How Obama can fix the economy — even with a GOP Congress

With control of the House, the GOP can block the president's economic initiatives, says Noam Scheiber in The New Republic, but he still has a chance to save Americans from a Japan-style "lost decade"

Republicans are "poised to sweep into office and obstruct" President Obama's agenda, says Noam Scheiber at The New Republic, so his plans to boost the economy are in peril. The U.S. may be in a Japan-style recession — also known as a balance-sheet recession — "a rare form of economic disease" in which consumers become so obsessed with paying down debts, no matter how low interest rates go, that they essentially stop spending. Japan lost out on a decade of growth before it finally escaped, and the only way it kept its economy from "shrinking into oblivion" was through "massive government spending." But with the GOP in control of the House, you can forget "a repeat of last year's stimulus." Fortunately, says Scheiber, there are still some things Obama can do to "revive the economy." Think infrastructure spending so unfriendly to unions that Republicans will love it. Think mortgage relief done through Fannie Mae and Freddie Mac, not Congress. And, of course, think tax cuts. Here, an excerpt:

The administration tried to limit the portion of last year's $800 billion stimulus that got allocated to tax cuts, the thinking being that tax cuts are less efficient as stimulus than government spending. This is true in normal times: People tend to save a large fraction of their tax cuts, while government spending works its way into the economy’s bloodstream more directly, at least if well-executed. But this tax cut/spending debate is largely beside the point during a balance-sheet recession. In that case, people refuse to spend until they've paid down debt. If you give them a tax cut that they end up mostly saving, you've still accelerated the debt payback and moved up the date when they're willing to spend again.

The real problem with tax cuts is that the ones Republicans favor skew heavily toward the wealthy, whereas its lower- and middle-income people who are groaning underneath piles of debt. In order to get a tax-cut deal, the administration may have to lavish more goodies on the wealthy than would be ideal. But, given the alternative — again, think lost decade — that may be a reasonable price to pay.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Read the full article at The New Republic.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

Political cartoons for January 3

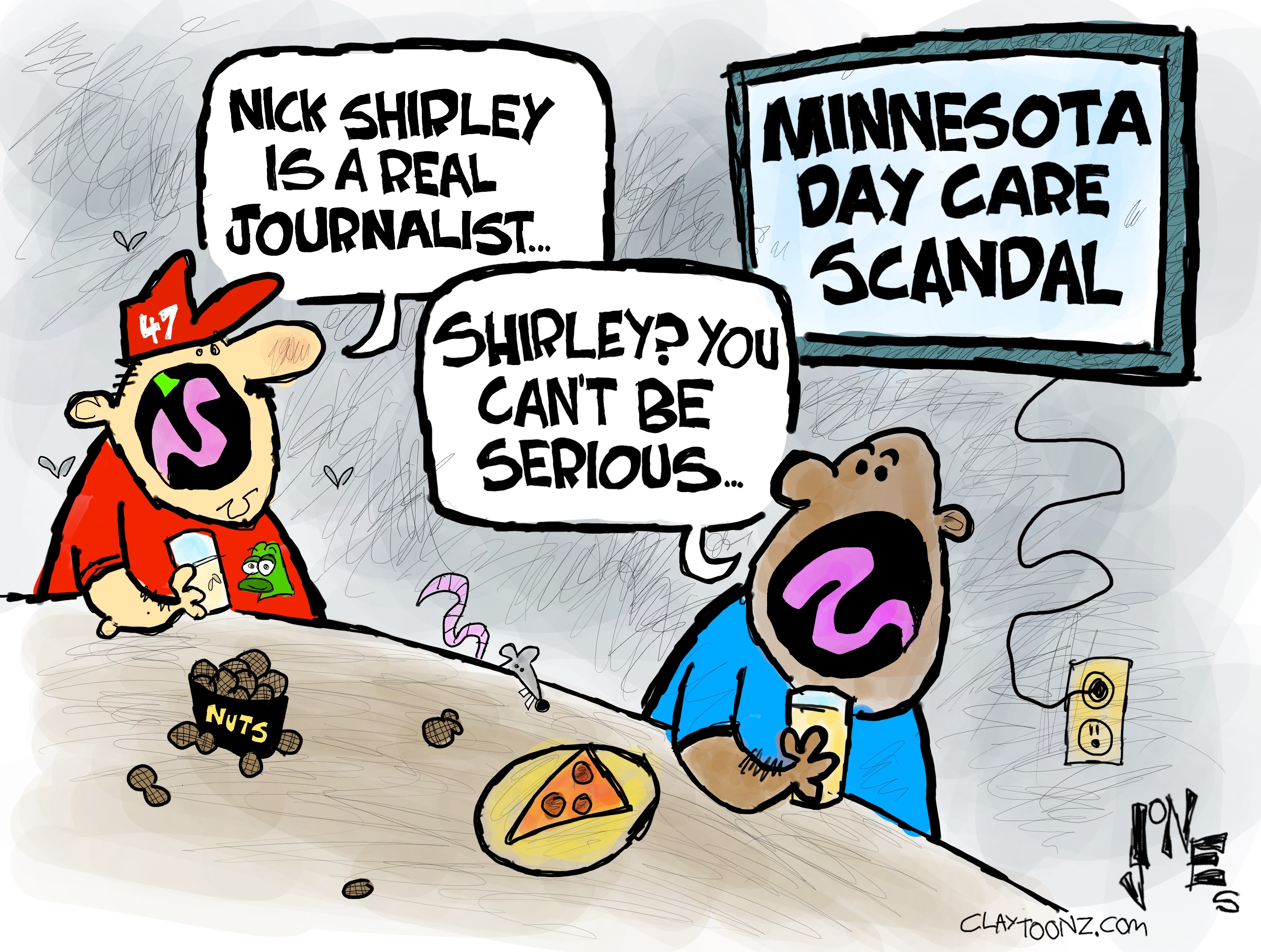

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency