How healthy are your finances? These 3 numbers will tell you.

They'll help you see exactly where you stand financially and what you should do next

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

When it comes to your money, there are an awful lot of numbers floating around.

From your savings account statement to your investing portfolio, every number tells you something … but some are more revealing than others.

Three numbers in particular give an indication of your overall financial health: Your retirement savings, your debt, and your emergency fund.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"These three numbers are your basic financial security," explains Stephany Kirkpatrick, director of financial planning and a Certified Financial Planner™ with LearnVest Planning Services. By getting a handle on these figures, she says, "you'll begin to develop the foundation to help build your future."

You're more than halfway through the 12 Days of LearnVest — we've helped get you organized and set your financial intentions for this year — and now, we want to help you see exactly where you stand, financially, and where you should go next.

For guidance, we've enlisted Kirkpatrick's help to explain the significance of these numbers, and how to help make yours represent finances that are in tip-top shape!

1. Retirement

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Why does crunching this number matter? Simple. The money you save today will most likely be your primary income source for the entire time you're retired, which could be 20 years… or far longer. And the secret of retirement savings is that the sooner you start saving, the more time your money has to grow. In other words, if you start investing money at 25 or 30, you'll actually have to save less (and worry less) in the long run.

Now that increasing numbers of people don't have pensions to rely on, it's more crucial than ever that you open the proper retirement account for you. Chances are, it will be just you and your savings to help you retire on a beach, travel the world or gift to your grandkids.

Later this week you'll hear from one woman who waited until it was almost too late to start investing for her retirement. She would probably tell you that the better plan is to get a handle on your retirement number today.

Crunch your 'retirement number'

First, it's time to track down all of your retirement accounts. Maybe you put some money away early on in your career — then switched jobs and left that 401(k) behind. (In that case, it's probably time for a rollover.) Maybe you opened a Roth IRA that you promptly forgot you had. Today's the day to figure out exactly how much you've saved so far.

If sorting through the details of your accounts sounds like a drag, head to the free LearnVest Money Center to link up each account and see your total savings in one place. Then, just for fun, go ahead and see how your savings compare to others'.

How much is enough?

Forecasting precisely how much we'll need in the bank when it comes time to retire is an inexact science — for starters, there simply isn't a way to predict how long we'll live.

But you should have a rough estimate to guide your savings. To predict how much you should aim to save in total, you can start by using a free retirement calculator.

All you need to provide is your birthday, the age you plan to retire (67 is standard), your annual pay, and how often you receive a paycheck to see how much money you'll need each month during retirement. Multiply that figure by 12 to see how much you'll need for a year, then by about 23 to get an idea of how much you'll need in the long term.

Now that you have that number with all the zeroes … don't panic! We have you covered, and there are a few things to keep in mind:

First, the calculator assumes a "replacement ratio" of 85 percent — the estimated amount of your current income that you'll need to have available during retirement. For most people, Kirkpatrick recommends replacing 85 percent of your current household pre-tax income at a minimum, but not everyone will need 85 percent exactly — check out our guide to estimating how much you'll need to live the retired lifestyle you want.

Second, remember the secret of investing: $500 in your retirement account today could equal as much as $21,000 in 20 years. And the earlier you start, the more time your money has to grow. Even if you can only sock away $100 a month, you can make it count by starting today.

Take action: Increase your contributions

"Truly, the hardest part is just getting started," says Kirkpatrick. If you've been dragging your feet until now — whether it's synching with HR about your 401(k) benefits or setting up automatic contributions to your Roth IRA — make it part of your New Year's resolution to take that first step.

And while everyone's retirement savings plan and goals will be unique, you can still start with some general must-dos. First, make sure you're socking away a minimum of one percent of your annual income, Kirkpatrick directs. And, if your company offers a 401(k) match, "Absolutely do whatever it takes to get the full match available," she says. "Never leave free money on the table."

Another way to rock that retirement account? Schedule increases of one percent to your retirement savings every six months. If your retirement plan doesn't provide an option for automatic increases upon signing up, you can set yourself a calendar reminder to log into your account and do it manually.

2. Debt

The first thing to know is that not all debts are considered equal. Maybe you have some student loan debt: That's the first type, called good (or "healthy") debt, and it includes loans taken to invest in yourself or in something that's expected to be worth more in the future. Mortgages also fall in this category, Kirkpatrick explains. The other type of debt, considered "bad debt," doesn't help you invest in your future — think credit card debt or payday loans. They also typically have higher interest rates.

See how much you owe

We know that tallying up your total debt can be terrifying — looking at this total isn't our idea of fun, either! But if you don't do it, you may never have a plan to pay it back.

One easy way to get a handle on your debt is to link up any of your accounts with outstanding balances in the LearnVest Money Center. Think: Your mortgage, car loan, student loans, or credit card debt.

Step 1: 'Rack and stack'

Now it's time to determine which debts to pay off first. You should always be making minimum payments across the board, but when it comes to allocating the bulk of your money, Kirkpatrick recommends a method called "racking and stacking" — making a list of every loan you have, ranking them in order of highest to lowest interest rate and prioritizing the highest-interest loan first.

Once you've managed to clear the most toxic type of debt out of the way, move down the list according to interest rate. By paying the most toward one priority debt at a time, you'll get the most expensive debt out of the way sooner, and should save a bundle on interest.

When racking, note that if you carry a balance on a credit card with zero percent interest, it doesn't necessarily belong at the bottom of the list. In fact, it should be one of your top priorities. "zero percent credit cards tend to have sneaky features," Kirkpatrick says. "If you're carrying a balance, you could get hit with deferred accrued interest if you haven't paid it off when that zero percent interest period ends."

Step 2: Explore repayment options

Grads with student loans are automatically enrolled in a standard payment plan; most homeowners settle into 30-year fixed mortgages. And this very well could be the best financial choice for you — but have you ever considered that you might be better off with a different plan?

"Look at each loan and see if there's a way to attack debt more quickly by changing your payment plan," says Kirkpatrick. That might mean a graduated payment plan for your student loans (or any other of these seven federal student loan repayment plans), or maybe even refinancing your mortgage, as long as you're still able to pay it off in the same time frame. Even if you're unsure of the changes that would suit you best, it never hurts to call your lender and ask.

3. Emergency fund

An emergency fund is the amount of money you have in cash savings if your car dies on the way to work, if you break your arm, or if you're laid off. The reason you need one is that the last thing you want to do is worry about how you're going to get by if any of the above happen — or worse, take on debt to do so. "Your emergency fund is your financial foundation, your safety net and your ticket to freedom," Kirkpatrick explains. That's why having 3-9 months of net income (depending on your situation) is so critical to your financial health.

If you feel that between your budget essentials, chipping away at debt and trying to pad that retirement account, you couldn't possibly spare any cash for a savings account — well, you're certainly not alone. In fact, more than a quarter of Americans have no emergency savings. And in a recent LearnVest survey, less than half of respondents said they're currently working on one.

We know creating this cushion seems daunting, and that it will take time — you won't have a full emergency fund next Tuesday. But, like with most major financial goals, even a few small steps today will help you get on the path toward financial security.

Your emergency fund is your financial foundation, your safety net and your ticket to freedom.

How much more do you need?

By now, the first step should be a no-brainer: Take stock of your current savings, then calculate how much more you need to have a full emergency fund. Bear in mind that while three months of savings might be enough for a single person with a safety net (like family who could help you out), you'll want to aim for six months of savings if you lack a safety net or have kids, and nine full months if you're self-employed.

To get on track, set a goal in the LearnVest Money Center. Simply plug in your savings target and find out how long your goal will take to achieve at your current savings rate. Play around with the tool to find out how kicking your monthly contribution up a notch will affect your time horizon — you'll see that even just funneling an extra $50 per month could make a big difference.

How do you get there?

Now, how do you get on the fast track to hitting that goal? Use these two strategies to streamline your progress.

1) Open a separate account. Your emergency fund should never live in the same bank account as money earmarked for other purposes. "It's all too easy to eat out of the cookie jar when it's within reach," Kirkpatrick explains. "Out of sight, out of mind." Instead, move your savings into a separate high-yield savings account with a competitive rate… then leave it alone.

