I'm a debt counselor — and I went bankrupt

It really can happen to anyone

There are certain times in your life you remember in stark detail. Your first kiss. The first time your heart was broken.

One of those days for me was the day I had to tell my wife that we needed to file for bankruptcy. That we would have to give up our three-bedroom home. That we had to break our lease with Infiniti. It wasn't the actual moment when I filed for bankruptcy — that was just a jumble of papers, numbers, and black-and-white print — that left an indelible imprint on my brain.

No, it was the expression on my wife's face when I broke the news. Shock, disbelief, anger, panic all flitted across her face, before she paused, gave a little laugh, and said, "Dave. That's not funny. There's no way you would need to file for bankruptcy."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sadly, she was very, very wrong.

She completely trusted me with our financial dealings, as I, a professional debt counselor, was the "expert." Surely, who would be better qualified to handle the family finances than the resident finance manager, who has seen so many people on the brink of financial ruin and helped them back onto their feet?

And I was good at my job too. I knew the many pitfalls of taking on too much debt, spending beyond your means, becoming overwhelmed with interest, losing jobs.

It's easier, however, to see other people's shortcomings and how to fix their issues. I was blind to — or at least myopic about — our struggles in a way that I'm sure another financial adviser would have spotted immediately.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What went wrong

Jennifer and I got married young, right out of college, both of us with student loans — to the tune of $40,000 altogether. Because we were young, we made poor decisions in the beginning, opting to pay for most things with credit.

It didn't matter if we didn't have steady jobs, or had incomes that supported our lifestyles — at the time, my wife worked at a local restaurant as a server making roughly $11.50 an hour plus tips. We needed new furniture, as we were just starting out, and we didn't want the regular IKEA stuff, so we wound up buying an overabundance of expensive furniture, calling it an "investment." If we got tired of one car, we'd quickly go out and get another. Trips to New York, Hawaii, and Europe were a part of our lifestyle.

Growing up, money and frugality were never topics that were widely discussed in my family. I think that lack of clarity may have had a slight influence on my career choice, to pursue something unknown. I also think it led to my eventual financial downfall, as I never grew up saving money — I only learned how to teach others.

In two years or so, we had amassed at least $20,000 in credit card debt to go with our solid $40,000 of student loans and thousands in car loans. In the meantime, I had been slowly making deals with bigger and more renowned clients and taking on more responsibility as a freelance financial adviser.

Then Jennifer got pregnant, which put a halt to our jet-setting ways.

But now we need a house for our growing family, so we bought a smallish two-bedroom house outside of Los Angeles. We didn't think we would need to upgrade immediately, but shortly after Sara was born, Jennifer was pregnant again, with Zoe. We thought we needed a bigger house at the time, but in retrospect, perhaps we could have done without. This was right after the economic downturn of 2008, so we sold our house at a massive loss — around $100,000 — and turned right around and secured a mortgage for a three-bedroom house in a good school district in Pasadena, California.

It's obvious to me now that we were doing everything wrong, that I was doing exactly the opposite of what I counseled my clients. Instead of paying down as much as possible on existing debts, I was paying just the minimum and going out and accruing more debt. Rather than immediately putting income into savings or retirement accounts, I was spending every last bit of my income to keep us in our lifestyle.

How did I not see that we were headed for financial disaster? Part of it was that I never adjusted to the mentality that we wouldn't always have two incomes. With my mind so focused on other people's finances, it was easy to wind up neglecting my own. After the birth of the girls, Jessica decided to stay home full-time (which I fully supported — the girls needed their mother to take care of them and not anyone else). We went from a dual-income family with no children to a single-income family with two children in what seemed like a blink of an eye, with two more mouths to feed and care for on top of our existing expenses.

Part of it was hubris as well. I was doing well in my practice and had amassed a sizable client base, which I thought would bring in more income than it did. I hadn't fallen behind on any payments (at first), and yes, I thought that nothing bad could happen to me because I knew better; I was financially invincible. I thought I knew how to save myself before things got too bad.

My breaking point

Three years passed and we were still scraping by. I was hiding the late payment notices from my wife so she wouldn't panic, and started making excuses for why we couldn't take that vacation to New York this month.

