Isas 2017/2018: Everything you need to know

These accounts protect you from income tax, capital gains tax and dividend tax on investments

We're now officially into a new tax year, which means you have a new Isa tax allowance to use over the coming 12 months.

So, how much can you invest, what can you invest in, and why should you bother? Here's everything you need to know.

What is an Isa?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

An Individual Savings Account (Isa) is a tax-efficient way of saving that allows your money to grow free from income tax, capital gains tax, and dividend tax.

What types of Isa are there?

This year a new account has been added to the , so there are currently six types of Isa:

1. Cash Isa. Like a traditional savings account, only tax free.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

2. Stocks and Shares Isa. Effectively a tax-free wrapper in which you can hold a range of investments.

3. Junior Isa. Tax-free account that holds tax-free savings for children aged up to 16, with the money locked up until the child turns 18. A Junior Isa can be either a Cash Isa or a Stocks and Shares Isa.

4. Help to Buy Isa. Cash Isa for people saving up for their first home. You can invest £200 a month and the government will add a 25 per cent top-up to your savings, to a cap of £3,000, when you put down a deposit on a home.

5. Lifetime Isa. A bit like a Help to Buy Isa, but specifically for those aged between 18 and 40 and with a much larger bonus accumulation cap that is designed to help people save for a pension. A bonus of 25 per cent will be paid each year to the age of 50, with up to £32,000 of government bonus is available.

6. Innovative Finance Isa. An Isa that allows you to enjoy tax-free returns on peer-to-peer lending.

How much can I invest?

In this tax year you can deposit up to £20,000 in a Cash, Stocks and Shares, or Innovative Finance Isa. That allowance is the total amount that can be invested across the accounts in any proportion and is up almost a third on last year.

The limit a Junior Isa is £4,128. The most you can put in a Help-to-Buy Isa is £3,400 a year – but be aware this is technically just a Cash Isa and you can only open one of these accounts in any one tax year.

For the new lifetime Isa, the limit is £4,000 a year.

What is the deadline?

If you do want to take advantage of this year’s Isa allowance you need to do so before midnight on 5 April 2018.

What can I invest in?

When it comes to your Stocks and Shares Isa you have a range of options.

These include:

- Individual shares listed on the London Stock Exchange, Alternative Investment Market and any officially recognised stock exchange in the world

- Exchange Traded Funds (ETFs) and Exchange Traded Commodities (ETCs)

- Corporate bonds

- Government bonds

You cannot put funds – that's unit trusts, investment trusts, Oeics and ETFs - into an Isa if they don’t have "UK-reporting status". This basically means you need to stick to funds that are based in the UK.

But, you can still invest in UK-based funds that invest in international stocks and shares.

How do I manage the risk?

If you are used to keeping your savings in cash, investing in a Stocks and Shares Isa can be unnerving as you are taking a risk with your savings. While investments can rise, they can fall leaving you with less than you initially invested.

However, there are ways you can mitigate that risk.

Firstly, don’t putyour eggs in one basket. Put all your money in one share and you are hanging all your savings hopes on the performance of one company.

Instead buy funds, as they invest in lots of shares on your behalf therefore spreading your risk. It's best to either invest in a range of funds across a range of sectors, or to use a "multi-manager" or "multi-asset" fund that does this for you.

Another way to reduce your risk is to make regular small payments into your Stocks and Shares Isa rather than one big lump sum. This means you aren't buying all your investments at one time and having to take the price given on that day.

Finally, if you're investing a significant sum use either a platform that helps guide and inform your investments – or else go to a fully qualified financial adviser to help you make the right choices.

How do I invest in a Stocks and Shares Isa?

If there is a specific investment fund or trust you wanted to put your Isa money into, then you could invest directly. The problem with this, though, is you can only open one investment Isa per tax year so that could limit you to putting all of your allowance in one basket.

A better option may be to use an online investment platform where you can open your Isa then invest in an array of shares and funds. Online platforms tend to be cheaper than a traditional broker and allow you to monitor all of your investments in one place.

Is there any point bothering with an Isa?

After the introduction of the savings allowance, which allows people to earn £1,000 tax free (or £500 for higher-rate taxpayers) from their savings before they have to pay income tax, you might wonder if there is any point bothering with an Isa.

Assuming a three per cent return that means a basic-rate taxpayer could invest £33,000 and not have to pay tax on the interest.

For cash savers with only small savings amounts that means a traditional savings account may be more attractive as, at present, they are paying higher interest rates than Cash Isas.

But, if you want to invest larger amounts, or there is a chance you could move up into a different tax bracket in the future you should consider opting for an Isa. That way you know your money can grow tax-free no matter what happens to your income tax bracket or how big your pot grows.

And if you are going to invest in an Isa, it's best to do it as early in the tax year as you can so you get the fullest benefit of the tax-free accumulation.

