The taper is finally here: What the Fed's move means for the economy

The central bank is reducing bond purchases by $10 billion per month

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Ben Bernanke, in his final press conference as chairman of the Federal Reserve, announced today that the central bank would be tapering asset purchases to $75 billion a month, down from $85 billion, which has been widely seen as a modest first step toward reducing the Fed's outsized role in financial markets and the economy.

The move caught many economists by surprise — a USA Today survey found that most economists polled said the Fed would maintain its current levels of quantitative easing, as the policy is known, before trimming down in January.

After the financial crisis in 2008, spooked investors started piling into low-risk assets like Treasuries, driving prices dramatically higher. The Fed’s aim in buying these assets was to take safe investments like Treasuries off the market, in order to encourage investors to take more risk and invest in higher-yielding and more productive ventures like stocks, equipment, and new employees.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The ultimate objective was more jobs, and more economic activity.

So what does the taper mean for the economy? Well, it’s a reaction to two pieces of very good news we’ve learned this month: Unemployment is falling fast, down to 7.0 percent in November, from 7.3 percent a month earlier; and the economy is growing at a faster pace, up to 3.6 percent year-on-year inflation-adjusted growth.

If the economy is recovering at a stronger clip, it makes sense for the Fed to begin winding down its stimulus programs. After all, the point of the stimulus is to fight unemployment, and a trend of falling unemployment makes stimulus less necessary.

But the Fed took a very, very cautious step. A $10 billion per month reduction is quite tiny. The Fed technically is not tightening monetary policy — it is only slightly decreasing the rate of easing. This caution is a recognition of the fact that although the unemployment rate is falling, the recovery is by no means secure. Tapering too hard too early could unnerve markets and businesses that feel dependent on Federal Reserve support, causing the economy to stumble.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

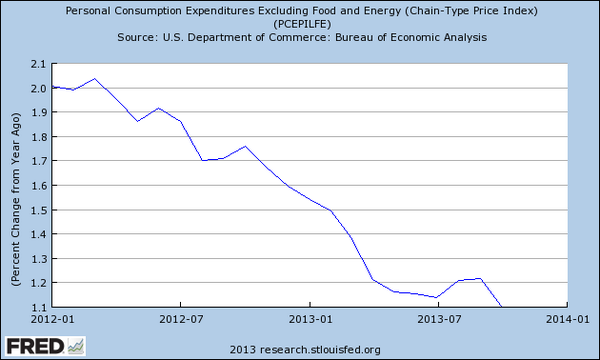

Inflation is already extremely low and falling, causing many economists to worry that this move risks sparking a deflationary cycle:

[Federal Reserve Bank of St. Louis]

Really, the Fed is dipping its toe in the water to see if the labor market and the broader economy can survive the taper. If unemployment continues to fall and growth remains strong, expect more tapering as the Fed becomes more confident of a recovery.

By the time unemployment falls to five percent, the Fed will likely have ended the stimulus program altogether.

But that remains a long way away. If unemployment rises, growth slows, or prices fall to deflationary levels, the Fed may resort to increased easing again.

Markets reacted to the taper by shooting up. Investors are happy. It is a cautious taper, one that is sensitive to the fact that the economy is still weak — but it also suggests the Fed can soon remove the economy's training wheels if it continues to move in the right direction.

I think the Fed's caution is appropriate. The recovery remains fragile, and it would be irresponsible to spook markets with a stronger reduction. As Bernanke noted, fiscal policy remains extremely tight (you can thank Congress for that). And the Fed can always switch course, since the inflation rate isn't in danger of reaching the Fed's target of two percent anytime soon.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.