Finally, one night, after shredding another pile of delinquent notices, I sat down and took a hard look at my finances. I felt it was finally time to do for my family what I had done for so many others. I treated myself as though I was a client, something I had refused to do for so long out of sheer ego … and what I found shocked me.

My habit of paying just the minimum on our debts while living beyond our means had left us with almost no savings (unless you count the paltry $2,000 in a savings account that wouldn't even pay for a month's mortgage). Our interest rates on the credit cards were through the roof due to several delinquent payments. We were at least three months behind on mortgage payments, and the bank was starting to threaten foreclosure. We had barely made a dent in paying back our student loans.

I kept looking for a way, a plan, some solution that would allow us to keep our house while paying down our debts, but it was too late for most programs. Credit card companies would be unwilling to work with me because we were so far behind on payments that some were in collections. I didn't want to file for bankruptcy, knowing full well that only some of that debt would be ameliorated (student loans, for example, would not), but after spending most of the night wading through calculations, it became abundantly clear that I didn't have many other options.

I filed in 2011, after struggling for nearly a year to keep afloat.

Life after bankruptcy

Instead of the cozy three-bedroom home where my daughters lived all their lives, we suddenly found ourselves crammed into a one-bedroom, one-bath apartment on the edge of downtown L.A. with two almost-teenagers, far from the city-suburbs of Pasadena where all our friends lived.

What was worse — much worse than losing our meager savings, our home, our car, and much of our belongings — was losing the respect and trust of my wife, and my confidence in myself.

Not only was I not able to support my family, but I had made things worse for them. My daughters now shared a corner of the living room, converted into a bedroom using screens, instead of having their own rooms. Jess barely spoke to me for weeks after I broke the news. Sometimes I think the only reason we didn't end up divorced was because we simply couldn't afford it.

My wife and I had to figure out how to go to work and shuttle the girls to and from school and to play dates and birthday parties, with just one car (it was a blessing our old Toyota was paid off).

I spent so much time resurrecting my own finances that I barely had a chance to maintain my business, so now I'm building it back up. My wife is working again in the service industry, and we discuss our financial situation openly, which puts us in a much stronger place than we used to be, both financially and on a personal level.

We've learned to cut out unnecessary expenses. Any vacations we take are day trips to somewhere local. We always pack our own lunches. Cable was quickly deemed an extravagance and cut out of the budget. Our old car may be old, but it still runs with a minimum of upkeep. My wife shops at secondhand stores for clothing and other necessities. We coupon clip now — I've become quite the pro. We've paid down roughly two thirds of our amassed debt, a number that dwindles by the day.

We also set up a budget for ourselves, detailing how we are going to pay down our remaining debt, while saving for a rainy day and retirement.

The one-bedroom is a tight fit, but we're going to hang in there a bit longer until we have more savings banked. I realize that getting a mortgage is going to be much tougher now, so I'll need to rebuild my credit and save up plenty of cash for the next go-round as a homeowner.

I never thought I was a particularly judgmental person — people from all walks of life came through my door needing assistance, and I was always able to help them out. But I never really understood just how humiliating, stressful, and demoralizing it is to find yourself in over your head in debt until I had to bail myself out.

Yes, some clients turn away from me because of my history; but just as many are happy to take on a debt counselor who has filed for bankruptcy. They think that I understand better than anyone else what they're going through and how to find the right solution for them, as they can see that I'm on my path to recovery.

Would I ever want to go through this again? Absolutely not. I wouldn't wish it on my worst enemy. However, I am lucky to walk away relatively unscathed; I'm poorer but much wiser. And I still have my family, which is the most important thing of all.

Dave Landry Jr. is a personal finance adviser and former accounts manager for several large companies. He enjoys blogging and creating infographics in his spare time, and frequently works with DepositAccounts.com to assist people in opening the savings, checking or CD account that is right for them.

More from LearnVest...

