Bitcoin would benefit from being boring

Wild price fluctuation isn't exactly a good thing for a fledgling currency

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

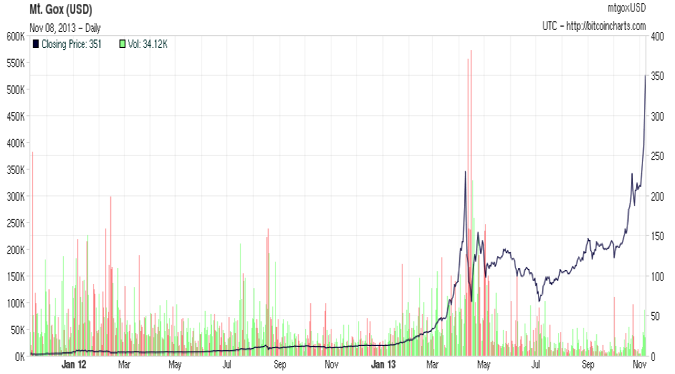

Last week, Bitcoin prices catapulted from around $200 to over $350. That made the digital currency's total purchasing power an incredible $3.2 billion — all generated from nothing but people's desire to participate in a new, intangible system. And now, some major offline chains like Subway are beginning to join online-only businesses like Reddit, Wordpress, and Amazon in accepting the digital currency.

But Bitcoin has many skeptics.

Joe Weisenthal of Business Insider wrote last week that Bitcoin is a "currency for clowns," claiming it has no intrinsic value, unlike state-backed currencies. Column after column after column after column call Bitcoin a bubble that is going to burst. And indeed, while Bitcoin is one of the most fascinating economic and social developments of our time, it is hard to see it as a successful monetary system at present.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

(Related: Everything you need to know about the Bitcoin boom.)

Money has three functions: A medium of exchange, a stable unit of account, and a store of purchasing power. While Bitcoin is beginning to achieve a wider acceptance with merchants as a medium of exchange, its extreme volatility in price means that it cannot really be seen as a stable unit of account or store of purchasing power. Its price fluctuations are far too drastic:

Bitcoin appears to be behaving as a speculative vehicle — less like a currency and more like an early stage technology stock. Speculators are buying into a novel piece of technology in the hope that it will become the next big thing. Whether Bitcoin rapidly goes bust like the dotcom failures Webvan or Pets.com, or whether it grows into a behemoth like Google, Amazon, or yes, Paypal, remains to be seen.

But if it were actually used as a piece of useful technology, than it might have a better shot at sticking around. Let me explain.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There are three main threats to Bitcoin at present:

1. Most obviously, the speculation itself could be problematic. Big booms often lead to big busts, and severe volatility may prove a big hurdle to further growth.

2. Bitcoin's challenge to state power — not least the state monopoly over the issuance of currency — is also a weakness. Since it's an alternative currency system, many governments may worry that Bitcoin could become a means for tax evasion. While prohibiting the currency wouldn't stop people from using Bitcoins entirely — they are an anonymous and global system — large countries like the U.S. outlawing Bitcoin would make it much harder for the digital currency to gain any kind of mainstream business acceptance.

3. Even if Bitcoin succeeds and becomes a global system, it will run into problems typical of other hard currencies (like the gold standard): Deflationary slumps where wages and the prices of goods and services fall. Debt denominated before the slump will become much harder to repay, leading to defaults, business failures, and unemployment, which will worsen the slump in a kind of nightmarish deflationary spiral.

However, if Bitcoin embraces its role as a complementary currency and payments system — rather than aspiring to be a sole currency — then mass deflationary busts may not prove to be a problem, and the danger of it being outlawed by powerful countries would diminish. There would be other benefits as well.

People who might not be looking to create a revolution could still benefit from its low-friction payments system. Forward-thinking governments could consider building Bitcoin-style features into existing currencies for frictionless payments. People could exchange regular dollars for virtual dollars kept in a Bitcoin-style virtual wallet to be used for transactions. This would remove what is probably the greatest disincentive against partaking in the Bitcoin economy: Speculation. If the price of Bitcoin is constantly rising due to growing speculation, people will refrain from economic activity and just sit on their Bitcoins, watching their purchasing power grow. Having a virtual payments system denominated in regular currency removes this barrier.

So while the crypto-anarchists may envision a world in which the state's monopoly on money is undermined by a new decentralized monetary system, the reality of Bitcoin may — and probably should — be far more mundane.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day