Will Iran's oil threat lead to $5 gas?

Tensions over Tehran's nuclear program have upset the already volatile oil market, and analysts worry that Iran will keep pushing up prices at the pump

Iran's increasingly provocative behavior is already having global consequences. Its threat to shut down the critical Strait of Hormuz has unnerved the oil market, pushing prices above $100 a barrel. Of course, the price hikes to date are nothing compared to what we'll see if armed conflict breaks out over Iran's refusal to rein in its nuclear program. Energy analysts warn that war could push prices above $150 a barrel, possibly pushing gasoline prices to $5 a gallon. Could it really get that bad?

In short, yes: For the time being, we're probably safe, says Michael Sivy at TIME. The U.S. could easily bust through any Iranian attempt to block the Strait — through which one-sixth of the world's oil shipments pass — and other suppliers could make up for any interruption in the flow of Iranian oil. But if there's armed conflict and "fighting spills over into Saudi Arabia" — damaging that country's oil fields — we could certainly see $5-a-gallon gas.

"Will tensions with Iran really push gasoline to $5 a gallon?"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sanctions and $4.50 gas are more likely: Despite all the saber rattling, says Rick Newman at U.S. News, we're more likely to see a slow climb in gas prices as the U.S. and Europe impose tighter sanctions, "essentially [preventing] Iran from selling oil to many of its usual customers." That could strategically devastate Iran, which relies on oil for 20 percent of its GDP. Since the country is the world's third largest oil exporter, limiting its market would inevitably push oil prices higher. Americans could expect $4 gas, "perhaps even approaching $5."

"How Iran could affect your wallet in 2012"

The fears are overblown: We can relax a bit, says Chris Kahn for the Associated Press. Military experts say Iran could not "keep tankers from exiting the Gulf, and energy analysts noted that the world remains well supplied with oil, whether or not Iran tries to block the waterway." Besides, Saudi Arabia is pumping extra oil to offset any reduction in Iran's exports, and economic problems in Europe and the U.S. are keeping down demand. Once fear subsides, we might even see gas prices fall.

"Oil prices fall as concerns about Iran retreat"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

