These are the countries most in danger of a banking crisis

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

As I argued earlier this month, rising levels of debt are a double-edged sword. While they spur more economic activity in the present, the more debt grows, the more money consumers and businesses have to set aside to service their debts. Debt becomes dangerous to the economy when it grows faster than the economy itself, and debt levels growing faster than the economy can herald a banking crisis, or recession.

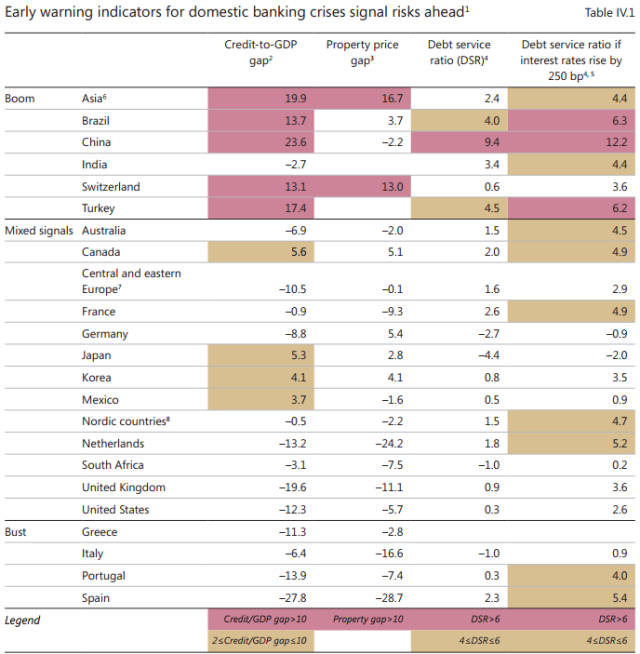

The Bank for International Settlements is out with a new report that looks at this difference between the growth rate in their economy, and in the level of debt in their economy, also known as the credit-to-GDP gap. The BIS is worried that the post-2008 global recovery is far from sound, and that rising debt levels may imperil it.

The BIS argues that history suggests that when the difference between a country or region's credit-to-GDP gap exceeds 10 percent, it indicates that serious strain on a banking system will occur within 3 years. And many of the countries in the danger zone are in Asia, most notably China:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

(Bank for International Settlements)

The U.S., happily, does not appear to be in the danger zone.

Of course, nobody knows whether banking crises or recessions will actually materialize. GDP might start rising faster, or debt accumulation may slow down. But this is certainly a worrying sign that a large amount of global economic activity seems to be built on sand rather than solid rock.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

British warship repels 'largest Houthi attack to date' in the Red Sea

British warship repels 'largest Houthi attack to date' in the Red SeaSpeed read Western allies warn of military response to Iranian-backed Yemeni rebels if attacks on ships continue

-

Houthi rebels claim Red Sea ship attacks

Houthi rebels claim Red Sea ship attacksspeed read Iran-backed Yemeni group vows to escalate aggression towards Israel-linked vessels in revenge for Gaza war

-

Israel plans next phase of Gaza war as first hostages released

Israel plans next phase of Gaza war as first hostages releasedSpeed read After four-day ceasefire 'we will not stop' until destruction of Hamas, says Israel

-

Mob storms Russian airport 'looking for Jews'

Mob storms Russian airport 'looking for Jews'Speed Read Plane from Israel surrounded by rioters chanting antisemitic slogans after landing in Russia's Dagestan region

-

Tuberville's military promotions block is upending lives, combat readiness, 3 military branch chiefs say

Tuberville's military promotions block is upending lives, combat readiness, 3 military branch chiefs saySpeed Read

-

Ukraine's counteroffensive is making incremental gains. Does it matter in the broader war?

Ukraine's counteroffensive is making incremental gains. Does it matter in the broader war?Speed Read

-

US commissions first-ever Navy ship in a foreign port

US commissions first-ever Navy ship in a foreign portSpeed Read

-

British spy chief, Wagner video suggest Prigozhin is alive and freely 'floating around'

British spy chief, Wagner video suggest Prigozhin is alive and freely 'floating around'Speed Read