Pension freedoms: everything you need to know

You now have more options than ever when it comes to your retirement savings. But what are they, and what are the risks?

In his 2015 Spring Budget, then-chancellor George Osborne introduced sweeping changes to the way that pensions are taxed. The new rules have led to people taking a variety of different choices when investing their nest eggs - but have also meant that the over-55s have become an attractive target for fraudsters.

Prior to April 2015, when most people with a defined contribution pension reached retirement age the only option available was to buy a financial product called an annuity, which involved using their pension savings to purchase a guaranteed income for life. These products sometimes came with special conditions or guarantees.

Hear Mike Broomfield from The Pensions Regulator talking to LBC's Ian Dale about investment scams

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For example, you could link your income to the rate of inflation, or include a spouse in order to ensure they wouldn’t be financially bereft if the annuitant died before them. Unsurprisingly, these extra options cost more up front.

The tax changes introduced by Osborne mean that anyone can now access their pension savings at any time from the age of 55, and make their own decisions about how to fund their retirement. Since the new rules, or “pension freedoms”, came into effect, the number of annuities purchased has fallen sharply - but the freedom for people to do as they please with their pension money could leave them vulnerable to fraudsters.

You now have a number of options for what to do with your retirement savings after you reach 55 (remember, this is the age the pension freedoms kick in. If someone tries to convince you to access your pension before this age, it is likely a scam and could result in a large tax bill).

Here we explore these options in more depth, including the potential benefits and risks associated with each. Not all of them will be available to everyone: the available options vary from one scheme to the next. Everyone’s circumstances are different. While we consider the options available in general terms, if you are considering accessing your pension pot, it may be useful to speak to The Pensions Advisory Service, who provide free independent and impartial information and guidance.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Additionally, if you’re over 50 and have a defined contribution pension, you can access the government service Pension Wise, which offers pre-booked appointments to talk through your retirement options. It’s important you make the best decision for your personal circumstances, so you should seriously consider using the services of a financial adviser.

If you do opt for an adviser, be sure to use one that is authorised by the Financial Conduct Authority (FCA) - check they are on the FCA’s Financial Services Register. The Money Advice Service has information on how to find a financial adviser, or you could get further information from a group that represents advisers such as PIMFA.

Before we look at your options, however, a warning: fraudsters are working hard to separate people from their newly accessible retirement savings. Never listen to someone who contacts you out of the blue with an offer, be it a pension review, an investment opportunity or so-called free advice.

One common tactic is to offer a “free pension review”, designed to persuade you to move your money into a high-risk scheme, perhaps overseas or in an unusual business. Be careful: some of these investments are badly run, while others are outright scams.

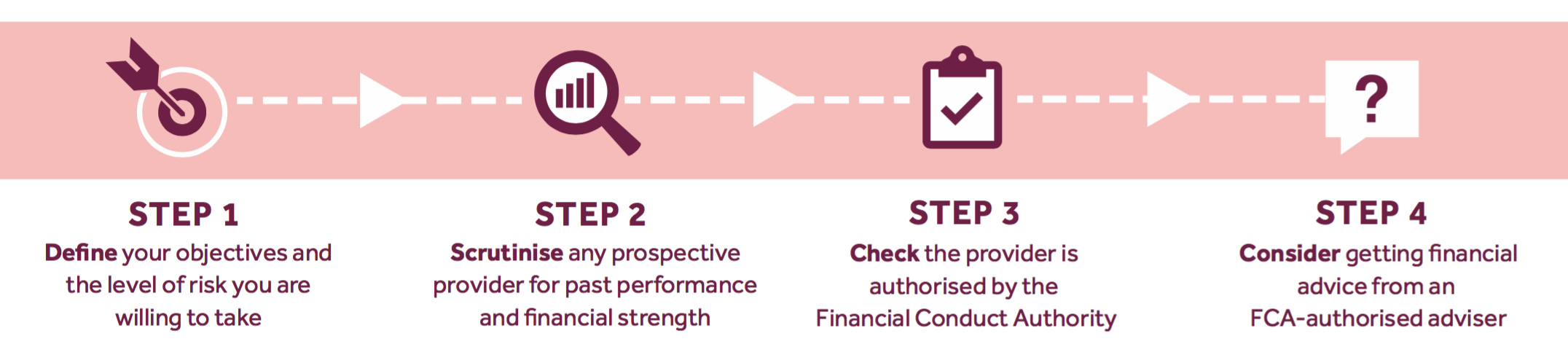

Four steps to take before investing:

Leaving it untouched

If you don’t need the money, you may decide to leave your pension pot where it is. Your pension savings are most likely to be in one or more investment funds, which in turn invest in a portfolio of shares and other assets selected by a fund manager. Investing is inherently risky, but the longer you stay invested the more chance you have of building up a larger pot, by reinvesting any earned dividend income and benefiting from growth in the prices of underlying assets. While the value of your investments may go up and down, it’s still safer to keep it invested conventionally than handing it over to potential scammers.

It is worth checking with your scheme what your pension savings are invested in, and whether this will change as you move closer to retirement. Unless you choose your investments, many schemes will “lifestyle” your investments as you approach retirement, moving you to lower-risk (and likely lower reward) assets to protect you from market volatility. You should also check whether your scheme has the correct retirement date for you. If it doesn’t, you should contact your scheme about changing it.