Also, if you are investing in shares that pay an income Isas have come into their own since the Budget, at which the allowance for tax-free dividends outside of an Isa was reduced from £5,000 to £2,000.

We're now officially into a new tax year, which means you have a new Isa tax allowance to use over the coming 12 months.

So, how much can you invest, what can you invest in, and why should you bother? Here's everything you need to know.

What is an Isa?

An Individual Savings Account (Isa) is a tax-efficient way of saving that allows your money to grow free from income tax, capital gains tax, and dividend tax.

What types of Isa are there?

This year a new account has been added to the , so there are currently six types of Isa:

1. Cash Isa. Like a traditional savings account, only tax free.

2. Stocks and Shares Isa. Effectively a tax-free wrapper in which you can hold a range of investments.

3. Junior Isa. Tax-free account that holds tax-free savings for children aged up to 16, with the money locked up until the child turns 18. A Junior Isa can be either a Cash Isa or a Stocks and Shares Isa.

4. Help to Buy Isa. Cash Isa for people saving up for their first home. You can invest £200 a month and the government will add a 25 per cent top-up to your savings, to a cap of £3,000, when you put down a deposit on a home.

5. Lifetime Isa. A bit like a Help to Buy Isa, but specifically for those aged between 18 and 40 and with a much larger bonus accumulation cap that is designed to help people save for a pension. A bonus of 25 per cent will be paid each year to the age of 50, with up to £32,000 of government bonus is available.

5. Innovative Finance Isa. An Isa that allows you to enjoy tax-free returns on peer-to-peer lending.

How much can I invest?

In this tax year you can deposit up to £20,000 in a Cash, Stocks and Shares, or Innovative Finance Isa. That allowance is the total amount that can be invested across the accounts in any proportion and is up almost a third on last year.

The limit a Junior Isa is £4,128. The most you can put in a Help-to-Buy Isa is £3,400 a year – but be aware this is technically just a Cash Isa and you can only open one of these accounts in any one tax year.

For the new lifetime Isa, the limit is £4,000 a year.

What is the deadline?

If you do want to take advantage of this year’s Isa allowance you need to do so before midnight on 5 April 2018.

What can I invest in?

When it comes to your Stocks and Shares Isa you h

These include:

Individual shares listed on the London Stock Exchange, Alternative Investment Market and any officially recognised stock exchange in the world

Exchange Traded Funds (ETFs) and Exchange Traded Commodities (ETCs)

Corporate bonds

Government bonds

You cannot put funds – that's unit trusts, investment trusts, Oeics and ETFs - into an Isa if they don’t have "UK-reporting status". This basically means you need to stick to funds that are based in the UK.

But, you can still invest in UK-based funds that invest in international stocks and shares.

How do I manage the risk?

If you are used to keeping your savings in cash, investing in a Stocks and Shares Isa can be unnerving as you are taking a risk with your savings. While investments can rise, they can fall leaving you with less than you initially invested.

However, there are ways you can mitigate that risk.

Firstly, don’t putyour eggs in one basket. Put all your money in one share and you are hanging all your savings hopes on the performance of one company.

Instead buy funds, as they invest in lots of shares on your behalf therefore spreading your risk. It's best to either invest in a range of funds across a range of sectors, or to use a "multi-manager" or "multi-asset" fund that does this for you.

Another way to reduce your risk is to make regular small payments into your Stocks and Shares Isa rather than one big lump sum. This means you aren't buying all your investments at one time and having to take the price given on that day.

Finally, if you're investing a significant sum use either a platform that helps guide and inform your investments – or else go to a fully qualified financial adviser to help you make the right choices.

How do I invest in a Stocks and Shares Isa?

If there is a specific investment fund or trust you wanted to put your Isa money into, then you could invest directly. The problem with this, though, is you can only open one investment Isa per

tax year so that could limit you to putting all of your allowance in one basket.

A better option may be to use an online investment platform where you can open your Isa then invest in an array of shares and funds. Online platforms tend to be cheaper than a traditional broker and allow you to monitor all of your investments in one place.

Is there any point bothering with an Isa?

After the introduction of the savings allowance, which allows people to earn £1,000 tax free (or £500 for higher-rate taxpayers) from their savings before they have to pay income tax, you might wonder if there is any point bothering with an Isa.

Assuming a three per cent return that means a basic-rate taxpayer could invest £33,000 and not have to pay tax on the interest.

For cash savers with only small savings amounts that means a traditional savings account may be more attractive as, at present, they are paying higher interest rates than Cash Isas.

But, if you want to invest larger amounts, or there is a chance you could move up into a different tax bracket in the future you should consider opting for an Isa. That way you know your money can grow tax-free no matter what happens to your income tax bracket or how big your pot grows.

