Will history look kindly on Ben Bernanke?

Some will say he left a big mess. Others that he averted a second Great Depression.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

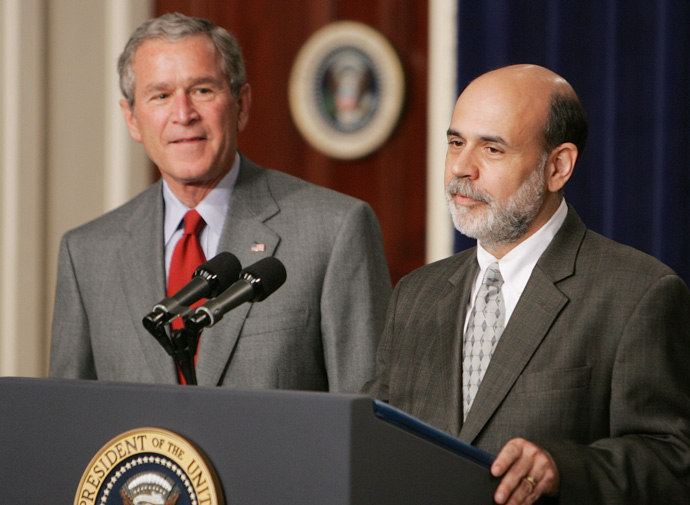

After eight tumultuous years, Ben Bernanke will soon step down as chairman of the Federal Reserve. How should we judge his 2006-14 tenure in charge of the world's most powerful central bank?

The short, truthful, and unsatisfying answer is that we don't know yet. Bernanke's legacy as a central banker is still up in the air, because we have yet to see the long-term effects of the programs and policies that the Fed initiated under his watch.

Yet we can, I think, begin to make a preliminary assessment. Bernanke did not leave the Fed in disgrace. He has not been hounded out by mobs with pitchforks or tried for treason, as some politicians suggested he should be. He did not leave due to economic collapse or hyperinflation, as some said he would.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

He did leave the Fed after two difficult terms, the first of which included the worst financial and economic crisis since the Great Depression. But in spite of these difficulties, the economy today is larger than it was when Bernanke succeeded Alan Greenspan, and is growing now at a rate of above four percent.

The Federal Reserve has a mandate to ensure steady, low inflation — around two percent — and low unemployment, with the current goal set between 5.2 percent and 5.8 percent. Bernanke has left an economy with seven percent unemployment and an inflation rate of just under one percent. In other words, unemployment is a little higher than might be hoped, and inflation a little lower. But not drastically so.

Bernanke's detractors will say that he missed the housing bubble and then messed up the response to it. But is that really fair?

I'd say no: The events leading up to the 2008 financial crisis were set in motion long before Bernanke became chairman. Although he sat on the Federal Reserve Board of Governors as Greenspan lowered interest rates in the aftermath of the 9/11 attacks (which may or may not have contributed to the housing bubble), he wasn't responsible for the congressionally supported subprime lending, the repeal of Glass-Steagall, the relaxation of lending standards resulting from securitization of risky mortgages, and the evolution of the unwieldy mega-banks.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Indeed, Bernanke's greatest missteps may have occurred before he became chairman, when he was Greenspan's deputy.

Before he became Fed chairman, Bernanke stuck his foot in his mouth, denying that a housing bubble existed and claiming that climbing house prices "largely reflect strong economic fundamentals," such as growth in jobs, incomes, and the number of new households. That was a mistake, especially when other economists such as Robert Shiller were warning that there could very well be a housing bubble.

But upon becoming chairman, Bernanke actually raised short-term interest rates, increasing the cost of borrowing and encouraging saving. So it's not like he was totally blind to the economy beginning to overheat.

And beyond raising rates, what else could Bernanke have done, even if he had believed he was inheriting a ready-to-burst housing bubble, and an irrationally exuberant stock market? The Fed's mandate is stable inflation, low unemployment, and acting as a lender of last resort, not bubble-bursting. It's hard to know with certainty whether there is a bubble until it pops. Trying to prick perceived bubbles carries risks, and tightening too hard may throw the economy into recession or deflation. Indeed, the very idea of bubble-bursting only grew popular after the financial crisis, with the benefit of 20-20 hindsight.

Bubbles, ultimately, are not rational phenomena. They burst when they burst, and very often the best governments can do is limit the fallout.

So the timeframe for judging Bernanke as Fed chairman, I think, begins with the aftermath of the bubble, and the central bank's efforts to stabilize the financial system, and fight off deflation and mass unemployment.

First, let's start with his response to the crisis.

The Federal Reserve — as a central bank — is charged with acting as a lender of last resort to prevent financial panics. The financial system is highly interconnected, with banks owing money to each other. This means the failure of one can lead to the cascading failure of many.

The Fed, with the help of JPMorgan Chase, bailed out Bear Stearns when it ran out of liquidity in March 2008. But when Lehman Brothers also faced a liquidity squeeze in September 2008, the Fed did not come to the rescue. Lehman filed the biggest bankruptcy in U.S. history, markets panicked, and the economy ultimately tanked.

Could Bernanke have avoided that outcome? No, he says — Lehman Brothers was beyond saving, because its balance sheet was in such dire straits that it could not post sufficient collateral to qualify for Federal Reserve aid. But as soon as Lehman was bankrupt, the Fed — beginning with the bailout of AIG — began lending over $7 trillion into the banking system, and in so doing averted a major systemic collapse.

This proved an important point — if a default cascade starts due to a bank failure, the Fed can stop it by bailing out the failed bank's counterparties. This hadn't really been tested before. And even if he wanted to directly bail out Lehman (as opposed to arranging a shotgun marriage with a healthier bank), the existing legal framework he inherited forbade him from doing so. The system was cracked with frailties.

Second, the Fed moved to shore up the broader economy. With unemployment rising so quickly, the Fed quickly dropped short-term lending rates to zero, to discourage investors from idly sitting on cash and savings.

Although Bernanke promised to keep rates low, unemployment was still rising, and deflation was setting in. Deflation is problematic for two reasons — first, it makes past debts more difficult to repay, thus increasing the risk of default; second, it discourages economic activity by depressing wages, leading consumers and businesses to just sit on bonds, cash, or bank deposits.

With its main tool — lowering the benchmark interest rate target — tapped out, the Federal Reserve needed a new set of tools to conduct monetary policy. (Congress was little help: After it passed a large stimulus package in 2009, it quickly became clear that no more stimulus money was forthcoming from the gridlocked legislature.) Japan had experimented with asset purchases to conduct monetary policy at the zero bound. But these methods were controversial, since Japan at the time had suffered 15 years of false starts, weak growth, and deflationary slumps.

Bernanke began this new unconventional monetary regime in November 2008 with a $600 billion program of quantitative easing asset purchases, which was expanded in March 2009 to $1.05 trillion. Bernanke's theory was that if you can't cut interest rates in the traditional way, you can still effectively cut rates by taking yielding assets out of the financial system and replacing them with cash. By taking safe yield out of the system, investors seeking a return on their investments would have to diversify their portfolios with productive assets like equities. More productive activities should produce more growth and jobs, bringing down unemployment and growing the economy.

By late 2009, unemployment finally began to stabilize just below 10 percent, and the threat of a deflationary cycle receded. But 10 percent unemployment is still perilously high, and after another year of stalled growth in the labor market Bernanke announced a new round of asset purchases — QE2 — worth $600 billion in November 2010. Unemployment fell, gradually. Yet each time the Fed began tapering its purchases, the market reverted back to risk aversion.

The real breakthrough in conducting monetary policy at the zero bound may have come as late as 2012, when the Fed initiated QE3. QE3 was not limited to an arbitrary level of purchases like QE1 and QE2. The Fed said it would make a variable amount of asset purchases — at first $85 billion a month, now $75 billion a month — until unemployment fell to around 5.5 percent, unless inflation rose above the Fed's two percent target. This would seem to get around the problem of tapering the stimulus too early.

Since commencing QE3, unemployment has fallen significantly, to seven percent, from about eight percent. Year-on-year growth has picked up. Inflation remains very tame. This improvement has been significant enough for the Fed to reduce asset purchases by $10 billion per month.

Some say that this experiment is dangerous, and that the Fed may struggle to unwind its asset purchases. But does the Fed really need to unwind? Not necessarily. The Fed's mandate is low inflation and low unemployment. There is no reason to "normalize" policy, and reduce the Fed's balance sheet unless inflation picks up.

Of course, as the recovery strengthens inflation is likely to rise due to rising demand. In that case, the Fed has two options: Raising interest rates, and reversing asset purchases, which entails sucking cash out of the system in exchange for the assets on its balance sheet. So the Fed now has more tools at its disposal for fighting inflation than before. This may, in the future, prove to be a useful tool for fulfilling its mandate.

This also means that Bernanke and his team may have planted the seeds for a future of workable monetary policy at zero bound. That would be a serious empirical breakthrough in economics and central banking, allowing central banks to fight unemployment and deflation when pulling the old interest rate lever is not an option.

Of course, the future is unpredictable. There remain doubts about the health of the financial sector. There remains risk, even after five years of gradual deleveraging, that private debt is too high and cumbersome. Some charge that having been bailed out, the financial sector has not learned many lessons from 2008, that the Dodd-Frank regulatory overhaul giving the Fed authority to wind down banks that are deemed "too big to fail" is insufficient, and that another financial blowup may be on the horizon. And unforeseen shocks — wars, natural disasters, energy shocks, political shocks — may derail this recovery and stain Bernanke's legacy. So would the emergence of uncontrollably high inflation or uncontrollable deflation.

But in spite of the difficult start he faced, the signs are beginning to point to history looking kindly on Ben Bernanke as America's central banker.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.