Making money

Interest rates: Make the cut pay off for you

Last week’s half-percentage point cut in the federal funds rate isn’t a cure-all for the economy, said Jane J. Kim and Ruth Simon in The Wall Street Journal. Consumers, though, should get some relief. If you have a home equity line of credit, for example, lower rates could “show up as soon as the next monthly statement.” If your adjustable-rate mortgage is scheduled to reset soon, that rate increase also should be “less painful” than it would have been a couple of months ago, according to Bankrate.com senior financial analyst Greg McBride. But only, that is, if your ARM is tied to Treasury averages. If your loan is tied to the London interbank offered rate, or Libor—as many American mortgages are—the U.S. rate cut will help little.

Lower rates may make life less onerous for some homeowners, said Jerome Idaszak in Kiplinger’s Personal Finance. “But the Fed’s actions won’t solve all of the housing market’s problems.” The combination of an oversupply of houses for sale and tighter lending practices “will continue to sap the market, leading to further average declines in home values.” Homebuilders say demand for new houses remains in bad shape and could become even worse in the coming months. More rate cuts would help, “but market watchers say that this credit crunch is like a fever that needs to run its course.”

Now might be a good time to consider converting to a fixed-rate mortgage, said Emily Brandon in U.S. News & World Report. A 30-year fixed-rate mortgage recently ran as high as 6.25 percent. Now it will be lower. If you do refinance, though, “be sure to carefully weigh the effect of closing costs and fees before refinancing.” Also, don’t forget to look at your other investments, especially money market funds and certificates of deposit. “If you’ve been looking for an opportunity to put money into a long-term CD, now is the time to do it, before rates decline,” says Bankrate.com’s McBride. What’s good news for borrowers may be a bummer for savers.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

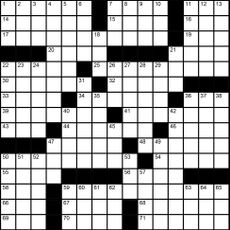

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published