And if you are going to invest in an Isa, it's best to do it as early in the tax year as you can so you get the fullest benefit of the tax-free accumulation.

Also, if you are investing in shares that pay an income Isas have come into their own since the Budget, at which the allowance for tax-free dividends outside of an Isa was reduced from £5,000 to £2,000.

-

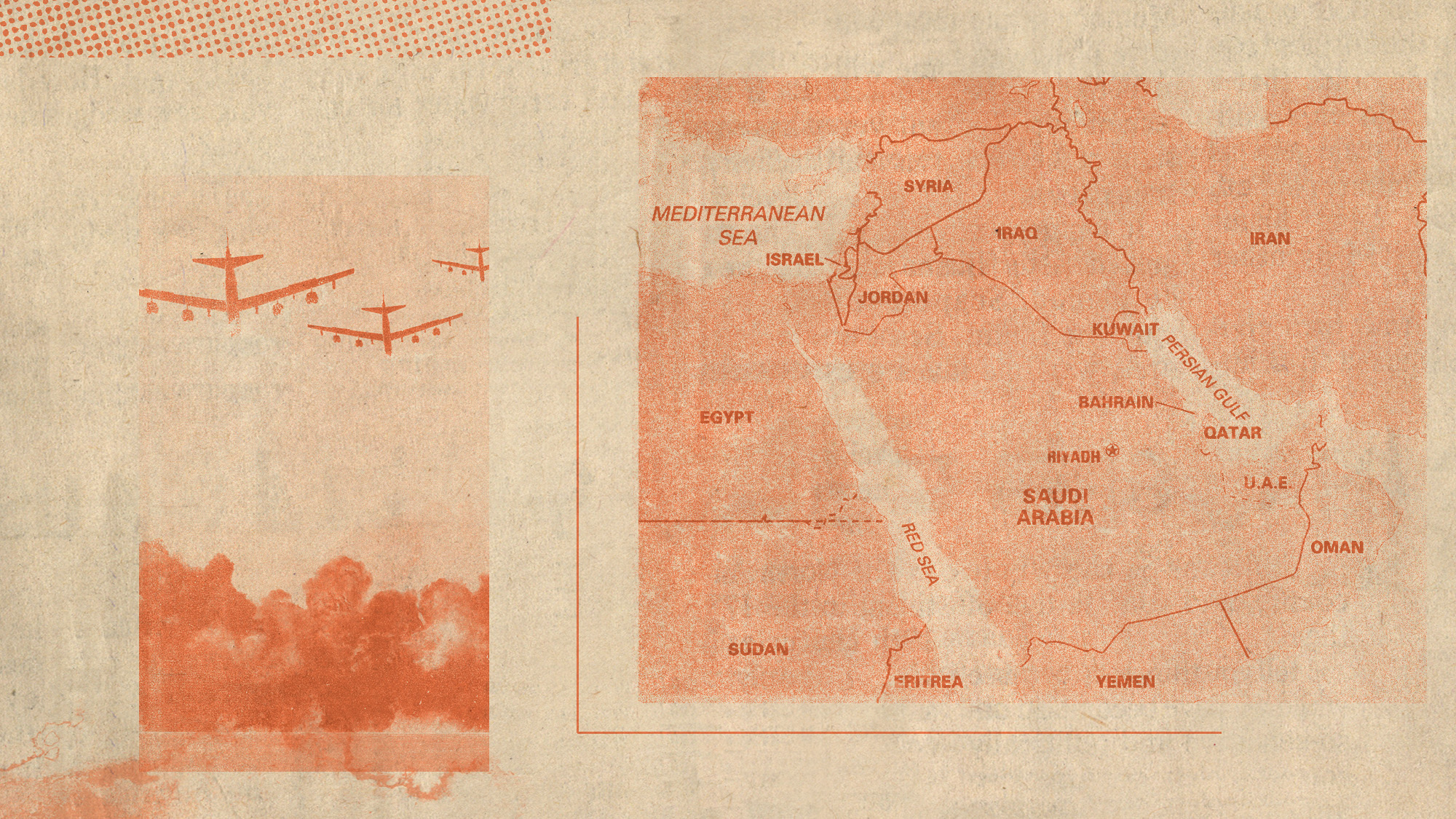

Will the Gulf states enter the Iran conflict?

Will the Gulf states enter the Iran conflict?Today’s Big Question Regional powers could transition from ‘defensive posture’ to ‘waging active war’ if Iranian aggression continues

-

The ‘golden age’ of HIV treatment

The ‘golden age’ of HIV treatmentThe Explainer Single-pill treatment proves as effective at suppressing virus as multi-pill therapy, while long-acting preventive injections are increasingly available

-

Underrated Italian gems for a memorable city break

Underrated Italian gems for a memorable city breakThe Week Recommends Ditch the crowds for a relaxing trip to one of these lesser-known spots