Best columns: Pushing trust, Self-bailout

Americans, unfortunately, appear “more interested in punishing Wall Street than saving the economy,” says David Leonhardt in The New York Times. Consumers should “do precisely what the governm

A question of trust

People, some of them in Congress, appear “more interested in punishing Wall Street than saving the economy,” says David Leonhardt in The New York Times. And no wonder. Nobody has connected the dots for us. So, why are we talking about another Great Depression? It’s not that we’ll repeat the severity of the Depression—the Fed has been more active and we’re richer than in 1929. It’s that the dynamics are the same. Things didn’t get bad until late 1930, when banks started collapsing, and the remaining lenders stopped trusting each other. Then as now, the pain from that freezing up of lending is a delayed pain. But there will be pain on Main Street unless we unfreeze lending. And, like it or not, our credit markets are on Wall Street.

Bail yourself out

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There is plenty of advice on where to invest in this roller coaster of a market, says Chuck Jaffe in MarketWatch, and much of it sounds pretty promising. “But the one thing most experts have failed to suggest is that consumers do precisely what the government has been talking about, namely bailing themselves out of debt.” The average U.S. household has $9,500 in credit card debt, not to mention mortgages and car loans. If you think of your net worth as “everything you own minus everything you owe,” then the best way to raise your net worth is to lower your debt. Not only are interest rates rising, but paying off debt “gives a big psychological boost.” If things get bad in the markets, you’ll feel good being debt-free.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Conservative influencer Charlie Kirk shot dead at 31

Conservative influencer Charlie Kirk shot dead at 31Speed Read Kirk was holding a debate session at Utah Valley University

-

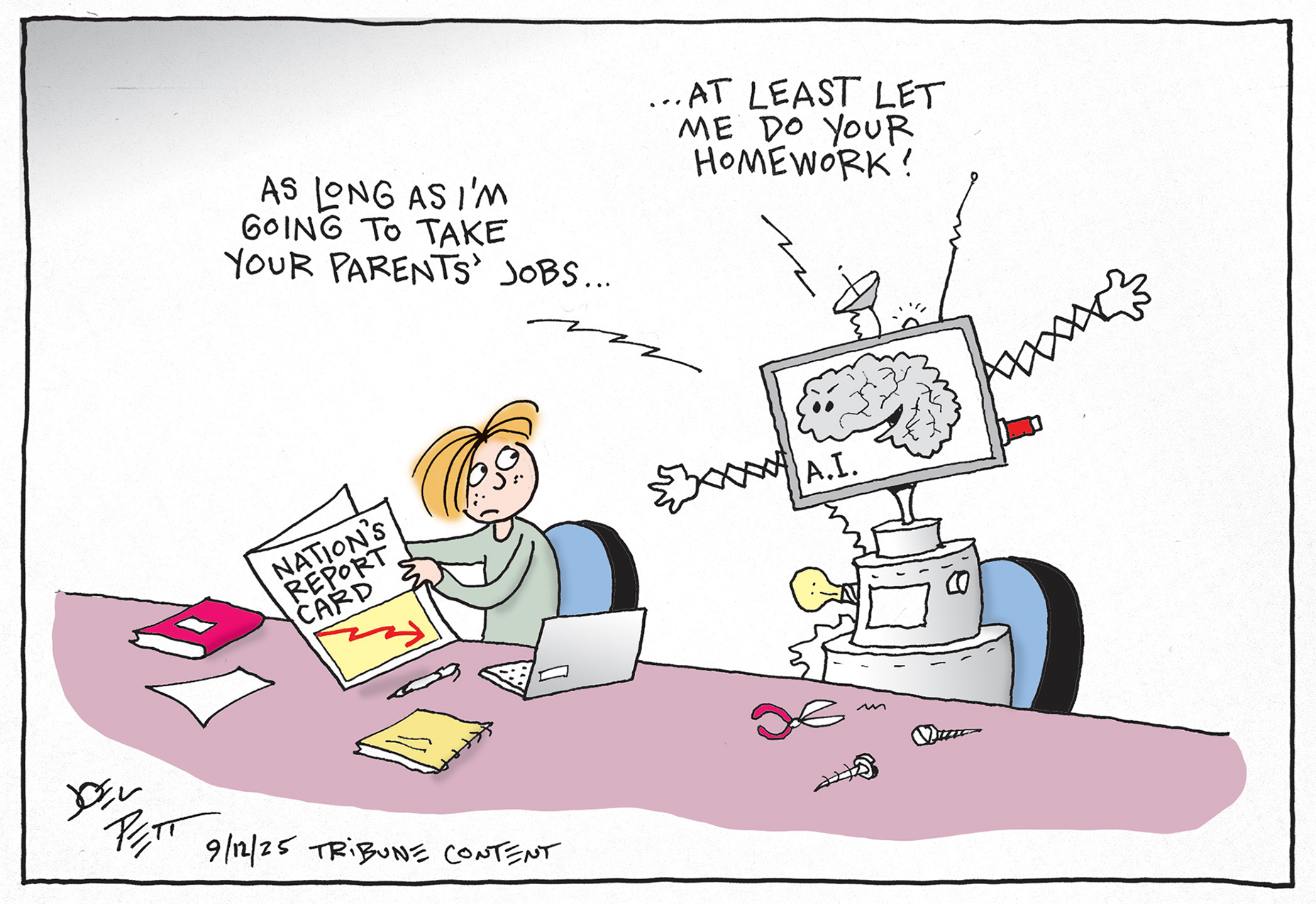

September 11 editorial cartoons

September 11 editorial cartoonsCartoons Thursday’s political cartoons include AI in schools, a deflated jobs report, and a new addition to Mount Rushmore

-

Downton Abbey: The Grand Finale – a ‘comfort’ watch for fans

Downton Abbey: The Grand Finale – a ‘comfort’ watch for fansThe Week Recommends The final film of the franchise gives viewers a chance to say goodbye