This is the key to understanding today's big GDP announcement

Growth soared to over four percent in the third quarter, the Commerce Department announced. Here's why.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The American economy grew at the fastest pace in almost two years in the third quarter. Business investment was stronger than previously estimated, too.

The revisions meant the economy grew at a 4.1 percent annual rate instead of the 3.6 percent pace reported earlier this month, the Commerce Department said in its third quarter estimate on Friday.

Consumer spending rose two percent revised upward from 1.4 percent, spending more on gasoline and health care. Business investment in software was revised up sharply to a 5.8 percent increase from an earlier figure of 1.7 percent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This is an another strong suggestion that the recovery is accelerating; anything above four percent growth is a decent rate of expansion. The question now is whether or not this rate of growth can be sustained once the Federal Reserve begins tapering its stimulus measures in January.

Stocks rose on the news, suggesting greater investor confidence.

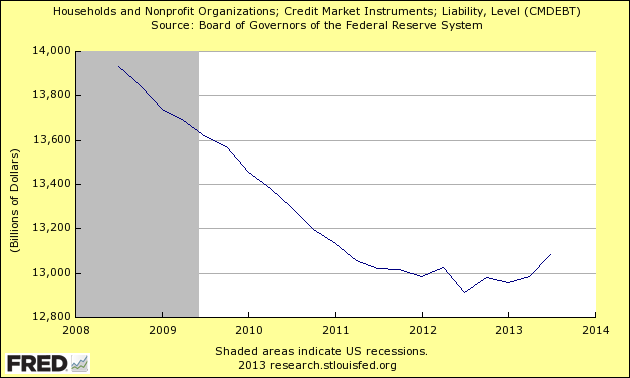

The key here appears to be that households have finally finished deleveraging. Household credit is now growing again for the first time since the 2008 crisis:

[Federal Reserve Bank of St. Louis]

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Every dollar a household spends paying down debt is a dollar not spent on consumption or productive investment. When household debt grows faster than income for a sustained period — as happened during the boom before 2008 — a period of defaults, repossessions, and deleveraging is inevitable.

The data suggests that that period is now over. This means that the stronger growth we are beginning to see may be sustainable.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

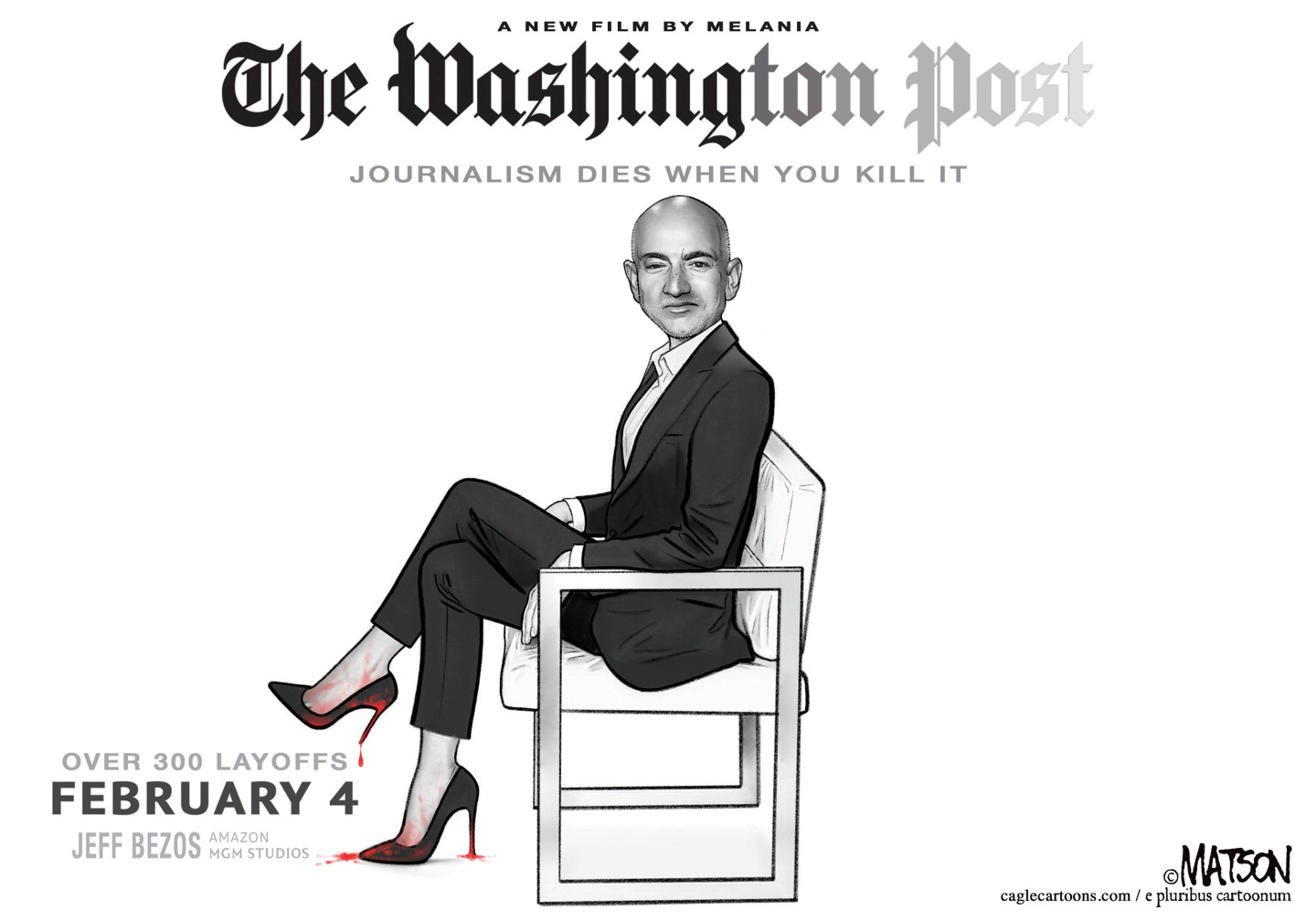

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky