Dow 16,000: Will the bull market continue?

Help me, Janet Yellen, you're my only hope

Yesterday, stock exchanges hit new all time highs — over 16,000 for the Dow Jones, and over 1,800 for the S&P 500. This caps off a monster year for stocks in which they’ve outperformed Treasury bonds by 37 percent.

Of course, this strong growth is rather out of step with the rest of the economy. Unemployment remains above seven percent, and a broader measure of jobs — the employment-population ratio — is still stuck where it was in 2009. Economic growth is still significantly below its long-term trend-line. And although mortgage, credit card, and auto-loan delinquencies are falling, student debt delinquencies continue to rise, illustrating that some people are still having trouble paying their debts. In other words: To date, we have seen a recovery for Wall Street, but less so for Main Street. Can that continue?

Two of the major threats that concerned some analysts — weakening demand from China due to a bursting Chinese real estate bubble, and the Federal Reserve tapering its asset purchase programs — haven’t materialized. And the economy has gained some tailwinds, including slightly lower energy prices, and real estate prices improving at the fastest rate in seven years.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So, where next?

First off, just because those concerns haven't materialized yet, doesn't mean all are no longer a threat. The fast-rising Chinese real estate market, in particular, could still dip at any time, resulting in trouble for America’s largest trade partner.

A second, newer concern is that margin debt on Wall Street is once again rising to new highs, meaning that investors are borrowing in order to buy. This, of course, is a highly speculative activity. If the market continues to rise, no problem. But if the market turns downward and investors face margin calls this speculation can lead to accelerated selling and a more severe downturn.

A third concern is the current frenzied mood around technology. Soaring prices in the Twitter IPO led some commentators, such as Forbes’ Jesse Colombo to declare that the market is in a bubble:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There is a mania for nearly all Web 2.0-related investments right now, and much of it is a product of the overall U.S. stock market bubble that I have been warning about…

U.S. interest rates have been extremely low since 2008, which is forcing investors out of conservative investments, and into riskier investments such as stocks, which is inflating investment valuations. [Forbes]

With companies like Snapchat that have never generated a dollar of revenue receiving multi-billion dollar acquisition offers, he’s right that this is a frenzy that can't last. But will it lead to a stock market crash? If momentum can hold, a crash can be avoided.

And there is a good reason to believe that momentum can be maintained.

Why? A premature taper of the Federal Reserve’s asset-buying programs is beginning to look significantly less likely with the appointment of Janet Yellen — who is determined to lower unemployment. Perhaps the Fed is not the ideal institution to fight unemployment — unlike Congress, the Fed cannot directly create jobs — but with unemployment still relatively high, markets can expect continued support from the presumptive Fed chair.

Inflation remains low and contained, giving the Federal Reserve significant scope to continue to act to fight unemployment. Clearly, the spike in interest rates that occurred after Bernanke implied in June that the Fed might begin tapering illustrates that the market is still keen to receive the Fed’s assistance, and doing so will support confidence and maintain momentum. The Fed has the scope to continue juicing the economy until inflation begins to rise, which shouldn't occur until unemployment moves lower and the recovery becomes firmly entrenched.

So, looking forward, there is room for cautious optimism. Of course there are many and varied risks, but with the Federal Reserve more determined than ever to lower unemployment, the prospect of a continuing bull market is strengthening.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

6 lovely barn homes

6 lovely barn homesFeature Featuring a New Jersey homestead on 63 acres and California property with a silo watchtower

-

Film reviews: ‘Marty Supreme’ and ‘Is This Thing On?’

Film reviews: ‘Marty Supreme’ and ‘Is This Thing On?’Feature A born grifter chases his table tennis dreams and a dad turns to stand-up to fight off heartbreak

-

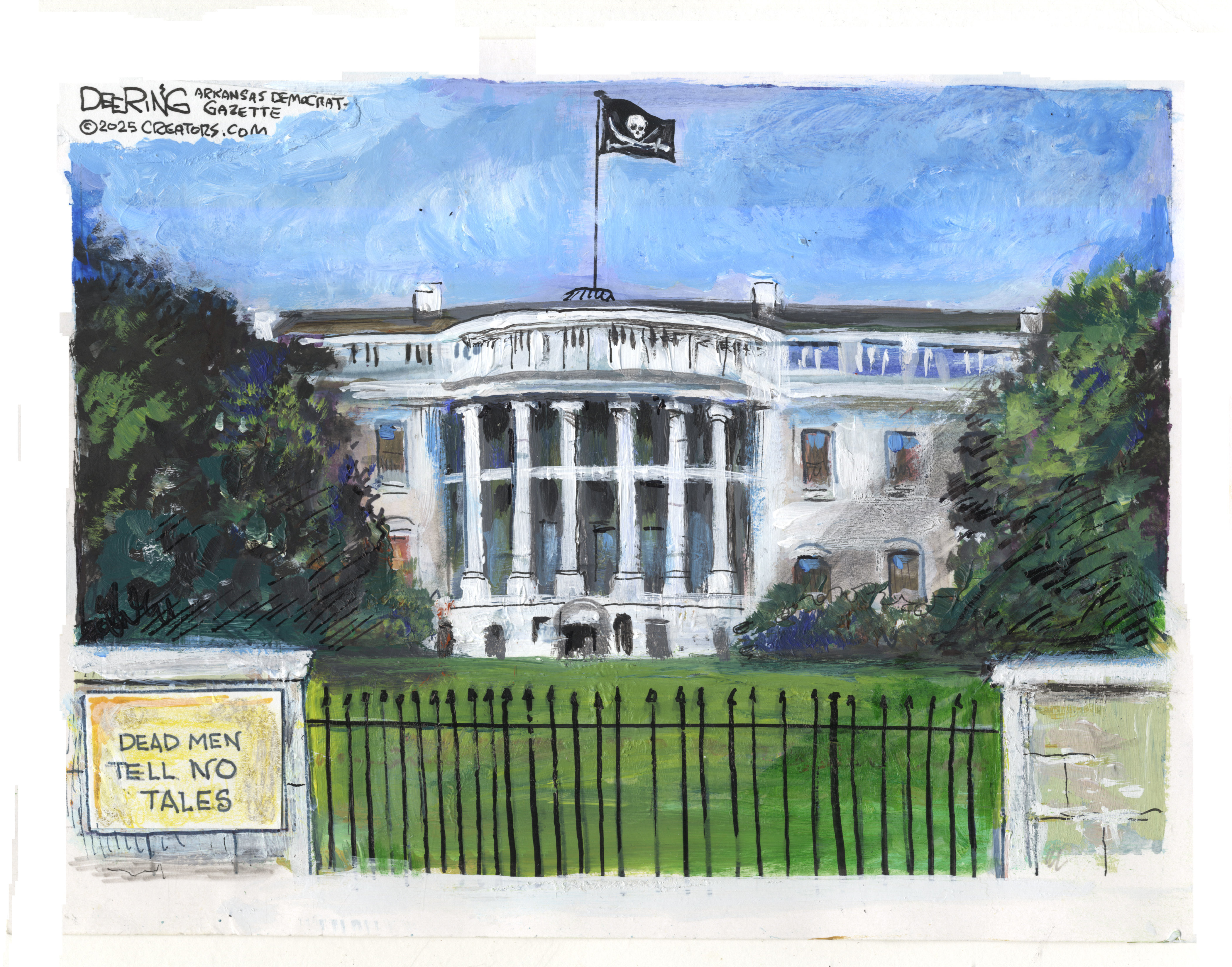

Political cartoons for December 14

Political cartoons for December 14Cartoons Sunday's political cartoons include a new White House flag, Venezuela negotiations, and more