Compounding success

What is compound interest and how does it work? Find out in our concise briefing

Albert Einstein once called compound interest the “eighth wonder of the world”. It might not rank up there with the Taj Mahal and the hanging gardens of Babylon, but the eccentric physicist knew what he was talking about. Whether you’re investing in cash, stocks and shares, in today’s climate of low interest rates the effect of compound interest can help your investment grow far quicker than you realise.

Put simply, compound interest is the effect of having your regular interest – either monthly or annually – paid back into your initial deposit, boosting your savings and providing a greater base from which your money can grow. As many funds and stocks on the market offer a regular income – often known as dividends – reinvesting the payments rather than taking them as income is the key to superior returns.

Einstein added that “he who understands it, earns it; he who doesn’t, pays it.” Here’s how it works: imagine you’ve invested in a fund that returns 7 per cent on average a year, which on a deposit of £100 is £7. After the first year, it will be worth £107, and provided you leave the money alone, you’ll continue to earn that 7 per cent a year on the higher amount, and so on.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

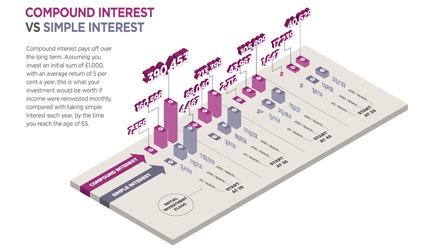

Click on the infographic below to expand it

The longer you leave the investment with the interest compounded, the more it will soar in value, as there will be more money to invest. For example, if somebody invested just £1 a century ago with a return of 7 per cent a year – assuming it keeps pace with inflation – it would be worth £867.71 today, if all the income was reinvested. But with simple interest, where the income is taken each month or year, the sum would be worth just £8 after 100 years.

That means that the younger you start saving, the more your investment can grow. Thanks to compound interest, you could save for 10 years throughout your twenties, and you’d earn more money when you retire than if you saved for 40 years, but started later. A longer investment time frame will also ride out the general rise and fall of the stock market. It takes market timing out of the equation too – when stocks are cheaper, the initial deposit will buy more; and when stocks are more expensive, the deposit will buy fewer.

Granted, compound interest won’t make you a millionaire overnight, but reinvest the income for enough years and you’ll really notice the difference.

In fact, if you save for long enough, you can even turn a regular small monthly deposit into a million. A 24-year-old today saving £100 a month, assuming an average annual growth rate of 7 per cent, could see their bank balance tip one million pounds after 59 years – not bad from putting just £100 aside each month.

It’s investors – rather than savers – who can really reap the benefits of compound interest as returns from the stock market are typically higher. If you’re investing in individual stocks or funds, you’ll benefit from both the capital growth of your investment over time, as well as any income, assuming the company or fund you’re invested in provides one. Rolling this income back into the investment means your pot can grow far quicker than if you just invested in cash.

The benefits of reinvesting any income are many – not least a higher return thanks to compound interest. For example, ploughing the income back into your investment encourages a good long-term saving habit, particularly if you are topping up the initial sum with monthly deposits. Understanding the benefits of compound interest is an important first step, but it is essential to review your investments on a regular basis to ensure you're getting the most out of them.

As Einstein suggests, there are rewards to be found in the principles of compound interest… but fortunately you shouldn't need a PhD in theoretical physics to understand them.

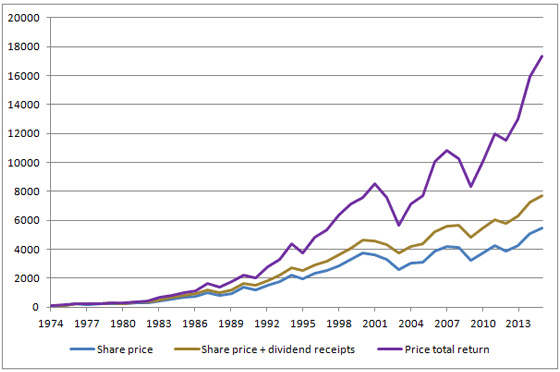

Case Study: Alliance Trust PLC

The benefits of compounding are clearly demonstrated in Investment Trusts. By reinvesting the dividends paid out this can mean a big difference to the return on investment. In the chart below, we highlight this using the example of Alliance Trust PLC over the last 40 years. You can see that the share price has risen from around the equivalent of 16p to £4.50. This means that the price has grown by around 8.7 per cent per annum over the 40 years. If you had spent £100 buying 1136 shares on 31 December 1974, your holding would be worth £5,400 today. In addition to the increase in the value of the holding, you would also have received over £2,250 in dividends, making a total of almost £7,700.

Source: Morningstar. Past performance is not a guide to future performance.

Had you elected to use the dividend income to buy more shares in the same company, then you would now hold over 3,600 shares and your holding would be worth over £17,300. In effect, you have more than doubled the value of your portfolio in comparison with the value of the shares and the income generated.

Investments can go down as well as up. Investors may get back less than they originally invested.

Investment trusts may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that a relatively small movement, down or up, in the value of a trust’s assets will result in a magnified movement, in the same direction, of that NAV. This may mean that you could get back nothing at all.

This is provided for general information only and takes no account of personal circumstances. It is not a recommendation to buy or sell. It is provided solely to support you in making your own investment decisions. Alliance Trust does not give advice. You need to ensure you understand the risks and commitments before investing. If you are unsure you should consult a Financial Adviser before investing.

For more on the power of compound interest, click here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney