Here's the latest economic 'crisis' that has pundits in a tizzy

That 1-in-500-million event in the junk bond market doesn't seem to be doing much

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

We are five years into what must be the most broadly pessimistic bull market of all time.

While the S&P500 has risen to all-time highs, levels of economic confidence are down in the dumps. According to a Wall Street Journal/NBC poll earlier this month, 76 percent of adults lack confidence that their children's generation will have a better life than they do. Seventy-one percent of adults think the country is on the wrong track, and 60 percent believe America is in a state of decline.

Now, the causes of this deep, entrenched pessimism seem to be mostly political. For example, according to the same poll, seven in 10 blamed the malaise "more on Washington leaders than on any deeper economic trends," and 79 percent expressed dissatisfaction with the American political system.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Indeed even as the economic recovery rumbles on — with unemployment having fallen to 6.2 percent, and the U.S. economy having grown faster than its rivals in the developed world — the mood of dire pessimism is not lifting.

Given that the poll numbers indicate that the cause of this crisis of confidence is more about politics than the economy, that is not really surprising. Washington remains dysfunctional with scant few compromises between President Obama and Republicans in Congress. And 2014 has been pockmarked with outbreaks of geopolitical turmoil. In this environment, it's no wonder that fears about a looming economic crisis can easily spark. And some pundits are more than happy to fan the flames.

This week, it's the turn of Michael Snyder of the economic fear porn website The Economic Collapse. He is convinced that the "bubble of false prosperity" is "about to burst," and reels off 14 arguments why he thinks so. Some of his points — like the fact that 40 percent of all households in the United States are showing signs of financial stress, and the fact that the U.S. homeownership rate has fallen to the lowest level since 1995 — are genuinely worrying, and may go some way toward explaining why the the post-2008 economic recovery has been relatively weak. But by no means do they suggest that a new financial crisis is imminent. Some of his other points — he worries that the Ebola virus may start spreading within the United States, for instance — are extremely unlikely.

Ultimately, he is convinced an economic collapse is coming, and is looking for evidence to support his view. That is called confirmation bias. As the author of a string of failed bearish predictions in the last five years — he argued that an economic collapse was coming in 2010, and 2011, and 2012, and 2013, and 2014 — his arguments should be taken with an ocean's worth of salt.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But he does raise one interesting point. There has been a huge exodus of money out of junk bonds — so called because they are at higher risk of default, and thus pay higher yields to compensate for that risk — this month.

Snyder argues: "Billions of dollars are being pulled out of junk bonds right now, and that has some analysts wondering if a financial crash is right around the corner." And indeed, as Business Insider's Sam Ro points out, when a record $7.1 billion was pulled out of junk bond markets the week before last, vastly more than in an average week, it was a one-in-500 million event. That meant that a record $13 billion was pulled out of junk bonds in the four weeks before August 6.

But what does that really mean for the economy? John Ficenec of The Telegraph sees it as a worrying sign. He notes that the withdrawals are "larger than those recorded at the height of the global financial crisis," and argues they are a signal that a bubble in junk bonds is bursting. In a so-called "dash to trash," investors seeking higher yields in the debt market bought heavily into junk bonds after the financial crisis. That has driven junk bonds up to record price highs.

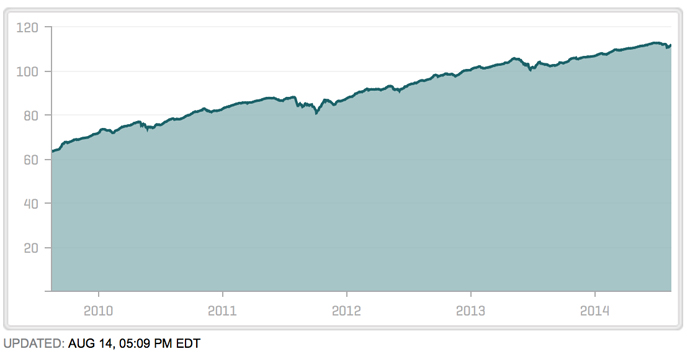

But there isn't any evidence that the recent junk bond exodus is about to send the economy into a tailspin. In fact, it seems to have meant very little even for the junk bond market itself. Money has flowed out heavily, but the price hasn't crashed. Here is the price of an index fund of junk bonds — the S&P U.S. Issued High Yield Corporate Bond Index — over the last five years:

That tiny dip at the very end is the so-called "exodus."

So this is really making a hullabaloo out of nothing. The price hasn't crashed because while lots of investors are exiting the junk bond market, large institutional investors are happily buying into it. As Katy Burne of The Wall Street Journal writes:

Large institutions are snapping up U.S. junk bonds, taking advantage of a price slide triggered by an exodus of individual investors. Many big money managers say they remain bullish on these risky corporate bonds despite concerns that the market is overheated and worries that geopolitical unrest could fuel a rush to safer assets. [The Wall Street Journal]

Nobody would be surprised to see the price of junk bonds falling. They are, after all, risky assets priced at record highs. In fact, falling junk bond prices could be taken as a positive sign for the economy, because it would reflect the fact that fewer investors are reaching into risky assets out of hunger for higher yields. But that isn't happening yet.

So the real story here is not that the U.S. is on the edge of another financial crisis, but that fear porn pundits will buy into any old nonsense to validate their views.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day