The Fed's easy-money extension is a short-term band-aid

Buying $85 billion in bonds for a few more months won't exactly cure what ails us

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

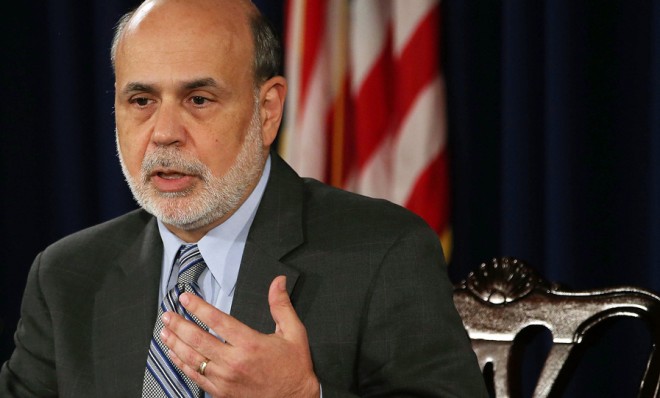

On Wednesday, the Federal Reserve shook up global markets by... well, essentially, doing nothing new. Chairman Ben Bernanke, true to his "Helicopter Ben" sobriquet, announced that the Fed would continue, full steam ahead, with its $85 billion-a-month quantitative easing program. Just about everyone had expected Bernanke to say the Fed was starting its long-awaited bond-buying "taper."

The reason the Federal Reserve will continue buying up $45 billion worth of Treasury paper and $40 billion in mortgage-backed securities each month, at least for now, is that the economy isn't recovering fast enough, especially on the employment front. And why is that? "In a word, Congress," says The Week's Carmel Lobello. Yes, "because Congress is horrible," agrees Neil Irwin at The Washington Post.

That was a recurring theme in the communications that emanated from the Fed and its chairman, Ben Bernanke, Wednesday afternoon. Indeed, taken together, it is a sense of frustration coming out of the nation's central bank. He is in effect yelling, from one end of Constitution Avenue to the other, "WHAT ARE YOU DOING??? We're busting our tails over here to try to keep this economy on track, and you clowns can't do your jobs well enough to avoid messing the whole thing up." [Washington Post]

Not everyone agrees with that assessment — Michael Gapen, chief U.S. economist at Barclays, said "he believed the Fed had purposely misled investors to push up interest rates and knock out speculation in risky financial products," notes Nathaniel Popper at The New York Times.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But the more pressing question is what the Fed will accomplish by keeping the stimulus spigot open?

In the short term, the continued quantitative easing should lower interest rates — which rose during the summer, partly in anticipation of the Fed tapering off its intervention. That's good news for people buying a car or house, and the Fed's decision juiced the stock market, which benefits from money being poured into financial markets. But the money-drops have to end at some point, and "analysts still expect the Fed to begin reducing stimulus at some point this year," says E.S. Browning at The Wall Street Journal.

That means that, as the next Fed policy meeting scheduled for Oct. 29-30 draws nearer, stocks could sink amid the same uncertainty and confusion that sent markets into a funk in August.... While short-term traders love the liquidity, some investors more focused on the longer term weren't pleased. They worry that U.S. stocks in particular are becoming overpriced and too dependent on government support. When the Fed begins withdrawing that support, they say, the market reaction could be more negative than if the Fed had begun the process this month. [Wall Street Journal]

There is also, let us not forget, the Fed's rationale for keeping the money coming: The economy just isn't that strong. On the other hand, "inflation remains below the Fed's target, giving further room for more stimulus," says Russell Lynch at Britain's The Independent. So who cares if this is just a temporary fix? "Bernanke has nothing to lose by hanging a little longer to check that this recovery is the real deal. It's no time for gambling."

Bernanke was right to forego "the 'Septaper' — get it, tapering in September — that most had assumed was a fait accompli," says Matthew O'Brien at The Atlantic. Turning off the spigot now "would have been a big mistake." But it's not all sunshine and flowers: "The bad news is that 'Octaper' is now a word." Watch for the drama to unfold again next month.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.