2) Pay yourself first. The best way to save is to make it mindless. Have your employer direct deposit a portion of your paycheck directly into a savings account — you won't miss what you never saw. If that's not an option at your company, automatic transfers from your checking to your savings are second best. "My secret tip? Set up those automatic transfers to occur on a weekly basis," says Kirkpatrick. "The more you can normalize cash flow so less money leaves your account at once, the less painful it will feel — and best of all, you're still hitting that target each month."

More from LearnVest...

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

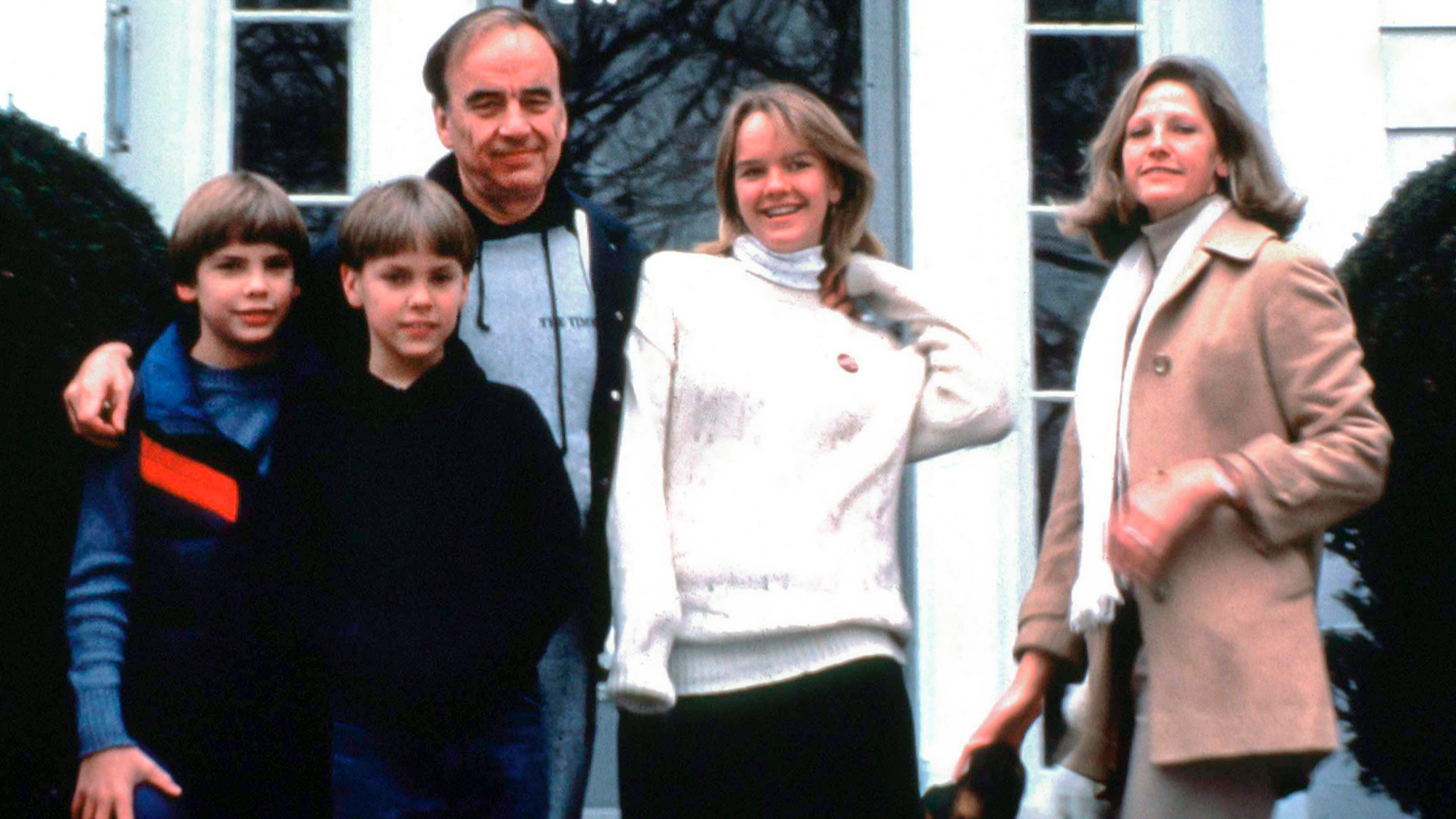

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

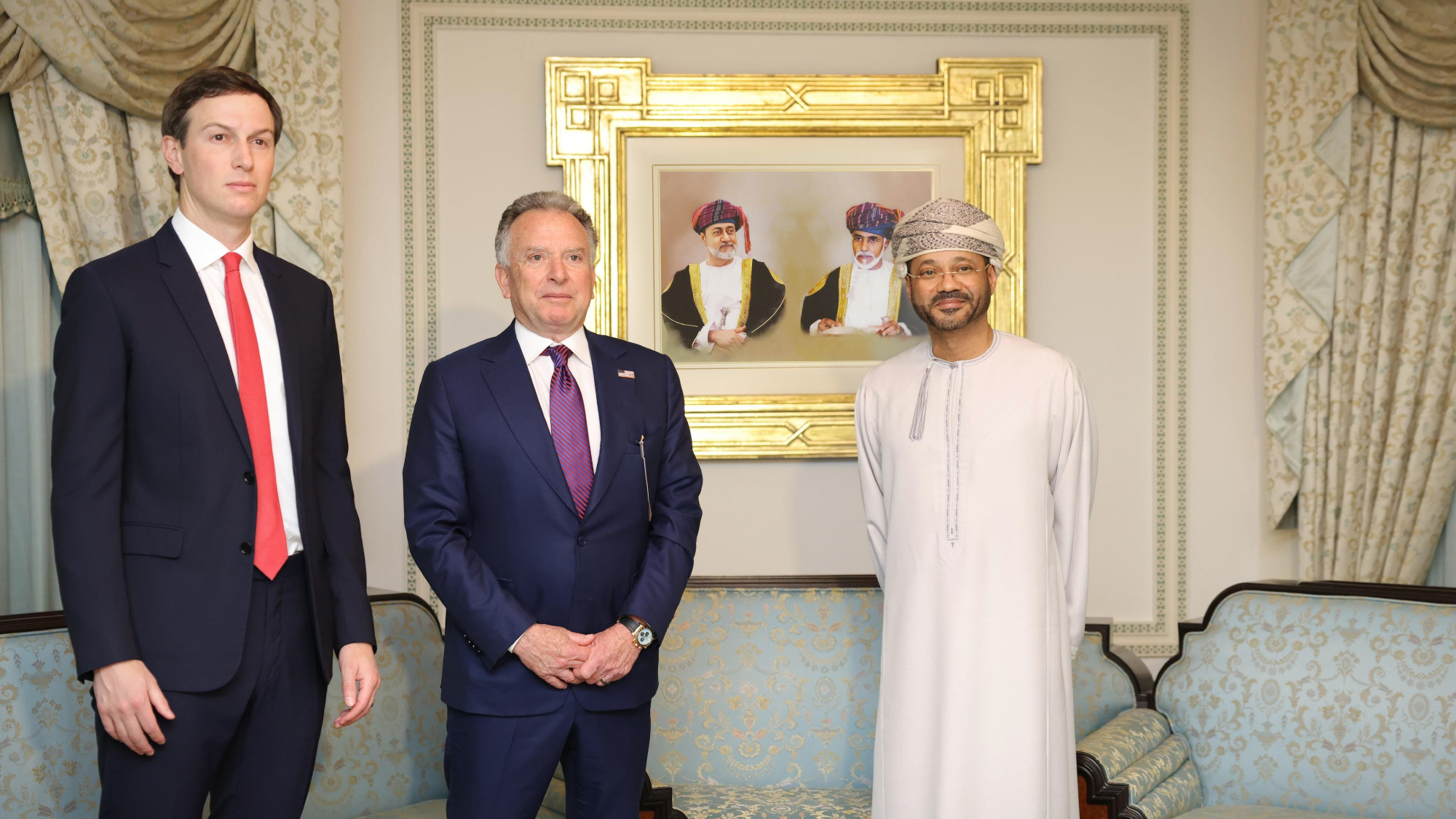

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine