Is the rent really too damn high?

The evidence shows that renters' problems may lie elsewhere

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

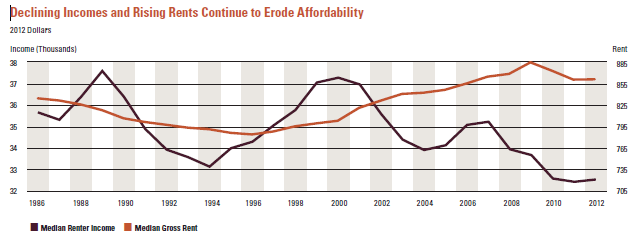

A new study from Harvard University shows that in the last 30 years, rents have risen and the income of renters has fallen:

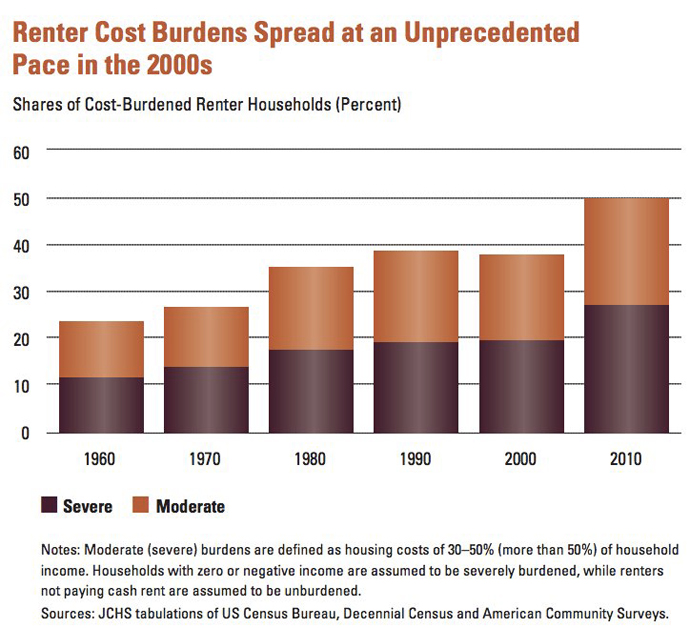

Indeed, more renters than at any point in recent history — just under half — are spending more than 30 percent of their income on rent. And of these renters, many are even devoting 50 percent of their income to rent:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This is clearly problematic. People who can’t afford their rent have to cut back on other essentials like food, transportation, and heating.

It also prompts an interesting question: Is the rent too damn high, or are incomes too damn low?

The Harvard study shows that 83 percent of those earning under $15,000 a year spend more than 30 percent of their income on rent. Even after the 2008 housing bust — which caused rents and housing prices to fall in the short term — there isn’t much housing available that low-income Americans can afford.

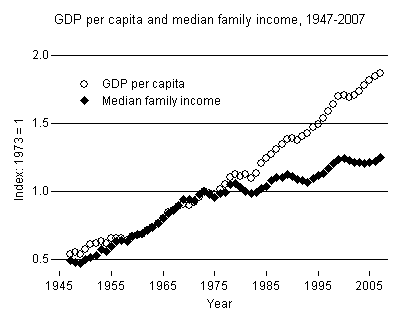

But the long-term rise in rent prices is not huge — and not out of line with the American population, which has also grown. If rents had risen this much, and incomes hadn’t fallen, the problem would be much smaller. The historically unusual phenomenon of the past 40 years is that incomes have totally failed to keep pace with growth in the wider economy:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In other words, falling income is the main problem, not rising rent.

As you can see, this trend began in the 1970s — precisely the time when globalization began to take hold and manufacturing migrated to places like China, where workers were willing to work for much less. This has been a major factor in depressing American wages and salaries. Meanwhile, American corporations that employ this foreign labor continue to make record-high profits.

Of course, as China and other developing countries develop, their wages are rapidly rising. But that won’t necessarily mean manufacturing jobs will come back to America. They’re more likely to go to other developing countries where workers are willing to work for less. Or if they do return to America, they will be coming back because robotic manufacturing costs have fallen below even foreign labor costs. That might create some jobs, but they will be higher-skilled jobs (e.g., in computer programming) than the ones they replaced.

So where does that leave the growing numbers of people struggling to pay the rent? Building more housing would not only create a larger supply, thereby driving down rents, but would also create jobs in construction and infrastructure. Raising taxes on corporations and high-income earners can yield funds to create jobs for the unemployed, build infrastructure, and invest in public projects like going to the moon. The strong economic growth and low unemployment of the 1950s and 1960s was accompanied by much higher taxes on the wealthy, and much more infrastructure building. And as I've argued before, the government could even start redistributing wealth in a more direct fashion.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

Political cartoons for February 21

Political cartoons for February 21Cartoons Saturday’s political cartoons include consequences, secrets, and more

-

Crisis in Cuba: a ‘golden opportunity’ for Washington?

Crisis in Cuba: a ‘golden opportunity’ for Washington?Talking Point The Trump administration is applying the pressure, and with Latin America swinging to the right, Havana is becoming more ‘politically isolated’

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more