-

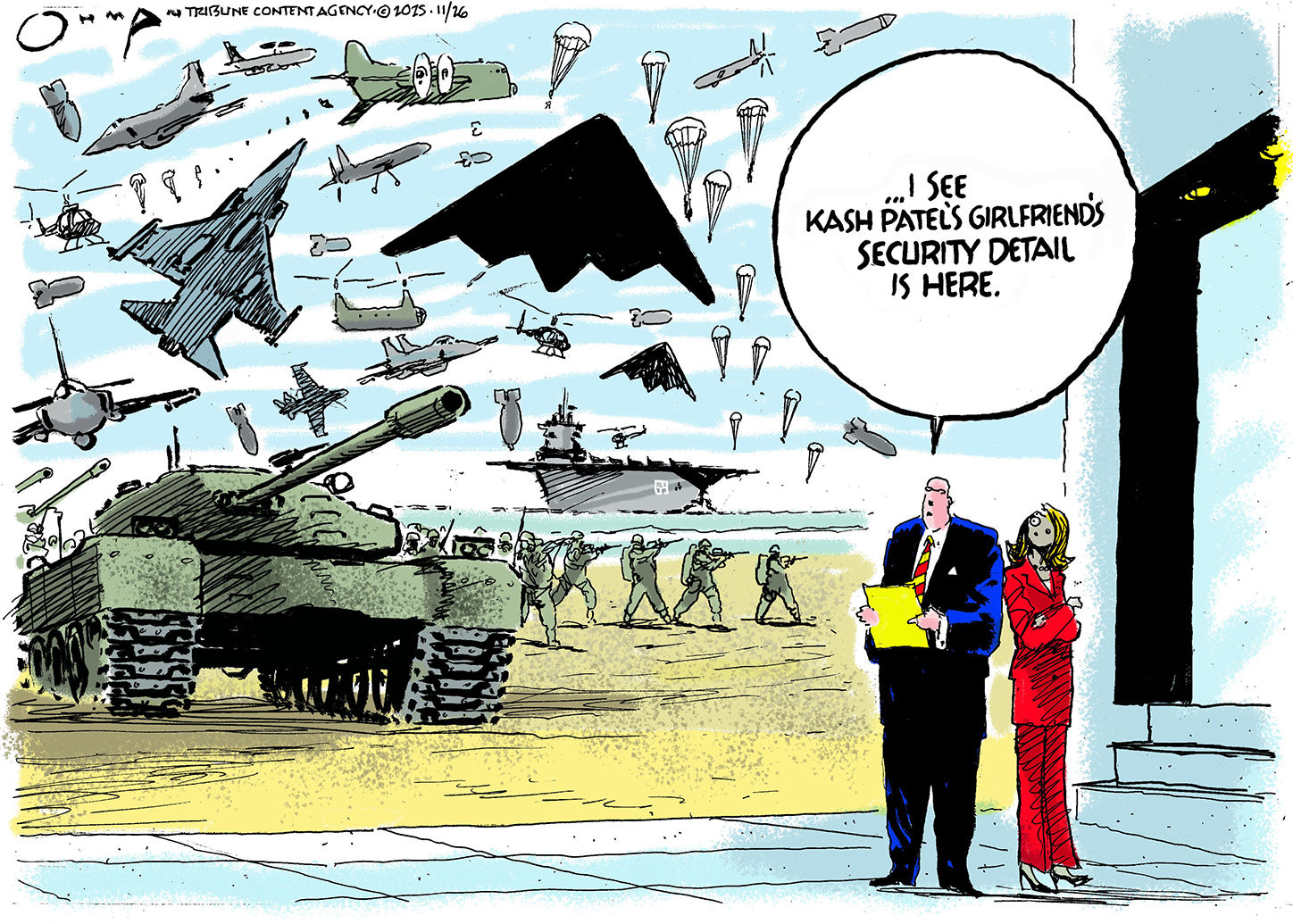

Political cartoons for November 29

Political cartoons for November 29Cartoons Saturday's political cartoons include Kash Patel's travel perks, believing in Congress, and more

-

Nigel Farage: was he a teenage racist?

Nigel Farage: was he a teenage racist?Talking Point Farage’s denials have been ‘slippery’, but should claims from Reform leader’s schooldays be on the news agenda?

-

Pushing for peace: is Trump appeasing Moscow?

Pushing for peace: is Trump appeasing Moscow?In Depth European leaders succeeded in bringing themselves in from the cold and softening Moscow’s terms, but Kyiv still faces an unenviable choice