Are tax inversions unpatriotic?

More than $2 trillion in U.S. corporate earnings are parked abroad

Treasury Secretary Jack Lew thinks U.S. corporations moving overseas should be ashamed, said Jim Puzzanghera at the Los Angeles Times. In a letter to lawmakers, Lew called for "a new sense of economic patriotism" and urged Congress to enact laws that would stop U.S. companies from reorganizing as foreign firms to avoid paying taxes — a practice known as tax inversion. It's an increasingly popular loophole that spells disaster for corporate tax revenue, said Edward D. Kleinbard at The Wall Street Journal. In an inversion, a U.S. firm acquires a much smaller company based in a tax-friendly country such as Ireland, "but the deal is structured so that the foreign minnow swallows the domestic whale." The U.S. company, now headquartered overseas, can then avoid paying corporate taxes on foreign earnings that are repatriated back to the United States. Chicago-based drugmaker AbbVie's pending inversion to the U.K., for instance, will probably lower its effective tax rate from 22 percent to 13 percent by 2016. Firms that invert argue the deals are perfectly legal and necessary to remain competitive against global rivals. But one thing is clear: "If allowed to continue, inversions will eviscerate the U.S. domestic corporate tax base."

The cost of these inversions is being wildly overblown, said Ike Brannon at The Federalist. Halting tax inversions tomorrow would net the government less than $20 billion over the next decade, according to official estimates — a drop in the bucket for Washington's coffers. And even that number is probably high, given that it "assumes that every single dollar held by U.S. companies overseas would eventually be returned to the United States and taxed fully." If political leaders really want to keep companies from fleeing overseas, they should tackle the underlying problem: the fact that the U.S. has the highest corporate tax rate in the developed world, said Edward J. Reilly at CNBC.com. Though many companies don't pay the top rate of 35 percent, our messy and onerous tax code is the primary reason "why $2.1 trillion in U.S. corporate earnings are parked abroad." So until we see meaningful tax reform, expect companies to keep cutting corners when and where they can.

"The long-term answer may be tax reform, but right now the leaks have to be plugged," said The Baltimore Sun in an editorial. Fourteen inversions have been announced this year alone. Better to block the inversions now and fix the code later, given that "once enough corporations are gone, there won't be much reason to institute reforms at all." Perhaps we should start by publicly labeling these companies for what they are: "deserters," said Allan Sloan at Fortune. They "don't hesitate to take advantage of the great things that make America America: our deep financial markets, our democracy and rule of law, our military might, our intellectual and physical infrastructure, our national research programs, all the terrific places our country offers for employees and their families to live." But when it's time to "ante up their fair share of financial support of our system," they run in the other direction. I understand inverting isn't breaking any law. "But being legal isn't the same as being right."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

The history of US nuclear weapons on UK soil

The history of US nuclear weapons on UK soilThe Explainer Arrangement has led to protests and dangerous mishaps

-

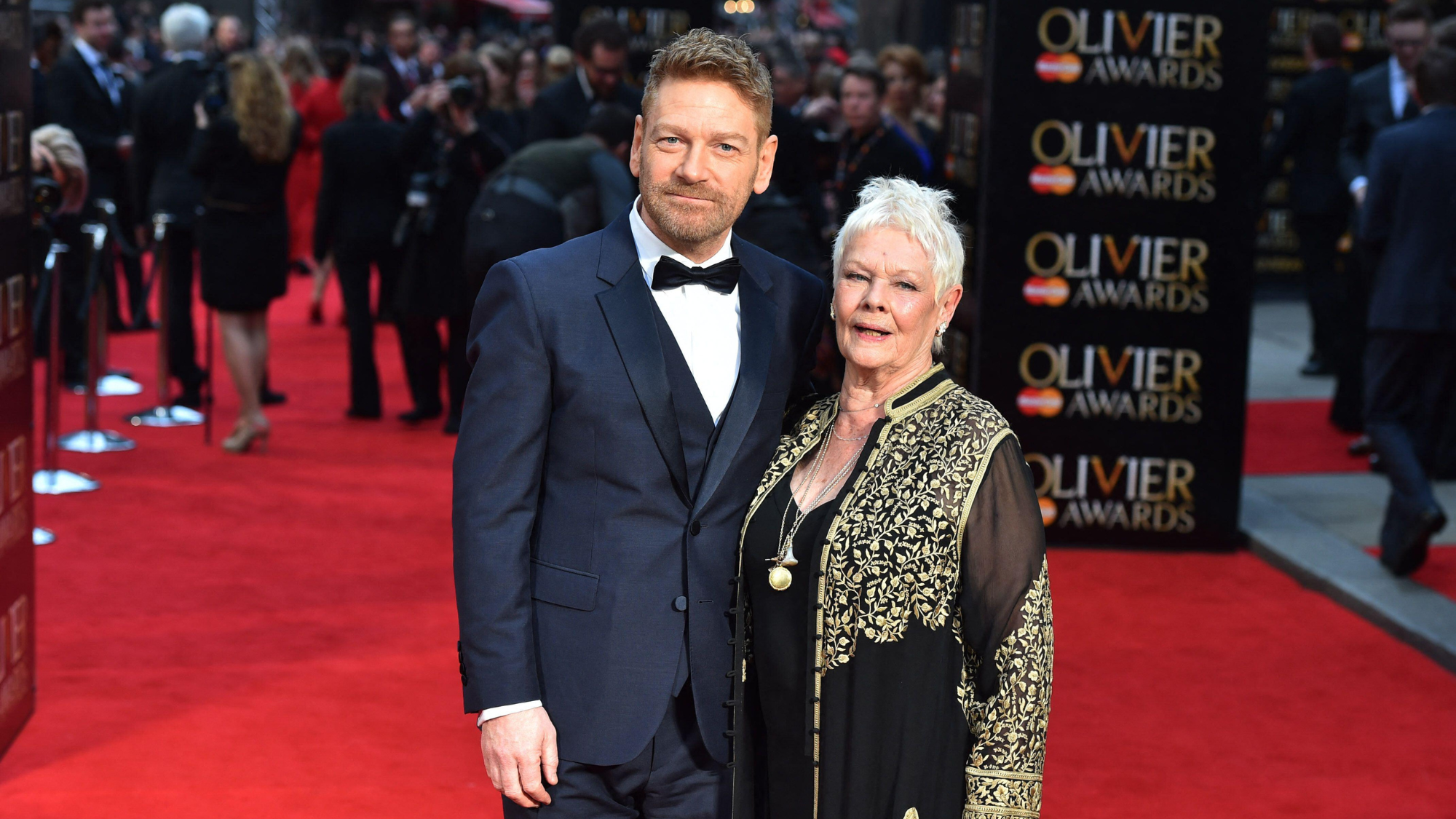

Tea with Judi Dench: ‘touching’ show is must-watch Christmas TV

Tea with Judi Dench: ‘touching’ show is must-watch Christmas TVThe Week Recommends The national treasure sits down with Kenneth Branagh at her country home for a heartwarming ‘natter’

-

Codeword: December 24, 2025

Codeword: December 24, 2025The daily codeword puzzle from The Week