen above $31 trillion for the first time, the Treasury Department said in a report released Tuesday. The news came as the Federal Reserve is raising interest rates to fight the highest inflation in decades, increasing borrowing costs. The Fed cut rates to near zero during the coronavirus pandemic, but has raised them to more than 3 percent this year and expects them to reach 4.6 percent in 2023. The higher rates make the nation's debts more costly. "Too many people were complacent about our debt path in part because rates were so low," Michael Peterson, chief executive of the pro-debt-reduction Peter G. Peterson Foundation, told The New York Times.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Stock futures fall after 2-day rally

U.S. stock futures fell early Wednesday after a strong two-day rally. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down 1 percent at 6:30 a.m. ET. Nasdaq futures were down 0.9 percent. The Dow and the S&P 500 jumped 2.8 percent and 3.1 percent, respectively, on Tuesday. The tech-heavy Nasdaq rose 3.3 percent as bond yields fell. Major stock indexes posted big losses in August and September as the Federal Reserve vowed to continue aggressively raising interest rates to fight high inflation, despite the risks of a recession. Stocks got a boost Tuesday from an unexpectedly modest interest rate hike by the Reserve Bank of Australia, which boosted hope that other central banks might ease back on their monetary tightening.

4. OPEC+ to discuss big oil production cut

OPEC+ nations are meeting in Vienna on Wednesday to discuss a big oil production cut to boost prices, which have fallen as global economic problems weakened demand. Sources told Reuters that the group, which includes members of the Organization of Petroleum Exporting Countries and other producers led by Russia, will be discussing cuts of one to two million barrels per day, with some of the sources saying they expected a reduction at the high end of that range. That would amount to nearly 2 percent of global supply. It will be the first in-person OPEC+ meeting since early in the coronavirus pandemic, with a goal of showing cohesion and a commitment to defend prices, which have dropped to about $90 a barrel from $120 three months ago, analysts said.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Job openings fall sharply

U.S. employers' job openings fell to about 10.1 million in August, a monthly decline of 1.1 million, suggesting that the Federal Reserve's aggressive interest rate hikes were starting to slow the economy and impact the labor market. The drop was bigger than expected, bringing total openings to the lowest level since June 2021. But the number of available jobs is still far higher than before the coronavirus crisis hit the United States in February 2020. The previous record was 7.7 million. "The broad-based decline in job openings across sectors in the U.S. shows a slight loosening in the labor market," said Jeffrey Roach, chief economist for LPL Financial. "But overall, still tight."

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

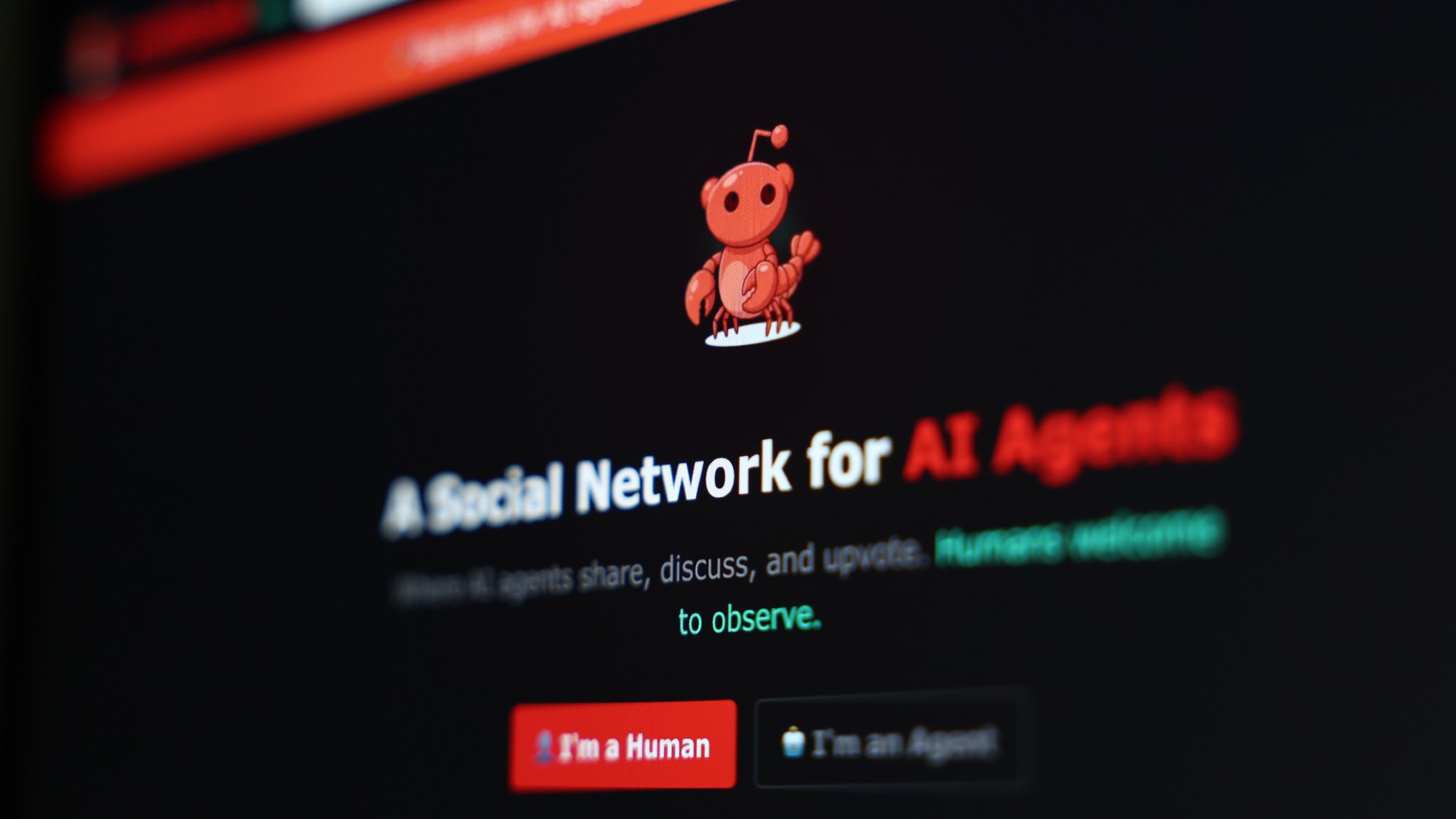

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more