Rejoice! Businesses are investing!

All the pieces for a strong economic recovery are finally coming together

There has been a slew of positive economic signs in 2014. Stocks continue to soar to record highs. Jobs are being created at the best pace since the 1990s. GDP grew last quarter at a blazing 4.2 percent pace. Even food stamp usage has begun falling after years and years of going in the other direction. Corporate profits are at all-time highs.

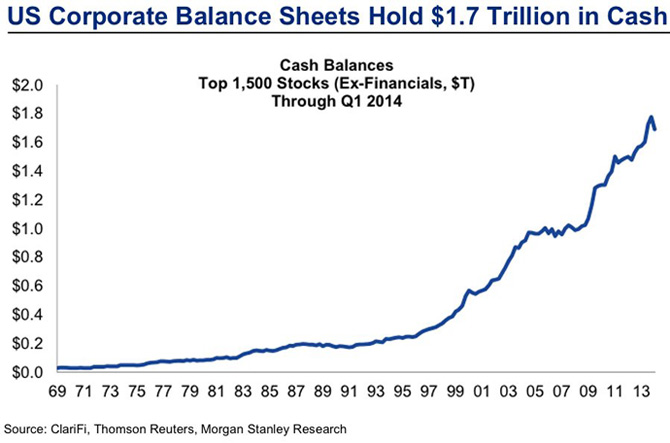

But the one big piece missing from the puzzle (alongside wage growth, which is still relatively lackluster) was capital expenditure. U.S. firms were sitting on huge piles of cash, and after 2011 they stopped investing it in the way you would expect to see during an economic recovery.

Yet at long last, as Sam Ro of Business Insider points out — and as I predicted earlier this month — that is changing. American firms' massive reservoir of cash is shrinking:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

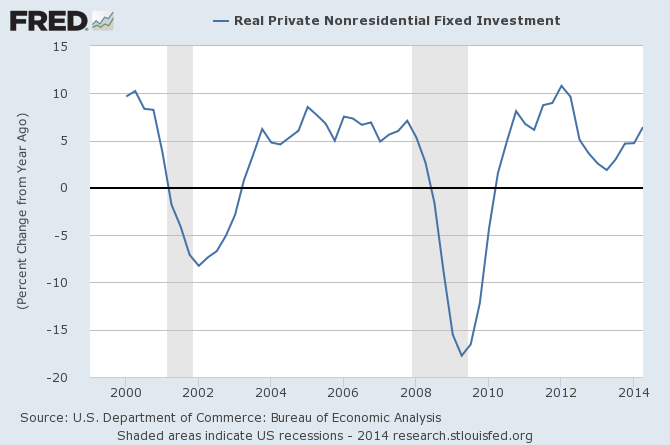

And money is pouring into business investment:

This was inevitable, mainly because America's factories, infrastructure, and equipment are the oldest they have been since the Great Depression. Crumbling equipment and premises are bad for business. If firms want to keep up those high profit margins and remain abreast of the competition, they need to replace, repair, or upgrade obsolete and failing equipment and premises.

The really exciting thing is that this is a very good indicator of a strengthening economic recovery that includes lower unemployment and higher economic growth. Sitting on cash might give firms a security blanket to insulate themselves against future economic shocks, but it does nothing to benefit the wider economy. It is just idleness.

Investing that cash, on the other hand, encourages a beneficent spiral — as firms invest, they put money in workers' pockets, which increases disposable income, bolsters confidence, and raises demand in the economy. Growing capital expenditure is the best evidence thus far that this is not a bubble, but a real, solid economic expansion. And long may it last.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

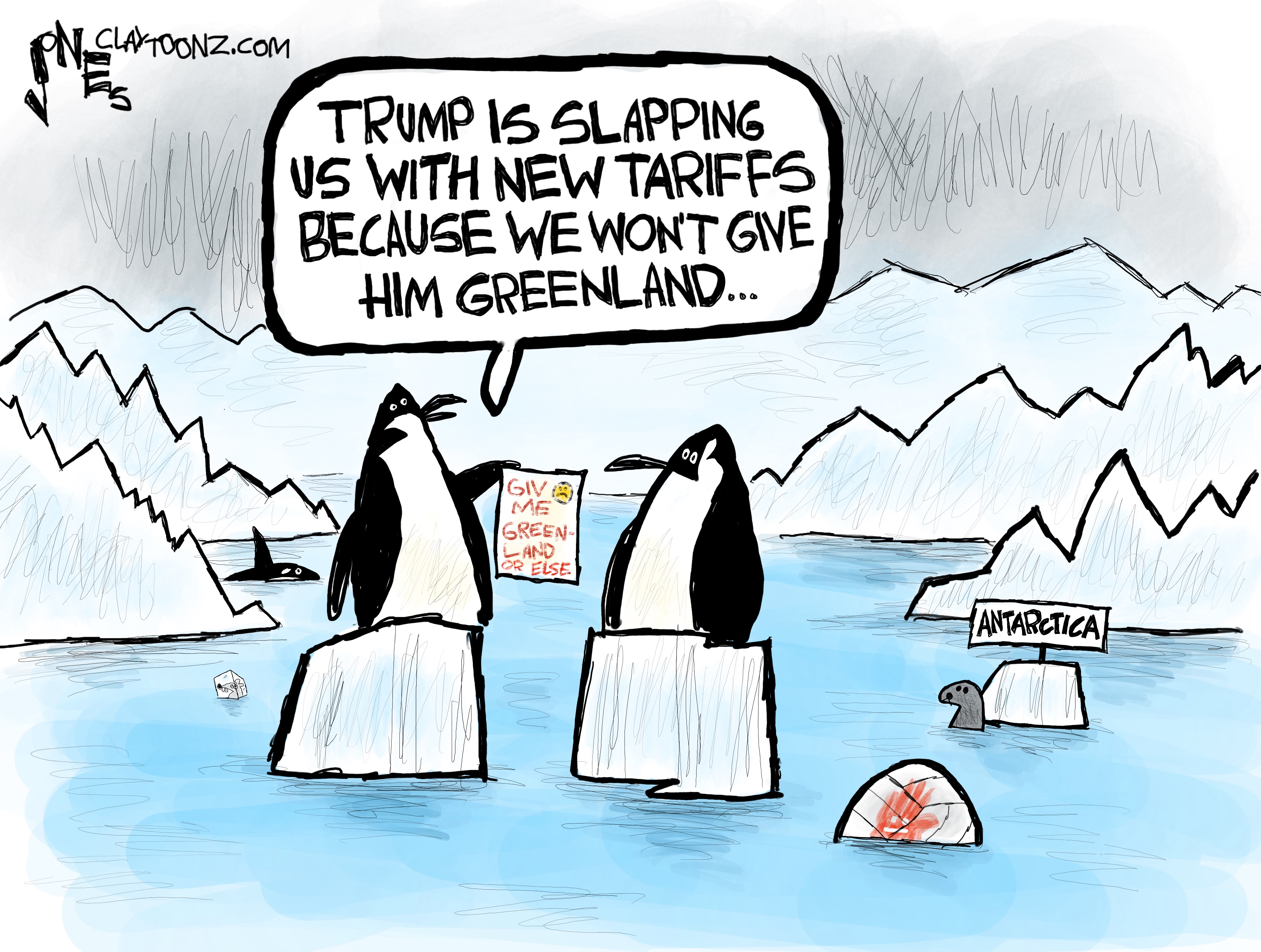

Political cartoons for January 19

Political cartoons for January 19Cartoons Monday's political cartoons include Greenland tariffs, fighting the Fed, and more

-

Spain’s deadly high-speed train crash

Spain’s deadly high-speed train crashThe Explainer The country experienced its worst rail accident since 2013, with the death toll of 39 ‘not yet final’

-

Can Starmer continue to walk the Trump tightrope?

Can Starmer continue to walk the Trump tightrope?Today's Big Question PM condemns US tariff threat but is less confrontational than some European allies