Making money: Dealing with gift taxes, and more

Three top pieces of financial advice — from avoiding sneaky credit card fees to getting better odds for early retirement

Sneaky credit card fees

Beware of hidden credit and debit card charges, said Blake Ellis at CNN.com. A recent study found that so-called "gray charges" can add up to hundreds of dollars a year. The most common of these arise when cardholders sign up for free product trials, but forget to cancel the service and end up getting charged the full price or an ongoing subscription fee. "While they may be aggravating and expensive, these fees aren't necessarily fraudulent or illegal." But to avoid incurring such gray charges, "be sure to read agreements and terms and conditions carefully" before making any purchases. And if you still find unexplained sums on your statement, "contact the merchant or credit card issuer to challenge the charge."

Better odds for early retirement

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Early retirement is "achievable if you save diligently," said Joe Udo at US News. Start by backing off on small, daily buys. The average American spends $1,000 each year on coffee, for instance — just "a few bucks each time, but those little purchases add up." And think about whether you really need that "ridiculously expensive" cable TV. Getting DVDs through the library, or signing up for Netflix, can save you hundreds of dollars per year. With those savings, make some prudent investments. Purchasing Series I savings bonds is "one of the safest ways to invest your money," and while the stock market "might be intimidating to new investors," investing in stocks and index funds will help you build a strong nest egg over the years.

Dealing with gift taxes

If you're in a giving mood, learn the basics of gift taxes, said Farnoosh Torabi at Yahoo. The IRS caps how much someone can give before incurring a tax. In 2013, that amount is $14,000 per donor per recipient. "As long as your gift is at or below that threshold, you don't have to worry about filing a gift tax return." And contrary to popular belief, "recipients never need to pay income tax on the gifts." If you give more than $14,000, prepare to fill out some paperwork, describing how much you gave away beyond the exemption. The good news is "this doesn't mean you'll owe any money" — at least not right away. The federal gift tax, currently 40 percent, doesn't kick in unless you give away more than $5.25 million in your lifetime.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

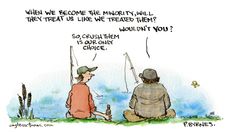

Today's political cartoons - May 4, 2024

Today's political cartoons - May 4, 2024Cartoons Saturday's cartoons - reflections in the pond, riding shotgun, and more

By The Week US Published

-

5 high-caliber cartoons about Kristi Noem shooting her puppy

5 high-caliber cartoons about Kristi Noem shooting her puppyCartoons Artists take on the rainbow bridge, a farm upstate, and more

By The Week US Published

-

The Week Unwrapped: Why is the world running low on blood?

The Week Unwrapped: Why is the world running low on blood?Podcast Scientists believe universal donor blood is within reach – plus, the row over an immersive D-Day simulation, and an Ozempic faux pas

By The Week Staff Published