Buy an annuity

Although the number of people opting to buy an annuity with their pension savings has fallen since April 2015, annuity purchase should not be ruled out altogether. A guaranteed income for life is not something to sneer at.

If you choose to buy an annuity, you can still take 25% of your pension pot taxfree. However, you’ll pay tax on the income the annuity generates.

By buying an annuity, you hand all the invested pension pot along with the associated risks to someone else - namely the annuity provider. However, there are other issues to consider. For example, should you die earlier than expected, you and your family may not receive as much benefit from your annuity as would have come from leaving it in the pot.

Annuities can’t be passed on to loved ones in a will, although for a premium, most annuity providers will include a spouse in your deal so that they would continue to receive some or all of the income even if you passed away.

The other risk is that the retirement income you get depends on annuity rates at the time you purchase the annuity. Annuity rates are affected by interest rates and gilt yields, and rates on offer can rise and fall together. This matters when you purchase the annuity, since the annuity rate is the percentage of a pot that a provider is willing to pay, effectively by way of an annual income, for life.

For example, if you have a £500,000 pot and are offered an annuity rate of 5%, you could use your pot to buy a guaranteed £25,000 (before tax) for life with an annuity. You may also be eligible for an enhanced annuity, since annuity rates are also impacted by a variety of factors personal to you, including ill health.

Go into drawdown, also known as flexi-access drawdown

Drawdown means keeping your pot invested and then withdrawing an income to fund your life in retirement. This is a more flexible option than buying an annuity, but it is also riskier, because it means leaving your undrawn pension pot exposed to the investment markets. That puts your pot of capital at risk, unlike with an annuity income, which is guaranteed for life.

You can also still take 25% of your pot tax-free. The money you take out in drawdown is taxed at your marginal rate after you’ve taken your tax-free 25% lump sum. Note that you can also take out irregular withdrawals in flexi-access drawdown, but the entire amount will be subject to tax.

The biggest risk of relying on drawing down from an invested pension pot is the chance that you outlive your savings. This is called longevity risk. Research has shown that people tend to underestimate how long they will live, which means they may find themselves running out of money later in life, having overestimated how much they can take out each year.

If your withdrawals from your pot exceed the investment returns on the funds remaining in your pot, the size of your pot will reduce. If you are able to draw only from the returns your pot generates, it will last longer.

On the other hand, an obvious potential benefit of drawdown is that you can take as much or as little of your money as you want. You aren’t subject to annuity rates when it comes to the time to retire. You could also access more from your pot in the event of an emergency, although taking out too much could put you in a higher tax bracket and will deplete your fund value.

A further benefit is that your pot doesn’t die with you - it belongs to you and can be passed on to your loved ones in your will.

Withdrawing lump sums

You can also opt to take out irregular lump sums as and when you need them while leaving the rest invested, with what the industry calls an “uncrystallised fund pension lump sum”, or UFPLS. You still get the same proportion of tax-free cash as you do with the other options, but you can’t claim the whole amount in one go. Each time you take an UFPLS, a quarter of the amount you withdraw will be tax-free, with the rest taxed at your marginal rate.

So the main difference between flexiaccess drawdown and an UFPLS is that with the former you get your 25% tax-free lump sum all in one go and then pay tax on any other withdrawals, while with the latter you don’t take your initial lump sum but only pay tax on 75% of subsequent withdrawals.

Taking a UFPLS exposes you to many of the same risks you would face under flexi-access drawdown, although leaving that 25% lump sum invested could arguably reduce the chances of running out of money later. The key benefits are that your pot potentially stays bigger and your withdrawals are cheaper, depending on how much of the pot you take upfront.

Take the whole thing

You can cash in your whole pot if you want. You’ll get your 25% taxfree lump sum and be taxed on the rest, but you’ll have the cash to do with as you please.

Since pension freedom came into effect, many people with smaller pots have been choosing this option, potentially because people are more likely to be able to cash in a smaller pot (up to three pots worth £10,000 or less) without having to pay a higher rate of tax. Those with larger pots may pay more tax relative to other options by taking it all at once.

If you take the entire pot in cash and leave it in a low-interest savings account, you’ll be swapping investment risk with inflation risk. By keeping the whole amount in cash, you won’t be affected directly by stock market crashes, but there is a strong chance that inflation will outstrip any interest you get. If instead you reinvest your money, the returns you earn could outpace inflation, but you will be taking on investment risk.

The bottom line

Before you make your choice, consider all your options carefully – an important decision like this shouldn’t be rushed. In fact, if someone is putting you under pressure to make a quick decision, it could be a sign of a scam. Consider taking financial advice, and finally, never listen to out-of-the-blue offers, no matter how great they sound.

To learn more about the types of scams catching people out, and to avoid becoming a victim, take a look at the FCA’s ScamSmart page: www.fca.org.uk/scamsmart

Contact

The Financial Conduct Authority: www.fca.org.uk

The Pensions Advisory Service: www.pensionsadvisoryservice.org.uk

Pension Wise: www.pensionwise.gov.uk

Money Advice Service: www.moneyadviceservice.org.uk

Take our survey for your chance to win £100 and £50 John Lewis vouchers

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day