Why BlackBerry's open letter was a terrible idea

You can count on BlackBerry, says BlackBerry

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

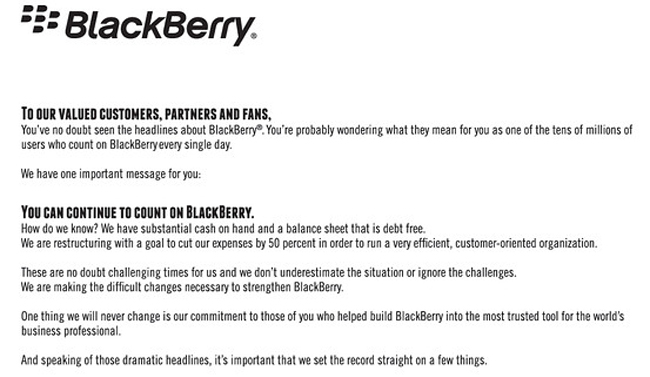

BlackBerry has a surprisingly optimistic message for its "valued customers, partners, and fans."

On Tuesday, the embattled smartphone maker took out full-page ads in The Wall Street Journal and 30 other publications across nine countries, to spread the word that everything is hunky-dory.

Here's a look at the opening:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

BlackBerry then goes on to state that the company is flush with cash and debt-free, and that despite recent hard times, the trusty brand is here for the long haul.

The last claim, of course, runs against some pretty convincing evidence to the contrary. Once the go-to smartphone for professionals, over the past five years Blackberry has lost 93 percent of its stock value, as touch screen smartphones like Apple's iPhone and Google's Android have gobbled up market share. In September, the company announced that it was forced to write off $934 million from unsold Z10 handsets — considered the company's last ditch effort to revitalize sales.

Shortly afterward, the company announced that it was up for sale, and that the investment firm Fairfax Financial Holdings was close to buying it for $4.7 billion. Meanwhile, reports say the company may soon be broken up and sold in pieces, "a prospect that analysts think looks increasingly likely as the Nov. 4 deadline for a formal bid approaches," says The Guardian.

All of which is to say: It may take more than an ad to convince the world the company is hale and hearty. When the ad was released to the press on Monday night, the share price slid — an unmistakable sign that it didn't exactly fill Wall Street with hope and optimism.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In fact, the letter may have had the opposite impact the company intended.

"It’s hard to read the company’s open letter as anything other than a desperate, defensive squeal of pain. Or a last-ditch effort to highlight its strengths in the hope of attracting a new bidder," says John Paczkowski at All Things D.

Regardless, it’s generally unwise to remind the public that your company is in trouble — or perceived as being in trouble. But if the situation has become so dire that the media’s chronicling of it has longtime customers fleeing, then perhaps desperate measures really are called for. [All Things D]

Still, it may be too soon to dig a grave for BlackBerry. The stock today recovered from yesterday's slide, and is now up 2 percent — that isn't much, but still something.

To survive, it will have to back up its letter's claims. "Here’s the thing though — as optimistic as the letter is, words are cheap and platitudes are unconvincing," says TechCrunch. "BlackBerry needs to prove to its core customers that it’s still a viable horse in a race dominated by nimble giants, and I wish them the best. They’re going to need it."

Here's the full ad:

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.