Best Business Commentary

Banks aren’t lending to each other or to us, but this isn’t the result of an “irrational panic,” says Paul Krugman in The New York Times. Sure, if you’re hoping “the Fed can turn around and twirl a magic wand to make everything OK, you’re apt to be disapp

The Fed’s not-so-magic wand

Banks aren’t lending to each other or to us, but this isn’t the result of an “irrational panic,” says Paul Krugman in The New York Times. “It’s a wholly rational panic,” and one that the Fed can’t calm with the wave of “its magic wand.” Unlike the financial crises of 1987 and 1998, the problem today isn’t just a lack of liquidity, which the Fed can fix. With banks and other financial institutions holding very real, “very, very bad” debt, “there’s also a fundamental problem of solvency” this time. The markets “won’t start functioning normally” until housing prices hit bottom and “financial institutions have come clean about all their losses.” So don’t hold your breath.

Sure, if you’re hoping “the Fed can turn around and twirl a magic wand to make everything OK, you’re apt to be disappointed,” says Randall Forsyth in Barron’s Online. But “give Professor Bernanke a B-plus for substance.” His new scheme to improve liquidity through auctioning off loans—an anonymous “eBay for credit for banks” rather than the old “pawn shop” Fed discount window—may not be a “magic bullet,” but “it’s a far sight better than the blunderbuss approach taken in recent years” by Alan Greenspan. Whether these “new, innovative weapons” will work is “an open question.” But at least it’s a promising idea.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

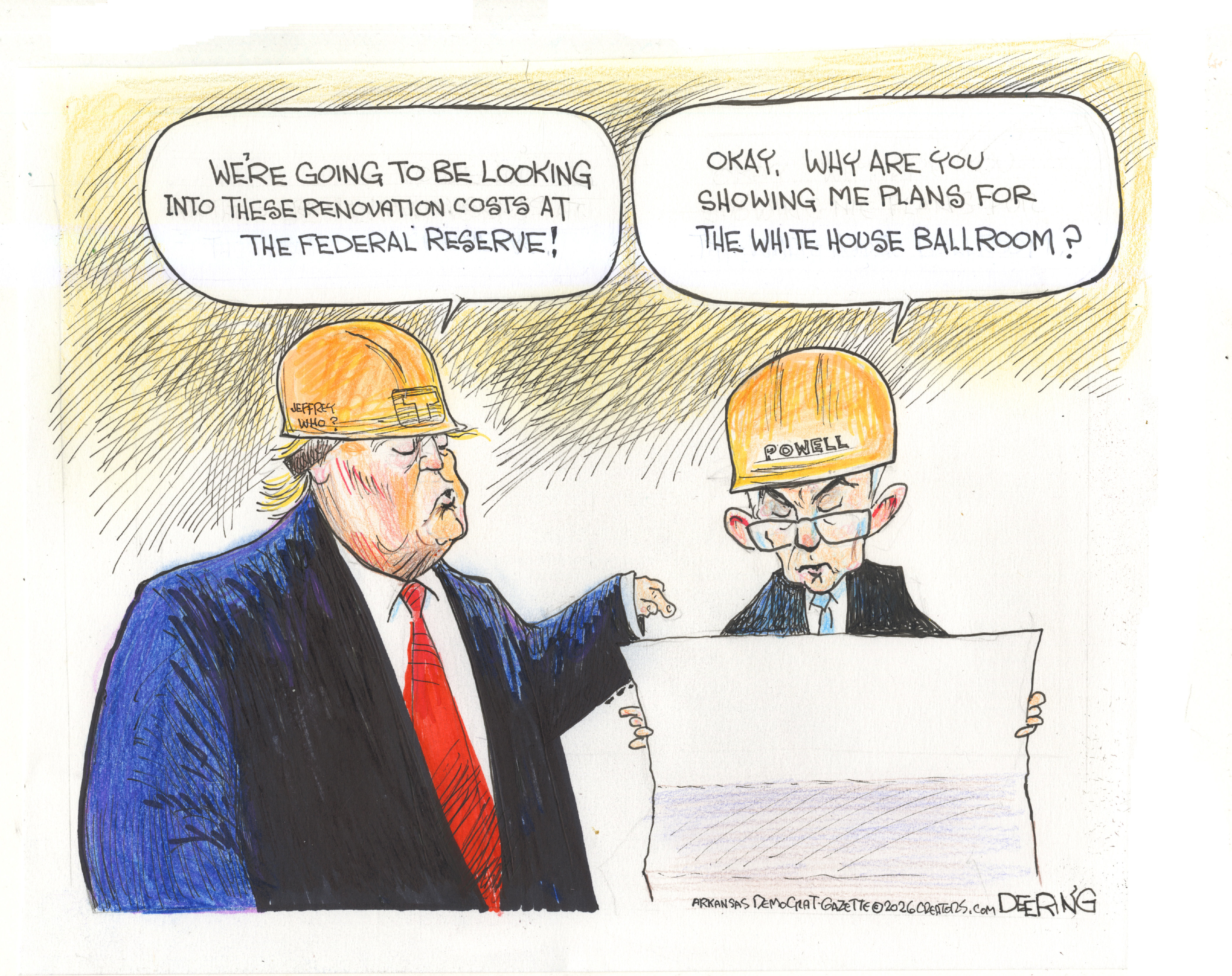

Political cartoons for January 17

Political cartoons for January 17Cartoons Saturday’s political cartoons include hard hats, compliance, and more

-

Ultimate pasta alla Norma

Ultimate pasta alla NormaThe Week Recommends White miso and eggplant enrich the flavour of this classic pasta dish

-

Death in Minneapolis: a shooting dividing the US

Death in Minneapolis: a shooting dividing the USIn the Spotlight Federal response to Renee Good’s shooting suggest priority is ‘vilifying Trump’s perceived enemies rather than informing the public’