How the euro can still unseat the dollar as the world's dominant currency

I didn't say it was going to be easy...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A huge penalty recently imposed on the French bank BNP Paribas for sanctions-breaking has intensified talk of the end of the U.S. dollar's international reign. Remember, the currency most favored around the world does change: the U.S. dollar replaced the U.K. pound, which itself replaced the Spanish real. Many have suggested the Chinese yuan is the next logical usurper (though the Chinese themselves have promoted the IMF's bundle of currencies instead). But what about the euro?

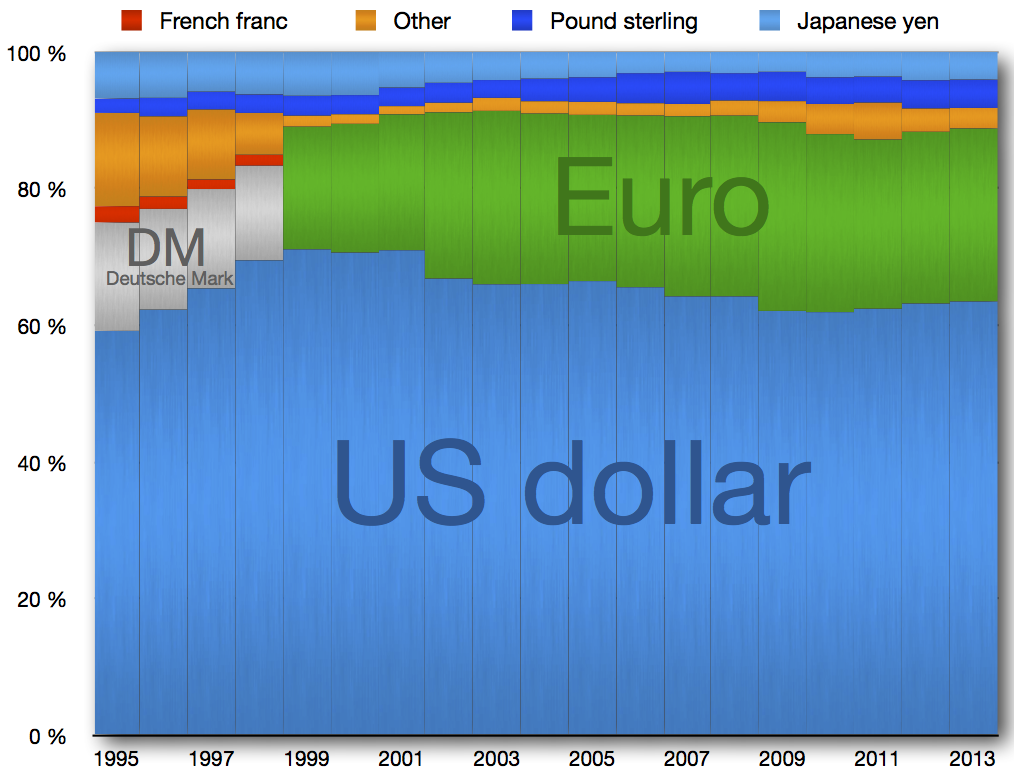

Currently, the euro is the second most widely held currency in the world after the U.S. dollar, making up about 25 percent of all currency holdings:

(Wikimedia)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It is highly liquid, it has a stable central bank, the European Central Bank (ECB), and it is backed by one of the largest and most successful economies in the world, namely Germany. Prior to the 2008 financial crisis, its use for international trade was growing rapidly and was widely seen as the next dominant global currency. Some even foresaw this happening as early as 2020.

Of course, enthusiasm for the euro has somewhat dampened since. First came the U.S. financial crisis of 2008-9, which badly damaged the European banking system, and then the eurozone crisis of 2011-12, when damaged banks dumped their risks onto European governments, causing a sovereign debt crisis. Use of the euro for international trade has continued to grow, but at a slower pace than before these crises, and euro reserves have also been growing at a slower pace. But the point is that they are still growing. The eurozone may be troubled, but the euro remains trusted. It is a measure of how successful the "currency without a state" model can be.

But does this make it a suitable candidate to replace the U.S. dollar as the currency of choice for international trade and reserves? No, it does not. And there are three reasons for this.

1. Liquidity. Although the euro is highly liquid, the quantity of it in circulation is seriously restricted by the ECB's hard-money policies. Disinflation (i.e. a decline in the rate of inflation) in the eurozone and outright deflation in places like Greece and Spain have not been offset by monetary easing. Consequently there simply are not enough euros in circulation for it to be used as the world's primary trade and reserve currency without causing deflation not only in the eurozone, but worldwide.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

2. Stability. The eurozone crisis is far from over. It is entering a new phase, in which disinflation and low growth slowly raise the debt-to-GDP ratio of many euro zone countries to intolerable levels. I say most, because the eurozone crisis has now moved beyond the famous "GIIPS" (Greece, Italy, Ireland, Portugal and Spain). France's economy is going into a tailspin, the Netherlands is in deep trouble because of a burst housing bubble, Finland is in recession and even mighty Germany is slowing. The European banking system is still under considerable pressure: Every day seems to bring news of yet another bank in trouble. European banks remain risky and under-capitalized, not only in the periphery but also in the core, and the sovereign guarantees on which much of the banking system depends are being challenged.

3. Debt. U.S. sovereign debt — which is a claim on future U.S. dollars — is crucial to the international financial system and by nature deeply intertwined with the dollar. It is the world's premier safe asset because the U.S. dollar is the world's premier reserve currency. Plentiful supplies of U.S. debt are needed to lubricate the financial system. Indeed, plentiful supplies of U.S. debt are needed to support the U.S. dollar's supremacy. Since reserve holders really don't want to hold currency (they want to hold a safe liquid asset that is easily convertible to that currency), the U.S. debt pile is an inevitable consequence of the U.S. dollar's premier status.

But in the eurozone, sovereign debt is seen as a problem: All countries have committed to reducing their debt through persistent fiscal austerity. This might maintain the quality of their debt (though as persistent austerity has contractionary effects this is doubtful), but it certainly won't maintain its quantity. Not only that, but all European sovereigns are not equal. German debt is the eurozone's risk-free asset, with all other sovereign debt trading at a spread over Bunds. And there is nowhere near enough German debt to support euro reserve holdings of 66 percent of all global reserves, which is what U.S. global reserves amount to.

So what would have to be done to eliminate these problems, making it possible for the euro to replace the dollar?

1. The ECB's hard money policies have to end. The ECB must create the amount of money that is needed to support trade not only within the eurozone, but internationally. Unfortunately, this won't be easy; Euro is also the national currency of 18 states, and the monetary easing required to support international trade would either be inflationary or blow up asset bubbles, neither of which would be acceptable to eurozone politicians. It would be a lot easier to achieve if the euro was simply an international trade and reserve currency and the members of the eurozone had domestic currencies whose exchange values floated with respect to the euro. But there would be so much political face to be lost by abandoning the euro as a national currency that this is very unlikely to happen – even though, as Kit Juckes says, changes in international settlement technology mean that the euro is no longer needed as a national currency.

2. The financial situation in the eurozone must be stabilized. A full banking union is needed, with a common resolution mechanism, common supervision, and common deposit insurance. And the eurozone's wobbly banks must be either sorted out or wound up. The ECB's forthcoming stress tests may go some way towards achieving the last of these, but the banking union proposals are at best half-baked and full union is not on the cards.

3. The insane commitment to trade and fiscal surpluses must end. The producer of the world's premier trade and reserve currency cannot run persistent trade surpluses without causing international deflation. And because debt is needed for reserve holdings, restricting its supply simply drives up the price of the safest eurozone debt. There already isn't enough safe eurozone debt, hence falling yields on German bunds. But if the euro were to become the world's reserve currency, the shortage of German debt would drive yields on Bunds deep into negative territory. The obvious solution to this, of course, is for the eurozone to produce eurobonds, backed by the full faith of all the eurozone sovereigns. But that requires full political and fiscal union, including tax harmonization, common social insurance, and debt pooling. While Germany and other core states remain opposed to these fixes, eurobonds remain a distant dream.

These three unresolved and seemingly intractable problems make it impossible for the euro to replace the US as the world's premier trade and reserve currency. Right now, eurozone politicians are the dollar's best friends.

Frances is the author of the Coppola Comment finance and economics blog, an associate editor at the online magazine Pieria, and a frequent commentator on financial matters for the BBC. Although she originally trained as a musician and singer, Frances worked in banking for 17 years and earned an MBA from Cass Business School in London.

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West