Wells Fargo's disgraceful discrimination scandal: A guide

The bank ponies up $175 million to settle accusations that it charged blacks and Latinos higher interest rates and fees on their mortgages

This week, Wells Fargo agreed to pay $175 million to settle charges that it discriminated against thousands of blacks, Latinos, and other minority borrowers between 2004 and 2009. The Justice Department had accused Wells Fargo, the country's largest mortgage lender, of charging minority borrowers higher interest rates and fees on home loans than it charged white borrowers with similar credit ratings. Thomas Perez, an assistant attorney general at the department, slammed Wells Fargo for levying the equivalent of a "racial surtax." People "should be judged by the content of their creditworthiness and not the color of their skin," he said. Here, a guide to the case:

What exactly did Wells Fargo do?

The Justice Department says Wells Fargo engaged in a pattern of "systemic discrimination" in which some 30,000 minority borrowers across 36 states were charged higher fees and interest rates than their white counterparts. A black borrower in Chicago, for example, paid an average of nearly $3,000 more in fees than a white applicant who had the same credit rating. A Latino borrower paid more than $2,000 extra. The average "surtax" for a black borrower in the Miami area in 2007 was $3,657. In addition, Wells Fargo steered some 4,000 minority borrowers with good credit toward subprime loans — which are usually reserved for those with shaky credit, and have interest rates that often spike after several years.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What does Wells Fargo say now?

Though it's coughing up a massive settlement, the bank did not officially admit wrongdoing, and claims that it settled the case "solely for the purpose of avoiding contested litigation" with the government. The bank stopped issuing subprime loans in 2008.

Why were minority borrowers treated differently?

The case was part of a recent phenomenon that civil rights groups call "reverse redlining," in which banks flooded poor, minority communities with predatory loans that contained hidden fees and interest rates. (Redlining in its original form dates to the days of segregation, when banks refused to give home loans to blacks.) The trend was spurred by financial innovations on Wall Street that made subprime loans profitable to investors — "and blacks were one of the largest untapped markets," says Ylan Q. Mui at The Washington Post. Reverse redlining played a significant role in the housing boom that preceded the 2008 financial crisis.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

How has it affected minority communities?

The bust in the subprime market has had a disproportionate impact on blacks. The fallout has "left a scar on the finances of black Americans," says Mui, "one that not only has wiped out a generation of economic progress but could leave them at a financial disadvantage for decades." The Justice Department's case against Wells Fargo stems from a lawsuit filed by the city of Baltimore, which found that its minority communities were decimated by the housing crisis. In late 2011, Bank of America settled a similar discrimination lawsuit in which it paid out $335 million.

What happens to the settlement money?

Wells Fargo will use $125 million to compensate affected borrowers. The remaining $50 million will go toward helping people in eight metropolitan areas' minority communities, including Baltimore's, make down payments or improve their homes.

Sources: Bloomberg, Los Angeles Times, The New York Times, Reuters, The Wall Street Journal, The Washington Post

-

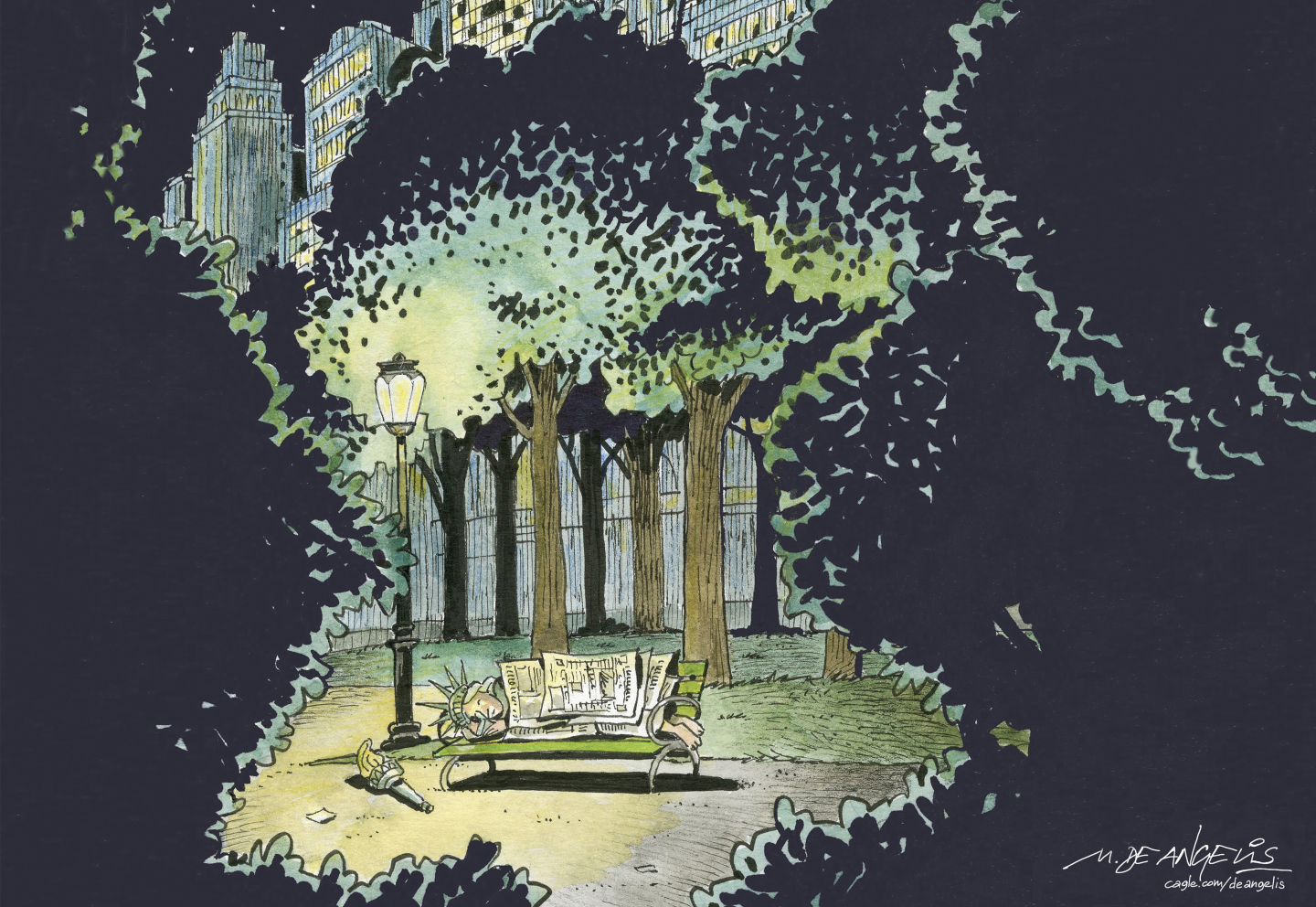

5 torch-carrying cartoons about Lady Liberty’s rough week

5 torch-carrying cartoons about Lady Liberty’s rough weekCartoons Artists take on dark nights, Lady Lineup, and more

-

Could Democrats lose the New Jersey governor’s race?

Could Democrats lose the New Jersey governor’s race?Today’s Big Question Democrat Mikie Sherrill stumbles against Republican Jack Ciattarelli

-

‘Porsche’s luxury credentials are now hanging by a thread’

‘Porsche’s luxury credentials are now hanging by a thread’Instant Opinion Opinion, comment and editorials of the day