Why you’re still being taxed on your cash returns even despite the savings allowance

Some payments, such as those made from the Halifax reward current account, are not classified as interest

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

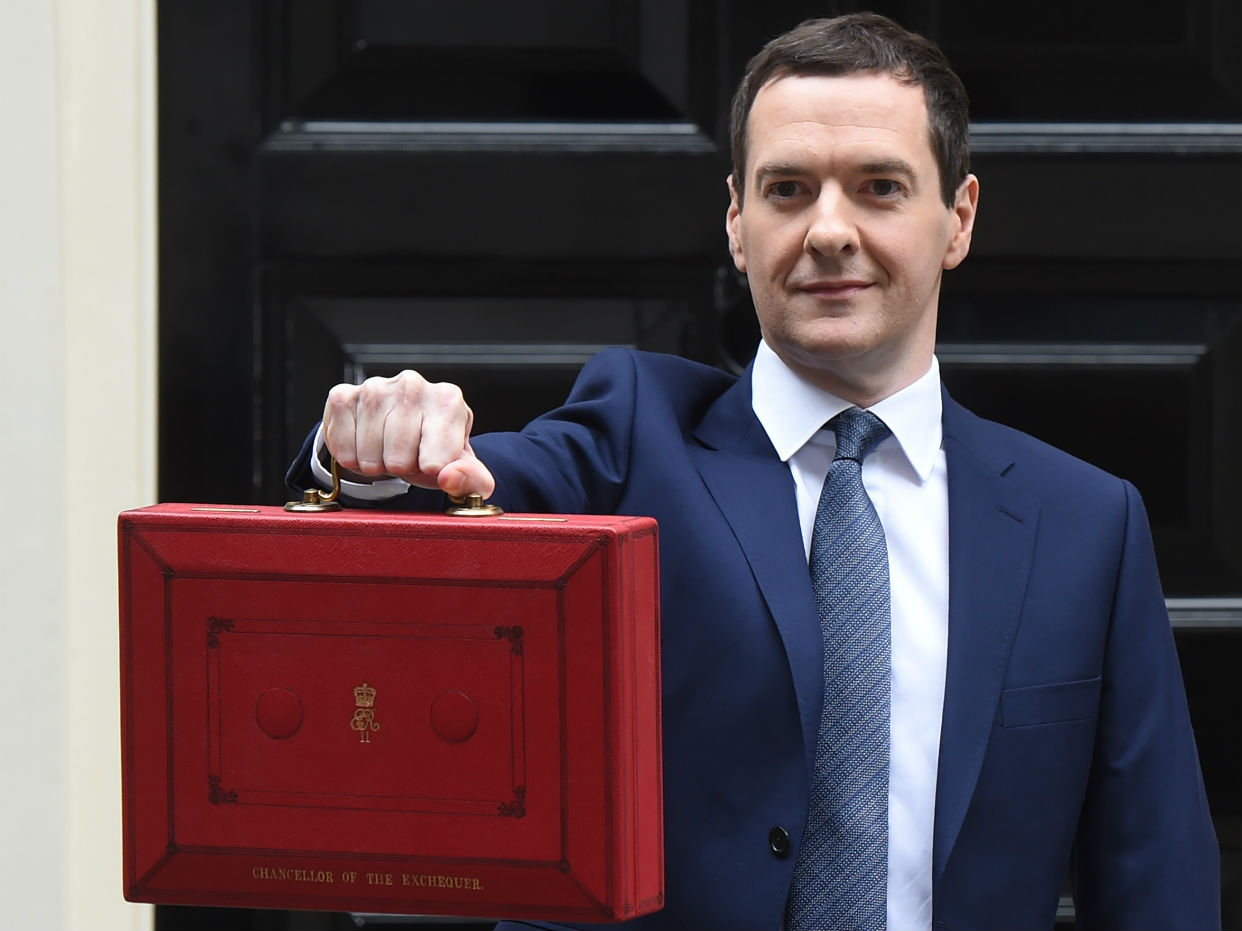

Last month the new personal savings allowance (PSA)came into affect. It supposedly means that we can all earn a certain amount of interest on our savings before we have to pay tax. But, it is a seriously messy bit of legislation and many people are starting to find they aren’t any better off.

What is the savings allowance?

The PSA gives basic rate income taxpayers the right to earn up to £1,000 interest per tax year before income tax is due. Higher rate taxpayers get a £500 allowance and additional rate taxpayers don’t get any allowance.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The allowance will mean 95% of savers no longer pay tax on cash returns, according to the Treasury. But the definition of a 'return' is a touch vague.

What counts as interest?

Not everything that you might expect. Many current account holders won’t benefit from PSA: a lot of banks have moved away from paying interest on their current accounts, instead paying a set monthly amount.

For example, Halifax’s Reward current account pays holders £6.25 a month, but this is reduced to £5 a month after tax. Many account holders expected their monthly reward to increase thanks to the new PSA, but Halifax says the £5 classes as "a payment and not savings income" so it will continue to be taxed. The same goes for Co-operative Bank’s £4 a month payment to current account holders.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, Barclays customers who join its Blue Rewards scheme get a £7 a month reward that is paid tax-free but doesn’t count toward the PSA.

Other current accounts which pay interest, including TSB, Nationwide, Santander and Lloyds, define those payments as interest that does count towards your PSA so they are being paid tax-free now.

It’s confusing, but does it matter?

Working out whether the money your receive from your bank counts towards your PSA or not may seem too complicated to bother with. But if you don’t you could fall foul of the taxman.

If you earn more than your PSA in interest in a tax year, you need to declare the excess on your tax return and pay the extra tax. Equally, if you are a higher or additional rate taxpayer and you receive a payment that is not taxed you will need to pay the additional income tax via your tax return.

You need to know what money coming into your bank accounts classes as interest for PSA purposes and keep an eye on them. You can find out by contacting your bank or building society directly.

If you are a non-taxpayer you will need to continue to fill out a R40 form in order to receive your payments from Halifax or Co-op tax-free.

How do I compare accounts?

The complexity of PSA doesn’t just mean a headache when filling out your tax return. It also makes it much harder to compare current accounts and work out who is offering the best deal. You’ll now need to factor in whether the rewards or interest offered will be taxed or not.

Luckily, the best current accounts at the moment are the ones paying interest not reward payments, so the money should be tax-free for most people. Santander pays up to three per cent on it’s 123 account plus up to thee per cent cash back on bills, but there is a £5 monthly fee. Alternatively, Nationwide’s FlexDirect account is free and pays five per cent interest on balances up to £2,500.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix