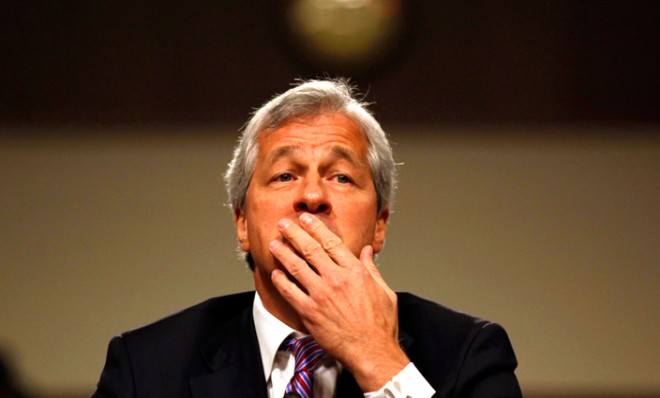

Can Jamie Dimon weather the storm?

JPMorgan's chief is having a terrible month

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

This morning, JPMorgan Chase CEO Jamie Dimon arrived at the Justice Department to meet with Attorney General Eric Holder about an investigation into the company's sale of shoddy mortgage-backed securities in the run-up to the recession.

After last week's painful $920 million settlement for charges related to the London Whale trading loss, a source told Bloomberg that Dimon is now facing fines up to $11 billion ($7 billion in penalties plus $4 billion in consumer relief). Depending on the final number, and how many charges go into the bundle, it easily will be the biggest settlement a bank has paid in the history of financial regulation.

The recent swirl of settlements sheds new light on JPMorgan, which back in 2008 was credited with emerging from the financial crisis relatively unscathed. In March of that year, Dimon "acted boldly" to "scoop up the remains of the wrecked investment bank Bear Stearns in a government-orchestrated salvage operation that forestalled even greater panic," says Paul M. Barrett in Bloomberg Businessweek. "His generally savvy stewardship" left JPMorgan relatively in the clear, as the financial industry crumbled around them.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But now, as the bank forks over bigger and bigger fines for the kinds of misbehavior it allegedly avoided before the crisis, Dimon's reputation is taking a beating. If the Feds had their way, he'd pay with his job, says Charles Gasparino at the New York Post. He explains:

[Dimon] continues to have the support of the people who think they're in charge of the bank: His board and investors. After all, Morgan's stock price has held up remarkably well, despite all the bad publicity. Shares even spiked on Wednesday's news that the firm is nearing a deal with the feds to pay $11 billion to settle a bunch of cases, as investors cheered the possibility that the regulatory onslaught was coming to an end.

But the firm's health is irrelevant to the people who are really in charge — namely the Obama administration and its cronies across the nation's most powerful law-enforcement agencies (state Attorney General Eric Schneiderman is a prime example).

For them, JP Morgan is worth nothing but scorn, class-warfare envy, and lots and lots of fines. And Dimon is, on top of all that, a major nuisance whose ouster would teach a lesson to the rest of the industry. [The New York Post]

Not only that, but with Dimon, "the Obama administration would finally have its financial crisis CEO scalp, even though he had nothing to do with the financial crisis in the first place," says Gasparino.

But Washington aside, what about the bank's board of directors?

"When it comes to holding Dimon accountable for the London Whale scandal, Chase has sent decidedly mixed messages," says Jason Gold at US News. "Its boards of directors cut Dimon's stratospheric pay in half – to $11.5 million from $23 million – but let him keep both titles: Chairman of the board and CEO."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Whatever the outcome, all the regulatory attention has shed a new light on the bank, which was "never as well managed as it appeared," says Joe Nocera in The New York Times:

The fact that the London Whale trades were being marked differently by two areas of the bank suggests that something was seriously awry. Ditto the investigation regulators opened last September, resulting in a cease-and-desist order a few months later, into whether JPMorgan had appropriate safeguards against money laundering. That kind of compliance is part of the blocking and tackling of the banking business. Only now is the bank hiring thousands of compliance officers who should have been in place years ago. [The New York Times]

Critics of the big banks aside, Gold says, these investigations will have a positive impact on the financial system. "No doubt Dimon — and his fellow CEOs — will be running a tighter ship in the future."

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.