Biggest cut to consumer loans since financial crisis

Cutback comes after repeated warnings from the Bank of England over the pace of household lending

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

UK lenders are planning the biggest cutback to consumer loans since the start of the financial crisis, after a warning from the Bank of England that the pace of household lending is unsustainable.

The amount pledged to lenders over the next three months is significantly less than the amount loaned in the previous quarter. The drop is bigger than between any two quarters since the end of 2008, at the height of the financial crisis.

While the Bank has said there is no overall debt bubble in Britain, it has expressed concern about consumer debt, which continues to grow at about 10% a year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This prompted the Financial Conduct Authority, which regulates consumer credit, to look into whether changes are needed to help people struggling with debt, especially with car loans and mortgages.

Most experts expect the Bank to raise interest rates before the end of the year, although some are worried this could be premature. They fear that yesterday’s figures show Britain’s consumer economy is running out of steam just when uncertainty is growing over the impact of leaving the EU.

Joanna Davies, economist at Fathom Consulting told Reuters a consumer squeeze driven by falling wages in real terms combined with historically low household savings and tightening credit condition, “didn’t bode well” for the economy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

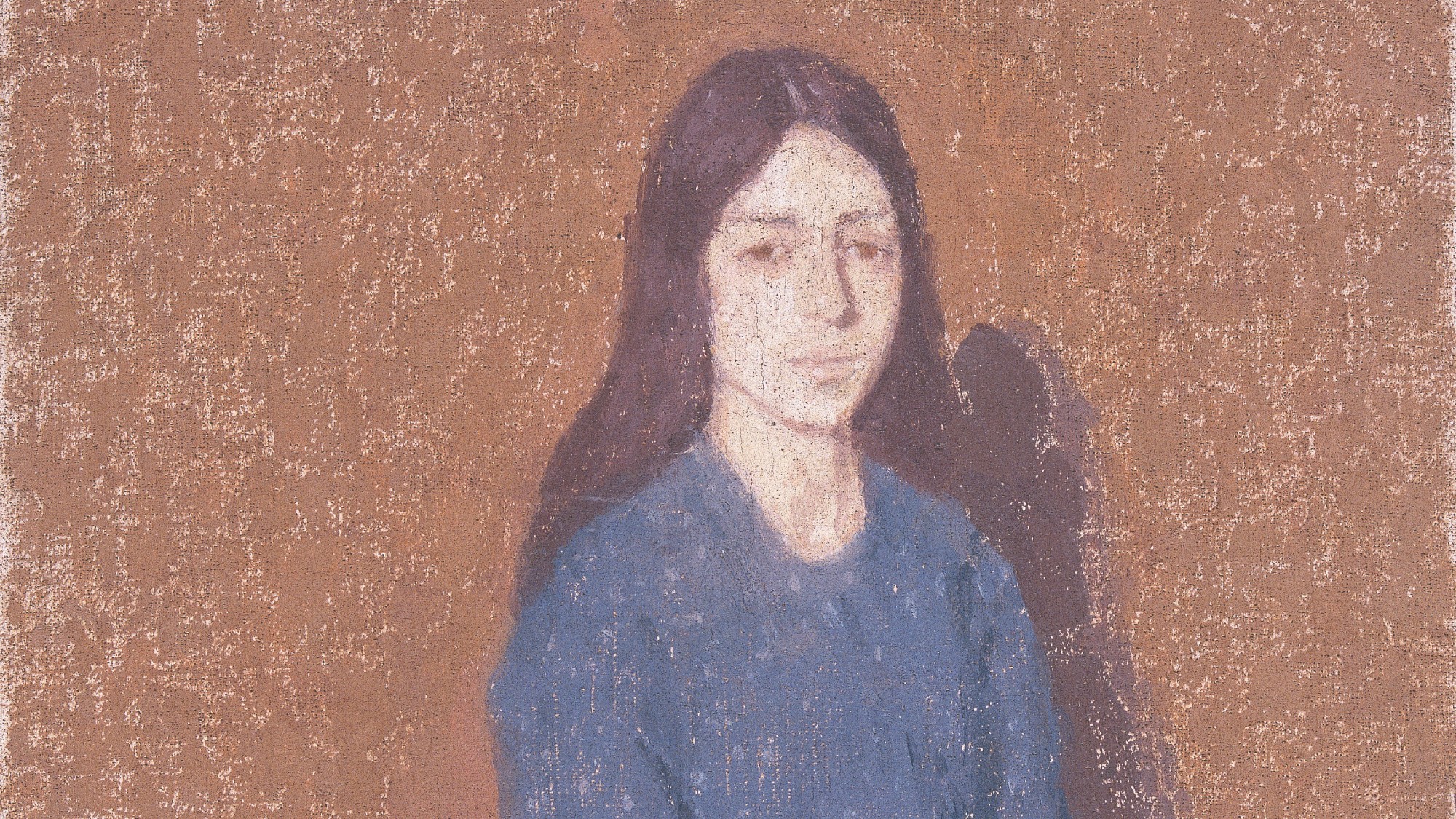

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Are UK pensions safe?

Are UK pensions safe?Today's Big Question Bank of England governor says its debt market support must end – but the multi-billion-pound scheme could be extended

-

When will paper £20 and £50 notes expire?

When will paper £20 and £50 notes expire?Business Briefing Old notes will soon be taken out of circulation by the Bank of England

-

What is inflation and why is it so high?

What is inflation and why is it so high?feature Smaller petrol price increases mean inflation has dipped slightly – but it remains in double digits

-

Brits keeping 21 million ‘money secrets’ from friends and family, survey reveals

Brits keeping 21 million ‘money secrets’ from friends and family, survey revealsSpeed Read Four in ten people admit staying quiet or telling fibs about debts or savings

-

Negative interest rates explained: how your finances could be affected

Negative interest rates explained: how your finances could be affectedIn Depth Money experts share their views and advice

-

London renters swap cramped flats for space in suburbia

London renters swap cramped flats for space in suburbiaSpeed Read New figures show tenants are leaving Britain's cities and looking to upsize

-

Should the mortgage holiday scheme have been extended?

Should the mortgage holiday scheme have been extended?Speed Read Banks warn that some homeowners may struggle to repay additional debt

-

RBS offers coronavirus mortgage holidays

RBS offers coronavirus mortgage holidaysSpeed Read Taxpayer-owned bank follows measures taken in virus-struck Italy