4 things we learned from Facebook's confounding earnings report

Facebook is finally earning money from smartphone apps, but the price tag of success has investors running for cover

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

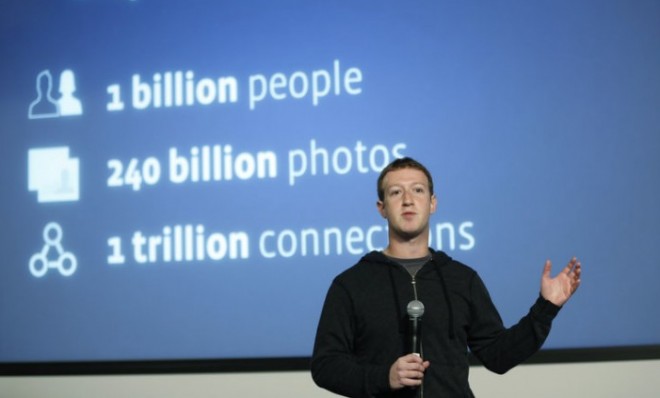

Wall Street just isn't sure what to make of Facebook. The social networking giant beat expectations in its latest quarterly earnings report, raking in $1.56 billion in revenue — a 40 percent jump over the final quarter of 2011 — but booked $64 million in profit, a 79 percent slump from a year earlier. The company's stock, which plummeted after its heady initial public offering in May 2012 but has regained a lot of lost ground in the past three months, dipped in after-hours trading, signaling that investors are leery of Facebook's narrowing profit margins — or perhaps of CEO Mark Zuckerberg's admission that his company won't be "operating to maximize our profits this year." The past quarter "was a little like a cold shower after you've been out all night — it's something that makes you sober up very quickly," analyst Jordan Rohan at Stifel Nicolaus tells The New York Times. Here, four things we learned about Facebook from its latest reckoning with Wall Street.

1. Facebook is rapidly becoming a mobile service

"The good news for investors," says Jessica Guynn at The Los Angeles Times, is that Facebook is "quickly figuring out how to make money from ads on mobile devices." That's crucial, because about 680 million of Facebook's 1.06 billion active users read their News Feed on their smartphones or tablets, a jump of 57 percent. "Today there's no argument," Zuckerberg said on the earnings call. "Facebook is a mobile company." The bad news for investors, says Guynn, is that the switch from desktop to handheld device "hasn't come cheap." More than half of users are on mobile devices, but mobile ads accounted for just 23 percent of ad revenue. That's the root of Facebook's "complicated" relationship with Wall Street. Investors have "a stubborn sense... that Facebook could be doing more to milk revenue from its users on mobile devices," while Facebook is proceeding with caution on mobile ads so as not to "alienate users who are more interested in catching up with friends than having their News Feed overrun with ads for products and services."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. It's starting to make serious money off mobile ads

"The Street may not love the financial results Facebook just announced," says Jeff Bercovici at Forbes, but the jump in mobile ad revenue is a huge deal. As Zuckerberg pointed out on the earnings call, "We started off the year with no ads on mobile, and we ended with 23 percent of ad revenue coming from mobile in the fourth quarter." Even if mobile revenue doesn't accelerate, "Facebook will completely blow away eMarketer's forecast of $851 million for 2013," and of course it will accelerate. Zuckerberg and Co. may not catch up with Google's mobile ad revenue anytime soon, but "concerns over Facebook's abilities to monetize mobile in any meaningful way were a big part of what dragged down its IPO just eight months ago," and the company largely put those fears to rest Wednesday.

3. Facebook is also spending a ton of cash

The main reason Facebook's revenue was up but profits were down is that Zuckerberg spent heavily last quarter — $1.06 billion, versus $583 million a year earlier — and plans to increase expenses by another 50 percent this year, mainly on hiring new staff and developing new tools for advertisers. Investors were obviously cheered that Facebook's inability to monetize mobile browsing "seems like a distant nightmare," says Jennifer Van Grove at CNET. But this "spending like crazy" isn't entirely welcome. It depends how the money is spent, BTR Capital Management's Adam Schneiberg tells Bloomberg. "Wall Street tends to be forgiving of higher spending during high-growth periods when new products are being built.... As long as eyeballs tune in and revenue keeps growing, the Street will believe that at some point the company can flip the switch on profitability."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Don't hold your breath for a Facebook phone

"Facebook is a closely watched test case of the speed at which the desktop web era can shift into the mobile era," and it just reminded us "that mobile is not an option; it's an inevitability," says Eliza Kern at GigaOm. And Facebook's success this past year was mainly from improving its existing mobile offerings, not coming up with new treats. Zuckerberg understands that for the company to grow, that's not enough — "Facebook needs to build the Instagrams, Snapchats, or Vines of tomorrow that actually engage mobile users in a new way." But don't expect Facebook to get involved in the hardware side of mobile, like Google and Apple. "People keep asking if we're going to build a phone," Zuckerberg said Wednesday. "And we're not going to build a phone.... We have a billion people using our product and we have to make Facebook really good across all the devices they're using." He might have added that the company has to get really good at making money off all those mobile users, too.

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.