The sale of the NYSE and the death of stocks

An upstart derivatives exchange buys the venerable New York Stock Exchange, confirming, analysts say, that derivatives are hot, and stocks are not

To the general public, it's quite a "shocker," says David Weidner at MarketWatch. IntercontinentalExchange (ICE), an upstart derivatives exchange, based in Atlanta, is buying NYSE Euronext, the company that owns the iconic, 220-year-old New York Stock Exchange, in a deal worth more than $8 billion. To long-time market professionals, however, this merger merely confirms something they've known for quite some time. They've been witnessing the slow death of stocks — as the lord of the marketplace — for years, as new regulations and decimalization of trades once done using rounder fractions "effectively squeezed the margins — and the potential for graft — out of the system." Initial public offerings offered healthy profits, but even those have dried up recently, leaving the NYSE and other exchanges "searching the globe for a merger partner," hoping they could buy their way to growth. But the lucrative futures and options exchanges that seemed like natural buyers of the stock exchanges turned up their noses, asking, "Why would we need them?"

There was an exception. The newcomer to the derivatives party, the IntercontinentalExchange (ICE) needed something to vault it into the conversation — even though it not only had profits, but market share and a valuation to rival any exchange in the world.For all of its lackluster financial cosmetics, the NYSE is still the Big Board. It is the venue where the great corporations of the world are listed. The announced deal will have some opportunities for technology sharing and other efficiencies, but mostly its an $8.2 billion deal for a brand.

As if that weren't already humiliating enough for the Big Board, says Felix Salmon at Reuters, "stock trading is a complete afterthought in this deal" for ICE. "The real reason that ICE wants the company is Liffe, NYSE Euronext's London-based financial derivatives subsidiary." Derivatives exchanges, you see, are few. They compete only with each other, so they make money hand over fist. "There are lots of stock exchanges," so they compete fiercely with each other, "and none of them make much money."

You can almost hear ICE CEO Jeffrey Sprecher rolling his eyes and wondering why on earth he needs to hang on to what at this point is little more than a heavily-guarded tourist attraction... [But] it's actually a good thing that stock trading has become a low-margin, low-value business: that's what's meant to happen when you have lots of competition. Think of it as one of the few areas of the financial-services sector where capitalism works as advertised.

This deal, once unthinkable, really does underscore "what a dog the stock trading business has become," say Zachary M. Seward and Matt Phillips at Quartz. There's just no denying it. But if all this gloom is driving down the value of stocks in everybody's eyes, maybe equities markets will soon be so undervalued that they'll bounce back.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If we were contrarians, all of this Death of Equities talk — reminiscent of the 1979 Businessweek cover that nearly nailed the bottom of the markets before surges of the 1980s and 1990s — might get us a little more interested in the markets.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

High Court action over Cape Verde tourist deaths

High Court action over Cape Verde tourist deathsThe Explainer Holidaymakers sue TUI after gastric illness outbreaks linked to six British deaths

-

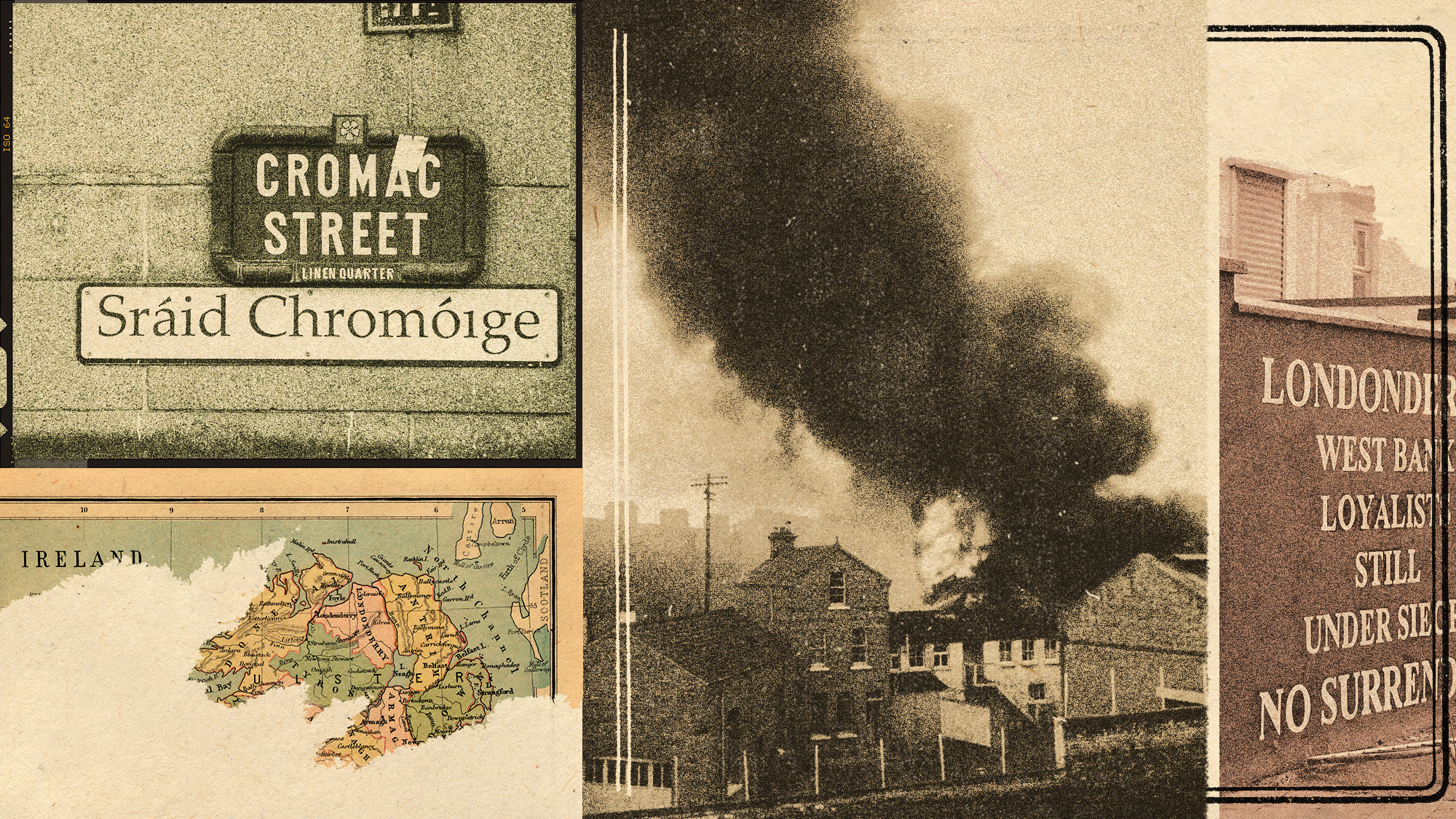

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels