Inside the utterly irrational modern art market

The same $142.4 million spent on a Francis Bacon triptych at Christie's would have funded India's entire Mars orbiter mission — twice

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

ART DEALER CHRISTOPHE Van de Weghe strode into Christie's auction house in New York City with orders from a mystery client. His mission that night, Nov. 12, 2013, was to buy a specific painting — for which the client was willing to pay an astonishingly high price. "He really wanted to have it," Van de Weghe recalls. The work was called Apocalypse Now.

By the end of the night, the auction at Rockefeller Center would make history many times over. As auctioneer Jussi Pylkkänen's hammer fell on lot after lot, the figures posted on the screen behind him were as eye-popping as the works on display. A Francis Bacon triptych set an auction record for any artwork, at $142.4 million. Jeff Koons's sculpture Balloon Dog (Orange), at $58.4 million, set a high mark for a living artist. An Andy Warhol picture of a Coca-Cola bottle sold for $57.3 million, pushing the overall take that night to $692 million, at the time the biggest single sale of art ever.

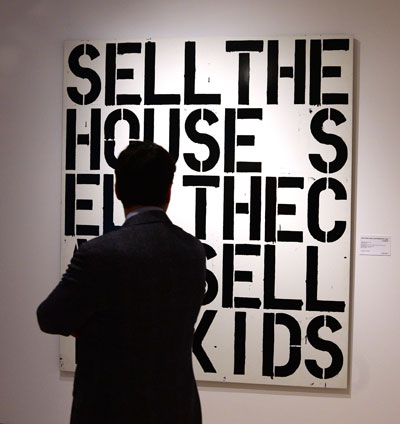

Apocalypse Now, the eighth lot auctioned that night, was created by Christopher Wool in 1988. It isn't much of a painting at all — just black letters on a 7-foot white background spelling out, in all caps, a line from Francis Ford Coppola's Apocalypse Now: sell the house sell the car sell the kids. Wool isn't a household name like Warhol or Koons, but his work has been gaining critical and commercial traction for years. Christie's had estimated Apocalypse Now would sell for $15 million to $20 million, more than double Wool's previous auction record of $7.7 million. Just 18 days earlier, in the closest thing that comes to a coronation in the art world, the Solomon R. Guggenheim Museum had inaugurated a massive midcareer survey of Wool's work.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

When Apocalypse Now came to the block at Christie's that evening, at least two potential buyers made their offers via phone. In the room, Van de Weghe sat near the front, with a diagonal view of the auctioneer's podium. The dealer was sandwiched between billionaires — on his left, J. Tomilson Hill, vice chairman at Blackstone Group, the world's largest private equity firm, and on his right, hedge fund manager Dan Loeb. At the time, each man had a Wool on loan at the Guggenheim show two miles north on Fifth Avenue. Hill's was a stark picture of black flowers. Loeb's, called If You, was block letters that spell (without the dashes): if you cant take a joke you can get the f--- out of my house.

The king of the Wools, however, is Apocalypse Now, widely considered his archetypal word painting. "It is his masterpiece," says Van de Weghe. As the price crept up toward $18 million, the dealer entered the fray. Doing battle now with three other buyers, he didn't relent. "My client wanted the best," Van de Weghe says.

And so the price kept going up.

CONTEMPORARY ART SALES at auction shot up 33 percent last year and 1,078 percent over the past decade. And those figures don't include private sales and gallery transactions, which dwarf auction sales.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The boom has made single works more expensive than the market values of more than 800 members of the Nasdaq Composite Index. The same $142.4 million spent on the Bacon triptych at Christie's would have funded India's entire Mars orbiter mission — twice. Koons' Balloon Dog, a 10-foot-tall stainless-steel rendition of a child's party favor, went for roughly the same amount the White House recently requested to develop an Ebola vaccine.

At these levels, art has become a significant slice of the net worth of some of the planet's richest inhabitants, a portfolio-diversifying store of value for anyone who already has enough homes, bonds, stocks, or airplanes. Financier Ronald Perelman's fortune includes $3 billion in art — more than a fifth of his $14.8 billion total. Artwork valued at $2.3 billion is the single biggest chunk of music mogul David Geffen's total $6.6 billion, and Los Angeles philanthropist Eli Broad's $7 billion includes $2.2 billion of art.

The art market has reached similar dollar amounts (adjusted for inflation) before, notably when Asian buyers snatched up impressionist artworks in the late 1980s and early 1990s. But it has never seen such extraordinary prices for contemporary art, when a 25-year-old word painting like Apocalypse Now goes to auction estimated at more than a 400-year-old work by a Dutch master, such as Jan Brueghel the Elder's The Garden of Eden With the Fall of Man, which sold for $11.7 million in July.

"If you're looking for something rational in the art market," says art adviser Thea Westreich, "go fishing, or go do something else instead."

Prices for Wools have paced the boom. In 1993, there were two public sales of his work, totaling $24,170. In 2003, the number was 11, for $807,580. In 2013, the year of the Guggenheim exhibit, 65 public Wool sales totaled $80.9 million.

Among his downtown peers from the 1980s, Wool, born in 1955, was something of a late bloomer. Money first flowed to publicity-savvy artists such as Julian Schnabel and Ross Bleckner, whose prices skyrocketed — and peaked — well before Wool's art was traded in earnest. He came upon the idea for text paintings in 1987 when, while walking in New York, he spotted a white van spray-painted in black graffiti. It read "luv" and "sex." His graphic riffs on those words launched the genre. The following year, Wool drew upon the 1979 film Apocalypse Now for new text, taking the "Sell the house" line from a letter a character sends home from the jungle after going mad.

THE PAINTING Apocalypse Now had its debut in April 1988 at the 303 Gallery, a sparse East Village space. Illuminated by track lighting, the work hung on a wall across from three urinal sculptures by Robert Gober, with whom Wool had organized the joint show. "It was probably the painting of the year," Richard Flood, now the chief curator of New York's New Museum, later wrote of Apocalypse Now. The stock market had crashed the previous year, and as the economy slid into recession, humbling the art world, Wool's apocalyptic text "became a kind of late-'80s mantra," according to Flood.

The show was such a hit that one couple bought the whole thing, urinals and all. Werner Dannheisser, who fled Germany in 1936, had founded an engraving company in Queens and in 1952 married a secretary there, Elaine, who had studied painting. In the 1980s, they filled their Tribeca loft with works by Keith Haring, Kenny Scharf, and other now-famous names. Though the price they paid for Apocalypse Now was never made public, a similar word painting by Wool sold a year later for $7,500. The pieces wouldn't stay in the four figures for long.

Werner died in 1992, and in 1996, Elaine offered MoMA most of her collection. Valued at more than $5 million, the donation allowed Dannheisser to join the museum's board. There was a twist: MoMA refused to take Apocalypse Now.

"They already had a Christopher Wool, and they thought they didn't need two," says art dealer Philippe Ségalot. In 1999, he says, Dannheisser approached him about selling the work at auction. Ségalot was then head of Christie's postwar and contemporary art department in New York. "Of course I took the picture," he says.

A few days after Dannheisser signed the contract to auction Apocalypse Now at Christie's, Ségalot mentioned the pending sale to Per Skarstedt, one of the most established contemporary art dealers in New York. Skarstedt implored Ségalot to sell Apocalypse Now to him, offering up an alternate Wool — titled Fool — that could be auctioned instead. Christie's agreed. Skarstedt paid Dannheisser $100,000 to $150,000 for Apocalypse Now, nearly double the $60,000 to $80,000 it was expected to fetch at the auction.

Within days, it became clear that Skarstedt had gotten a steal. At the Christie's auction on May 19, 1999, Wool's Fool was estimated to sell for as little as $40,000. With Dannheisser in the room, a bidding war erupted. As a shocked audience looked on, Westreich, the art adviser, placed a winning bid of $420,500 for the lesser Wool.

"Elaine almost died in the auction room," Ségalot says. "I wanted to hide behind the podium." He says she didn't speak to him for six months.

With Wool prices in new territory, Skarstedt added Apocalypse Now to his inventory and waited for an offer. It didn't take long. By the end of 1999, St. Louis–based businessman and collector Donald Bryant Jr. made an approach, agreeing to pay about $400,000 for Apocalypse Now.

But two years later, Bryant called Ségalot, who was working as a private dealer at the time, with a tale of family drama. "'I want to install it in my house,'" Ségalot recalls Bryant saying, "'but my wife hates it. She can't live with a work that says sell the house sell the car sell the kids. So do you know anyone who might want to buy it?'"

Ségalot did: French billionaire François Pinault, who'd bought Christie's in 1998 and houses his art collection in the Palazzo Grassi, a restored 18th-century mansion in Venice. Pinault bought the painting for "around $400,000," Ségalot says. It was the first time the painting had changed hands without a big jump in price. Four years later, in 2005, Pinault decided to sell the work, saying his collection was too light on Wools to justify keeping it. "He likes to collect in-depth," Ségalot says.

This time, the buyer was a player in the booming hedge fund world, David Ganek. "I sold it to him for $2 million in 2005," Ségalot says. Then in 2005, Ganek conquered prestigious social turf on Manhattan's Upper East Side — joining the board of trustees of the Solomon R. Guggenheim Foundation and spending $19.1 million for the duplex apartment where Jacqueline Kennedy Onassis once lived at 740 Park Ave., one of the city's most formidable addresses.

In the same way a homeowner can take out a home equity loan, a collector can borrow against a painting, and in 2006, Apocalypse Now became collateral with Bank of America, and then, a year later, with JPMorgan. According to loan documents, the painting was pledged to JPMorgan for almost the entire time Ganek and his wife owned it.

THE FIRST NEWS that the Ganeks had sold — to a still-unknown party — came on Oct. 4, 2013, in the form of a Christie's press release. The work was to be immediately offered up at the auction house's big Nov. 12 show. That evening, Van de Weghe didn't flinch as he bid until the competition dropped out. When the hammer came down, the audience broke into applause. The final price for Apocalypse Now, including the buyer's premium paid to Christie's: $26.4 million. It had appreciated roughly 350,000 percent in 25 years.

After the sale, speculation raced through the art world about who the mystery buyer — and seller — had been. "It's a little bizarre," dealer Skarstedt says. "Normally, even when someone's discreet, three weeks later, everybody knows. It could be someone in Europe or in China; you never know." Van de Weghe has stayed mum. "The person who bought the painting wants to remain very quiet," he says.

Apocalypse Now has been seen in public on at least one occasion since then. In February, when the Wool retrospective moved from the Guggenheim in New York to the Art Institute of Chicago for 11 weeks, the new owner agreed to lend the painting. Wool attended the Chicago opening, where he spoke with Van de Weghe about Apocalypse Now. "'I would love to know who the owner is,'" Wool said, according to Van de Weghe. "'I would love to know who owns my work.'"

Excerpted from Bloomberg Businessweek. Used with permission of Bloomberg L.P. Copyright © 2014. All rights reserved.

-

Political cartoons for February 22

Political cartoons for February 22Cartoons Sunday’s political cartoons include Black history month, bloodsuckers, and more

-

The mystery of flight MH370

The mystery of flight MH370The Explainer In 2014, the passenger plane vanished without trace. Twelve years on, a new operation is under way to find the wreckage of the doomed airliner

-

5 royally funny cartoons about the former prince Andrew’s arrest

5 royally funny cartoons about the former prince Andrew’s arrestCartoons Artists take on falling from grace, kingly manners, and more