Don't believe the haters: Abenomics is working

Though the hard work has only just begun

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

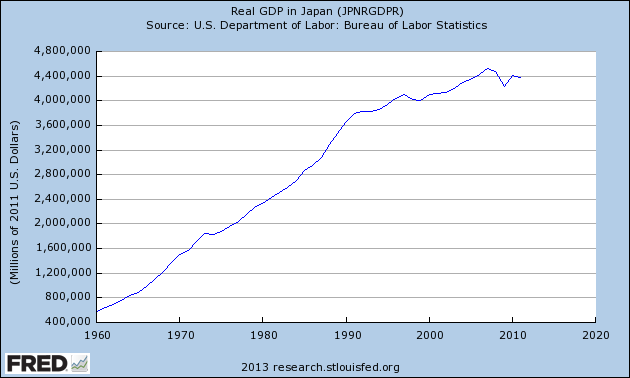

It has been one year since Prime Minister Shinzo Abe entered office and launched Abenomics — a three-pronged plan of monetary stimulus, fiscal stimulus, and structural reform — to lift Japan's economy out of two decades of deflation and economic depression.

Many economic commentators were initially skeptical of Abenomics. Hedge fund manager Kyle Bass, for example, thought that the program would lead to soaring interest rates and spiking inflation. This has not happened. In fact, all signs point to the fact that Abenomics is beginning to work.

Japan's long, deep slump began in the very early '90s, when 40 years of very strong economic growth — characterized by the global rise of Japanese corporations like Sony, Mitsubishi, and Toyota — abruptly ended, and real estate and stock market prices fell drastically. The initial slump lasted for more than a decade — Japan's lost decade. Plummeting asset prices resulted in a huge accumulation of toxic loans, and subsequent difficulties for many financial institutions.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Ever since then, Japan has suffered from a depressed economy — recessions and slow growth.

Between 1992 and 1997, the Japanese government spent money on infrastructure to stimulate the economy and the economy indeed grew, albeit at a slow rate of 1.7 percent. After 1997, as the stimulus ended and austerity measures began, Japan's economy fell back into recession. This pattern has continued ever since — each time a Japanese recovery began to take hold, Japan fell back into recession, whether as a side-effect of a global economic shock (2008) or due to Japan's central bank or government ending stimulus measures in 1998 and 2002.

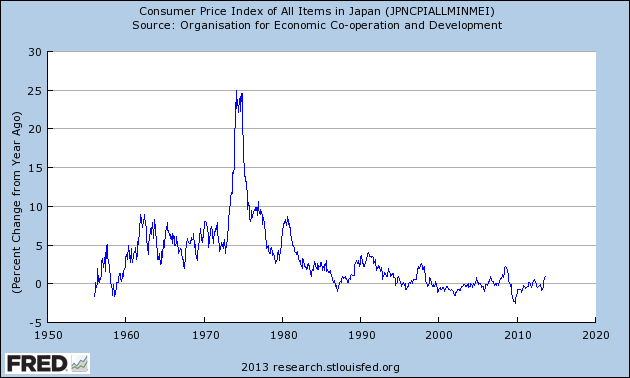

One key factor sustaining the Japanese depression was falling and depressed asset prices. Japan has experienced bouts of deflation throughout its depression:

(Federal Reserve Bank of St. Louis)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Lower asset prices might sound attractive to consumers because it means they get more bang for their buck, but it also has the effect of encouraging people to sit on cash and defer economic activity. This has become a particular problem for Japan in the past 20 years. Japanese households and firms are sitting on big piles of cash, largely because they anticipate deflation.

Abenomics aims to fight this cash-hoarding behavior with massive monetary easing. The Japanese central bank is engaging in a $3 trillion quantitative easing program, with the aim of generating two percent inflation.

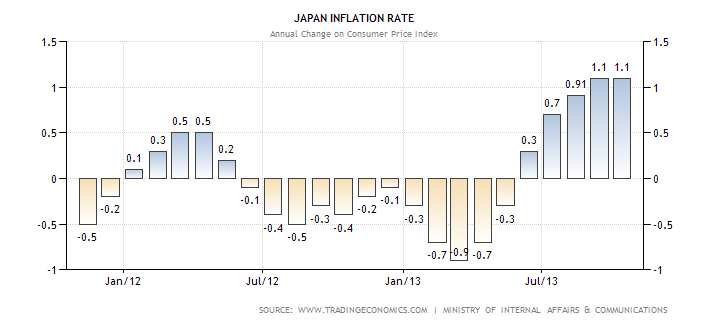

After starting the year with deep deflation, Japanese deflation has now ended, although inflation is still below two percent:

(Trading Economics)

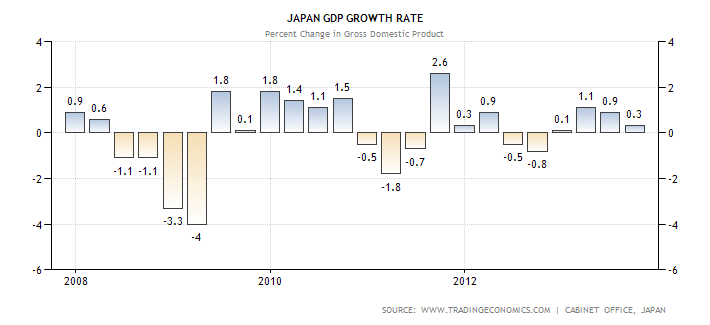

Abe also announced a $107 billion infrastructure-building fiscal stimulus program to reignite growth. Japan's economy is indeed growing, though not with incredible strength. Japan is forecast to achieve stronger growth in 2014.

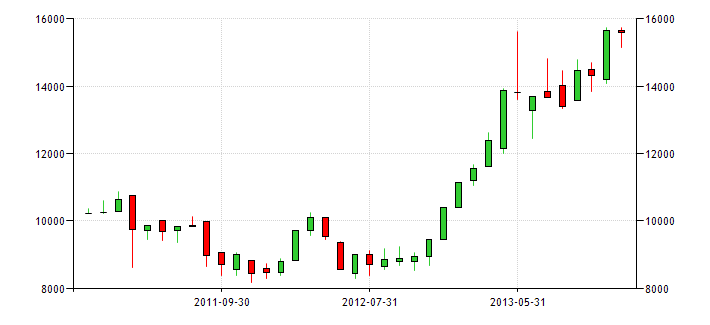

Meanwhile, the Nikkei-225 stock exchange has strongly improved in the last year, showing that overall, Japanese business and investment confidence is rising:

So the first two parts of Abenomics — monetary stimulus and fiscal stimulus — are beginning to hit their targets. However, the policies may not be sustainable. Although Japan's deflationary low growth created a stagnant and weak economy, the deflation also boosted the purchasing power of Japan's many pensioners, who have hoards of cash stuffed in mattresses and savings accounts. It remains to be seen if the Abe government has the vision and will to sustain these policies for the time necessary to achieve a self-sustaining recovery — especially as it hurts the purchasing power of Japan's aging population.

Meanwhile, the third prong of Abenomics — long-term structural reform — has yet to really begin.

Japan's labor markets are famously inflexible. Japanese firms are barred from firing most employees. This has led to the strange phenomenon of banishment rooms. As The Economist explains:

Some well-known firms, it was reported, were sending hundreds of employees into special rooms and leaving them with little or nothing to do all day...Most companies hang on to their excess workers, so their costs are inflated, leaving them unwilling to take on young employees or to raise salaries. This in turn has contributed to stagnant wages and continued deflation. [The Economist]

And Japan's economy is blighted by zombie firms — highly indebted and unprofitable operations surviving and servicing their debt only thanks to the low interest-rate environment. These unprofitable firms cannot afford to invest and grow. If these firms failed, it would open a gap in the market for new firms and new growth and investment. Or, if the economy recovered and incomes rose, many of these firms might shed their zombie status and start investing and growing again.

Abe is aiming to create a more flexible and responsive economy by increasing female participation in the labor force, by allowing zombie firms to fail where necessary, by reforming farmland ownership so farmers can own the land they farm on instead of renting it from the government, by allowing companies to fire employees more easily, and by allowing corporations to bring in independent directors to improve corporate governance.

Whether these longer-term reforms will be successfully implemented is unknown. Abenomics is off to a good start — but the hard work has just begun.

Editor's note: This article has been revised since it was first published in order to more clearly include proper attribution to source material.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

The environmental cost of GLP-1s

The environmental cost of GLP-1sThe explainer Producing the drugs is a dirty process

-

Greenland’s capital becomes ground zero for the country’s diplomatic straits

Greenland’s capital becomes ground zero for the country’s diplomatic straitsIN THE SPOTLIGHT A flurry of new consular activity in Nuuk shows how important Greenland has become to Europeans’ anxiety about American imperialism

-

‘This is something that happens all too often’

‘This is something that happens all too often’Instant Opinion Opinion, comment and editorials of the day