Charter's merger with Time Warner Cable: How the death of antitrust law hurts everyone

As anyone with a Time Warner account knows, corporate gigantism does not offer better services or prices

Back in 2014, Comcast made a $45 billion bid to buy Time Warner Cable. The deal would've created a telecommunications behemoth, controlling 57 percent of the American broadband internet market and almost 30 percent of the pay television market.

It also raised a number of eyebrows at the Justice Department and the Federal Communications Commission. Antitrust law, which the government has enforced for a century or more, is aimed at preventing monopolies that will harm consumers and competition, and regulators felt the merger would fall afoul of those limits. The deal eventually crumbled earlier this year, as opposition from activists, politicians, and consumer watchdogs heated up.

Fast forward to this week, and another company's proposition to snatch up Time Warner Cable. This time the buyer is Charter Communications, and the deal will be worth a sweet $56.7 billion. And while observers expect Charter will also face antitrust scrutiny, everyone seems to think this new merger has a good shot at sailing through.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That reversal is the legacy of a massive shift antitrust enforcement went through in the 1980s — one that arguably left the law a shell of its former self.

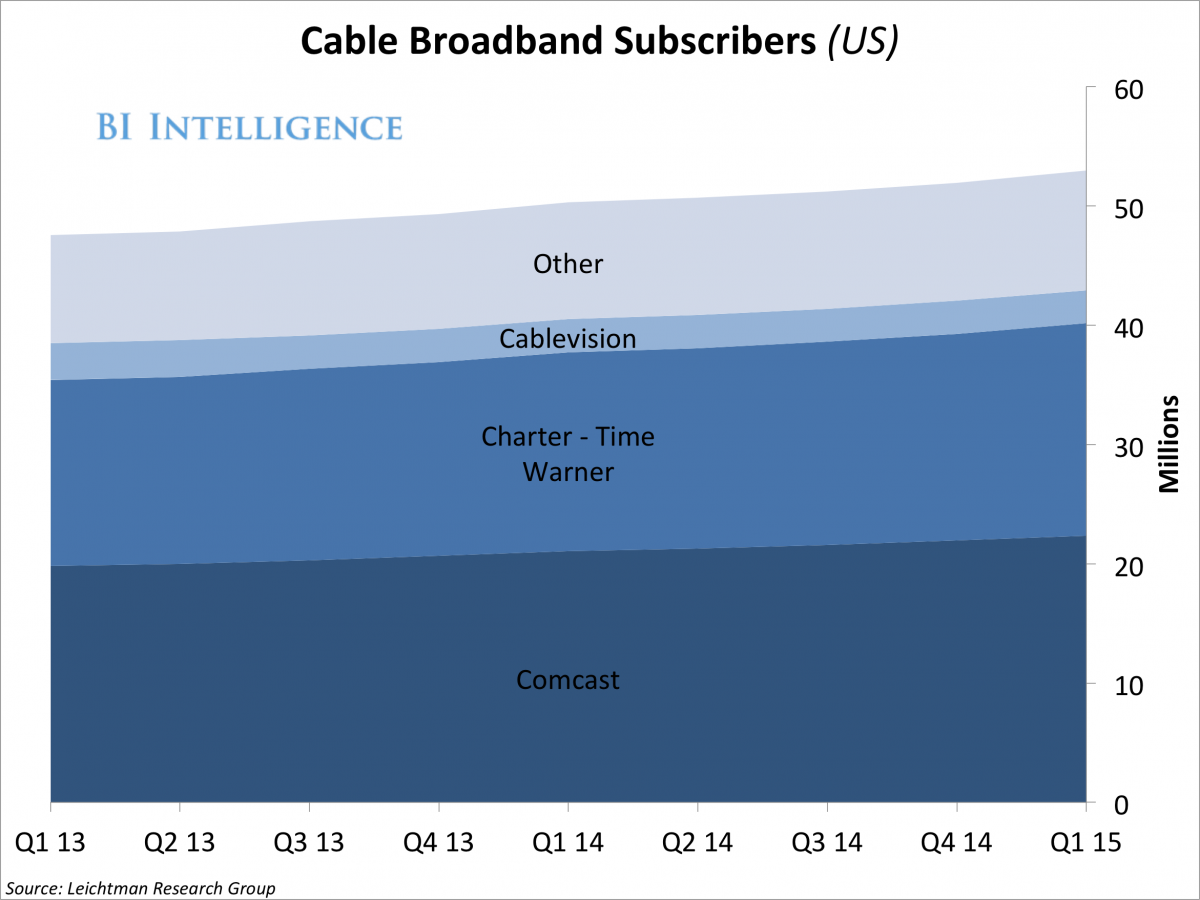

Granted, the new company — to be named "New Charter" — would be nowhere near as egregious as the ill-fated Comcast-Time Warner hybrid. New Charter would be one of the biggest cable and broadband companies in the country, but it would still only boast 24 million customers even after a separate bid to buy Bright House Networks as well. Comcast, by comparison, has 27 million customers as it stands.

But that's a cold comfort. According to calculations by Business Insider, New Charter and Comcast would control well over two-thirds of the American cable broadband market between them.

(Graph courtesy of Business Insider)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

For anyone who worries that bigger corporate size inevitably comes with opportunities to squeeze out competitors and stifle market function, the promise of a New Charter could hardly be called "good."

Prior to the Reagan administration, the premise of antitrust enforcement was that the more smaller companies in a given market the better. Allowances were made for natural monopolies, like water and power utilities, where meaningful competition is just intrinsically hard to come by — you're not going to get multiple, competing water pipe systems serving the same communities. And sometimes for sectors involving enormous economies of scale, you had to settle for competition between a handful of corporations. But generally speaking, in mid-century America, the size of companies was itself a metric used in enforcing antitrust law.

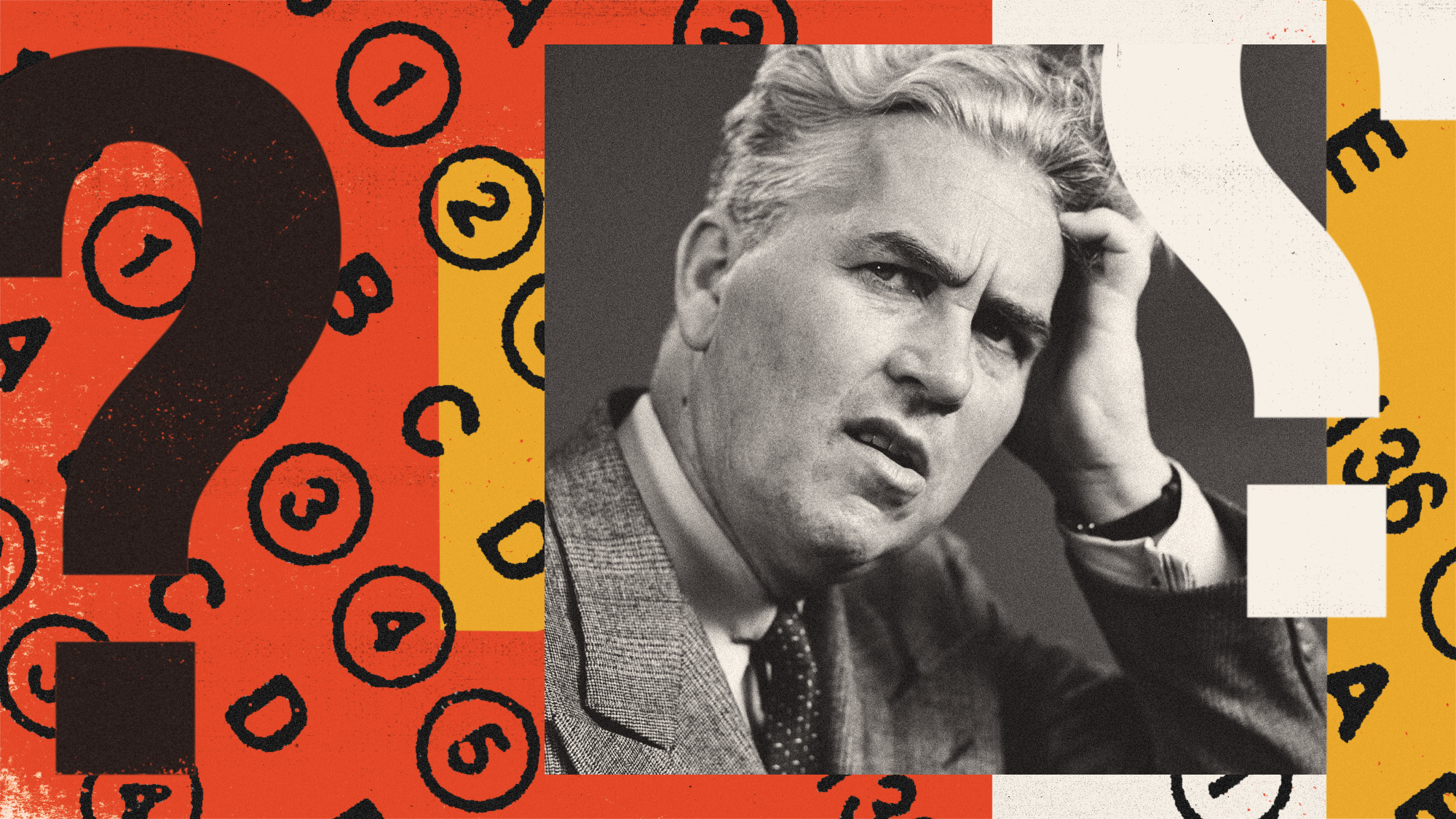

The rejection of that framework began under the Carter administration. But it was really the Reagan White House — heavily influenced by legal scholar Robert Bork (whom Reagan tried and failed to put on the Supreme Court) — that moved antitrust enforcement to a much more limited vision. Size and competition ceased to be key factors; instead, regulators would only intervene when it could be shown that a merger would lead to high prices for customers.

"That's pretty much the only actionable violation," Barry Lynn, the author of a book on monopolies, told Chris Hayes in a 2011 interview. "It's really hard today when there's a proposed merger […] to prove that this is going to lead to higher prices. You can prove it's going to lead to less competition, but that's not illegal under the present regime. So basically, the change in 1981 kind of made almost any merger legal."

Antitrust lawsuits still happen — think of Microsoft in the late 1990s — but antitrust law has largely abdicated its role as a constant force for promoting churn and diversity in the markets.

The problems here are myriad. To take the specific example of broadband internet: Even if a merger doesn't drive up prices, it can still entrench the high prices and sclerosis a sector already suffers from. Bigger firms with fewer competitors can throw more weight around in terms of lobbying, campaign donations, and sheer social pressure on lawmakers. Choice in broadband service providers is already notoriously limited, with many American cities stuck with only one or two options like Time Warner or Comcast. Thus there is little to no pressure on providers to offer better deals or quality service, as anyone with a Time Warner account knows all too well. The difference between the range of choices here in America versus Europe, where deliberate government intervention has forced internet service providers to share infrastructure and allow competition, is telling.

The rebuttal is that the American system is designed to foster competition in infrastructure specifically — internet infrastructure is a lot cheaper and easier to lay down than the aforementioned water pipe infrastructure, so theoretically you should be able to have multiple infrastructures competing to serve the same communities. But this setup also requires policy choices, just of a different sort, and the oligarchical nature of the current broadband market prevents those choices just as easily.

Setting aside lobbying and the capture of policymaking, there's also a subtler point here: Size allows firms to engage in behavior that can count as "market behavior," crudely speaking, but doesn't have anything to do with what markets are actually supposed to do — i.e. use competition to drive concrete improvements in quality, prices, and business models.

With unusual size, for example, a company can gain the financial cushion and the borrowing power to sell at a loss for a while, driving smaller competitors out of the market with absurdly low prices. Then, once the competition is gone, the prices come back up and the company corners the market. (See: Amazon.) Or large companies can bully suppliers and distributors into contracts that force them to deal with the big company only, squeezing smaller rivals out of even the chance to try their hand in the market. (Broadly speaking, this is what Microsoft was accused of in the antitrust lawsuit the U.S. government brought against it.) Pristine economic models of competitive efficiency in the absence of government regulation break down in all sorts of ways when they run up against the complexities and oddities of the real world.

