Why doesn't General Electric pay taxes?

GE made $14.2 billion in worldwide profits last year. Its U.S. corporate tax bill? Zero

The largest corporation in America paid precisely zero dollars in taxes to the government last year. Despite making $14.2 billion in profits, General Electric managed to exploit legal loopholes and tax breaks to avoid paying any corporate tax in the U.S., reports David Kocieniewski at The New York Times. In fact, GE was able to claim a tax benefit of $3.2 billion in 2010. GE's extraordinary success at avoiding taxes comes courtesy of an "aggressive strategy that mixes fierce lobbying for tax breaks and innovative accounting that enables it to concentrate its profits offshore," says Kocieniewski. Who's to blame for what critics are calling a "travesty"?

Blame General Electric: GE chief executive Jeffrey Immelt won high praise for "blasting the greedy culture of big business" as Wall Street burned back in 2009, says Zaid Jilani at ThinkProgress. But he's a part of the problem. GE is "exploiting loopholes in the tax code to shirk its responsibilities" to the American people.

"Despite paying no income taxes, GE CEO lauded his company's patriotism in 2009 West Point speech"

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Blame the tax system: The problem here is not that GE is a "greedy corporation," says James Joyner at Outside the Beltway, but that we have a "humungous tax code" with loopholes that "amount to corporate welfare." We can't blame GE for maximizing its profits within the system and rules we've created for it.

"GE pays zero taxes: Hate the game, not the player"

Blame our corporate tax rate in particular: The U.S. corporate tax rate is, at 35 percent, "the highest in the world" says Conn Carroll at Heritage.org. So it's no surprise that GE does everything it can to avoid paying it. Until we reduce the corporate tax rate to something more competitive, companies like GE will continue to flee offshore. "Our system is clearly broken." It's time for the government to fix it.

"General Electric's Jeffrey Immelt: Looter or producer?"

Blame the politicians: The "culprit" here is our political system, says Ed Morrissey at Hot Air, which has structured a "Byzantine" tax code to "curry favors and pick winners and losers in the market." So what has the Obama administration done to help end this? It has made Jeffrey Immelt, GE's chief executive, chairman of his council on jobs and competitiveness. No doubt Obama's latest hire will do all he can to maintain the status quo. "Thieves are rarely interested in catching other thieves."

"Obama's favorite CEO gets GE out from paying any U.S. taxes"

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

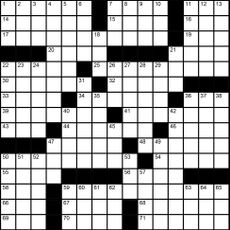

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published