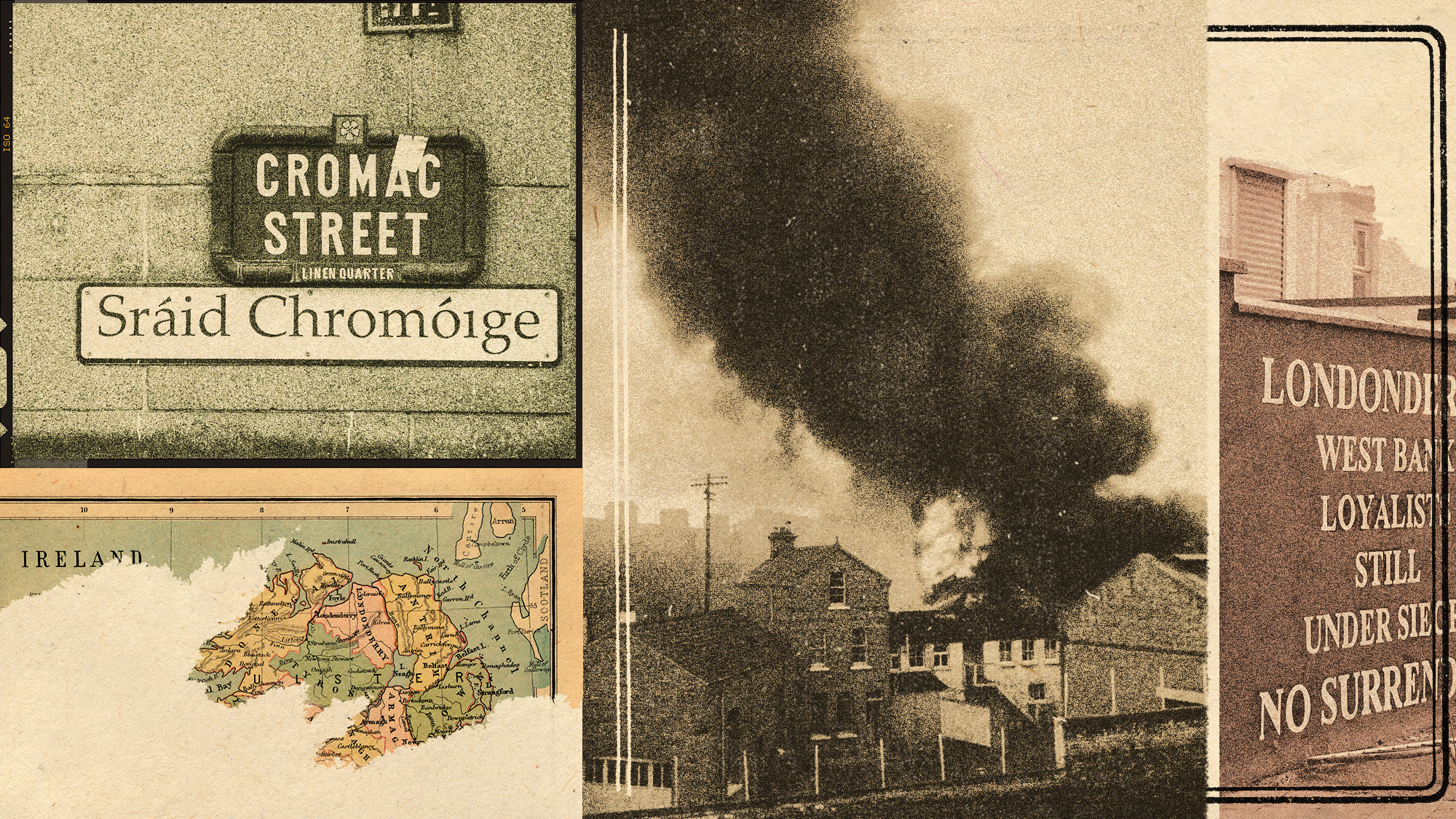

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels

-

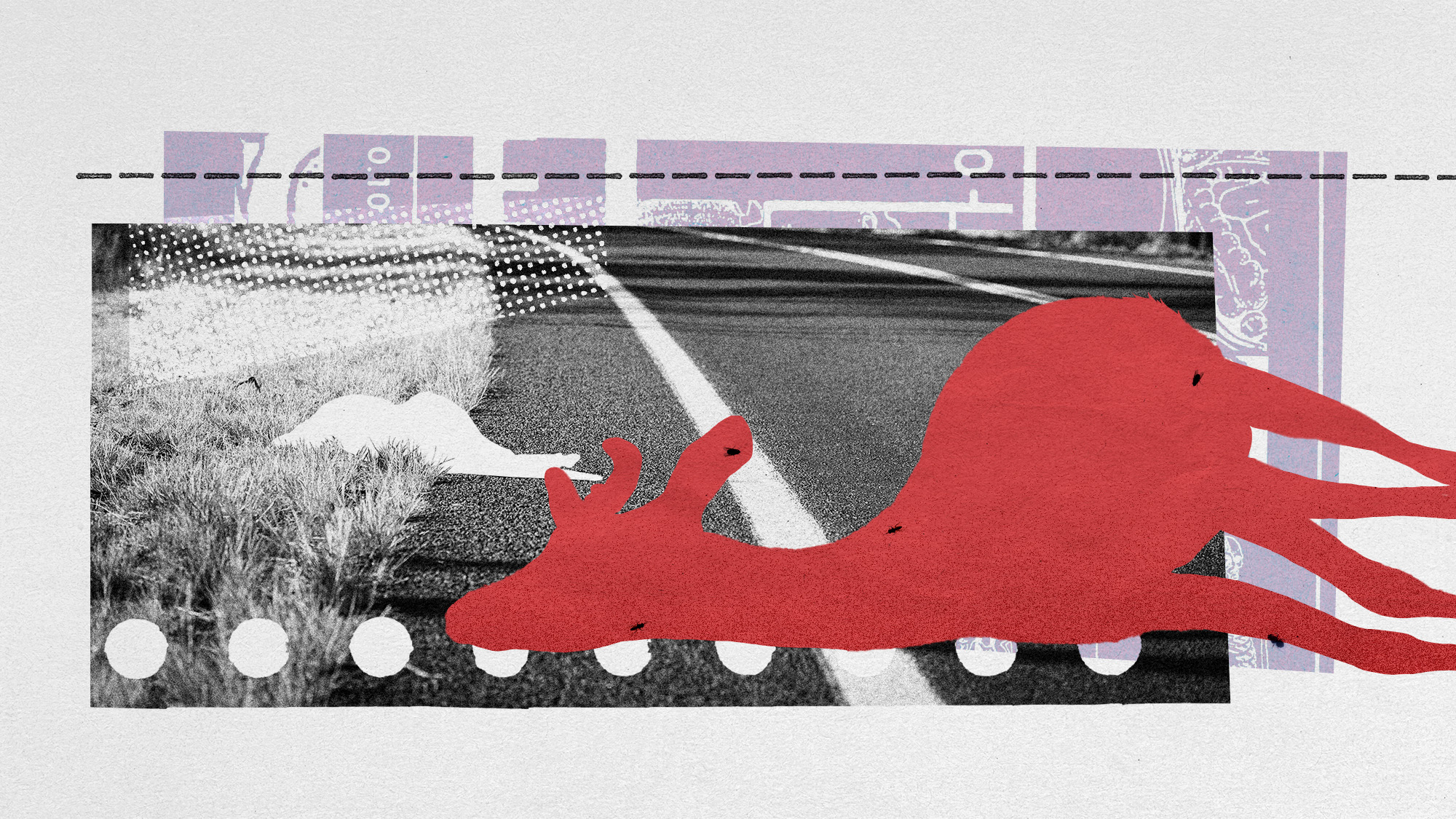

How roadkill is a surprising boon to scientific research

How roadkill is a surprising boon to scientific researchUnder the radar We can learn from animals without trapping and capturing them