A renewal of antitrust law certainly wouldn't be a cure-all for the U.S. economy. It's only one of many interlocking trends that have driven up inequality and hampered innovation and spurred corporate gigantism. But it's a helpful reminder that concretely useful market competition doesn't just happen; it requires the right mix of surrounding forces, and many of those forces are set by social and political choices.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The Week’s big New Year’s Day quiz 2026

The Week’s big New Year’s Day quiz 2026Quiz of the Year How much do you remember about 2025’s headlines? Put yourself to the test with our bumper quiz of the year

-

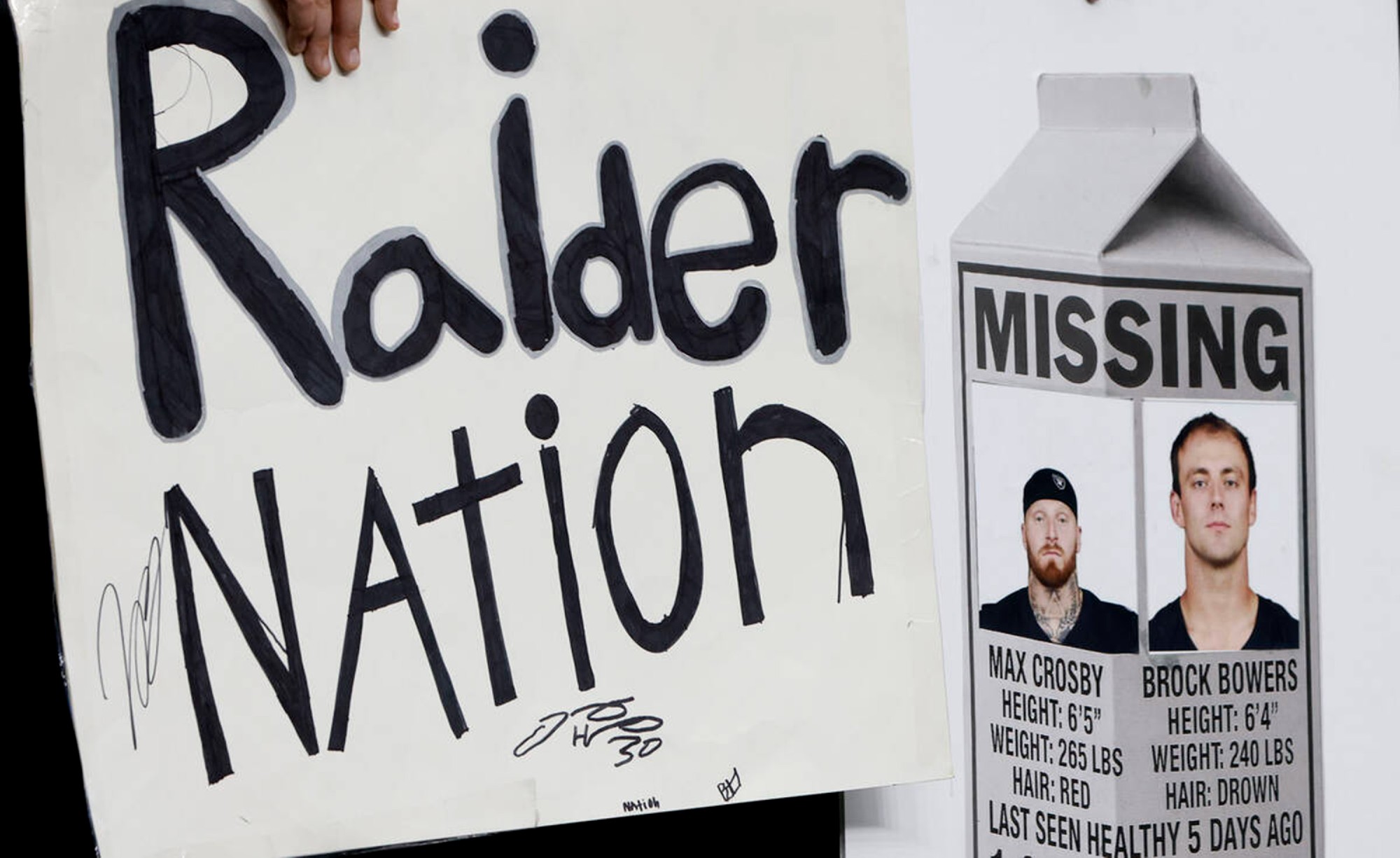

Is tanking ruining sports?

Is tanking ruining sports?Today's Big Question The NBA and the NFL want teams to compete to win. What happens if they decide not to?

-

‘Netflix needs to not just swallow HBO but also emulate it’

‘Netflix needs to not just swallow HBO but also emulate it’instant opinion Opinion, comment and editorials of the day