Initial public offerings: Should you take the plunge?

The market for initial public offerings is on the upswing. Since the start of the third quarter 21 firms valued at roughly $10 billion total have filed to take their companies public.

After coming to a screeching halt, the market for initial public offerings is “suddenly crowded with some very high-profile players,” said Ben Steverman in BusinessWeek. Since the start of the third quarter, in July, 21 firms valued at roughly $10 billion total have filed to take their companies public, according to Hoover’s. Among the companies looking to make a market debut are such household names as Hyatt Hotels, Dole Food, Swift & Co., and Dollar General. Contrast that activity with that of the previous three quarters, which saw just 13 filings worth a scant $3 billion. “The uptick in IPOs has coincided with a rebound in equity markets.” Assuming the market holds steady, investors “can expect even more IPOs being floated soon.”

Technology companies will likely represent a big share of the market’s incoming class, said Michael Copeland in Fortune. “Right now in Silicon Valley, investment bankers are busy making the rounds of promising portfolio companies, trying to convince them of the wisdom of an IPO.” Don’t hold your breath for the next Google; most tech IPOs will be lucky to have market capitalizations of several hundred million dollars. That said, investors are likely to see some “very high-quality companies”—including LinkedIn, Pacific Biosciences, and Zynga—make the leap. “For those investors with the stomach, it might not get much better.”

The market certainly seems primed for fresh faces, said Will Deener in The Dallas Morning News. The average return, so far, for companies that have gone public this year is a “sterling” 40 percent, according to Renaissance Capital. There’s a reason why. “Today’s new public companies are the real deal—with real earnings, real boards of directors, and actual audit committees and internal accounting controls.” That should be a comfort for any investors still feeling burned by the “heady days of the late 1990s,” which produced big returns followed by big busts. Even so, mutual funds that specialize in IPOs, such as Renaissance Capital’s IPO Plus Aftermarket Fund, are probably the best bet for individual investors looking to buy into start-ups “before they become household names.”

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

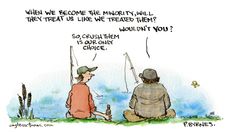

Today's political cartoons - May 4, 2024

Today's political cartoons - May 4, 2024Cartoons Saturday's cartoons - reflections in the pond, riding shotgun, and more

By The Week US Published

-

5 high-caliber cartoons about Kristi Noem shooting her puppy

5 high-caliber cartoons about Kristi Noem shooting her puppyCartoons Artists take on the rainbow bridge, a farm upstate, and more

By The Week US Published

-

The Week Unwrapped: Why is the world running low on blood?

The Week Unwrapped: Why is the world running low on blood?Podcast Scientists believe universal donor blood is within reach – plus, the row over an immersive D-Day simulation, and an Ozempic faux pas

By The Week Staff Published