Tapering delayed: Why the Fed is continuing its easy-money policies

Surprise!

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

On Wednesday, the Federal Reserve unexpectedly decided not to scale back its $85 billion-a-month quantitative easing program, saying the economy just isn't ready yet for the so-called "taper."

"The Committee has decided to await more evidence that progress will be sustained before adjusting the pace of purchases," the central bank said in a statement, following two days of deliberations by the Fed's policy-making board, the Federal Open Market Committee.

Under the program, the Fed buys $45 billion worth of Treasurys and $40 billion in mortgage-backed securities every month, the point of which is to tether interest rates to the ground and stimulate economic growth. The program is especially crucial for the housing market, which more directly feels the benefits of the Fed's mortgage-asset purchases.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

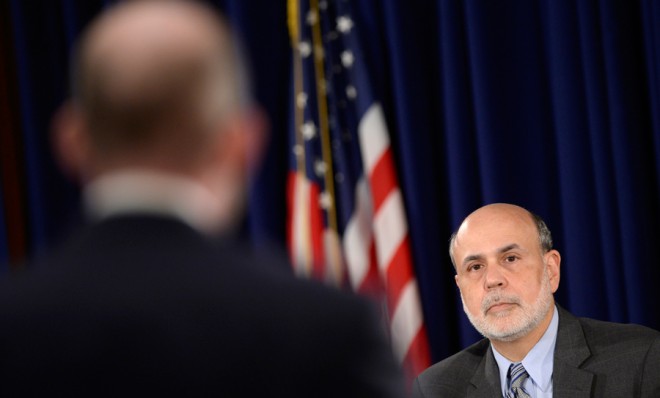

But the central bank has to pull back at some point, and in June, Fed Chairman Ben Bernanke said the Fed planned to start tapering as soon as later this year — just as long as the economy continued its path to recovery. Most economists and analysts expected Bernanke and Co. to announce the first stage of tapering today.

So why did the Fed hold back? In a word, Congress.

The central bank said that the economy is improving, but that it decided to maintain current policy because of "federal fiscal retrenchment," a reference to Congress' indiscriminate budget-slashing. Congress last spring passed the so-called sequester — across-the-board spending cuts that have bitten into economic growth — because Republicans and Democrats could not come up with a deal to lower the long-term budget deficit.

Furthermore, in a best-case scenario, Congress will continue those cuts for another year. In a worst-case scenario, Congress will shut down the government, default on the country's debt, and send the global economy into a tailspin. All of which means the Fed, as the only adult in the room, may have to continue propping up the economy for some time.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In addition, the FOMC noted that there has been a "tightening of financial conditions" in recent months, which "could slow the pace of improvement in the economy and labor market." The irony is that Bernanke himself is somewhat to blame for this trend, since financial markets began to freak out only when the Fed announced its intention to taper.

Slate's Matt Yglesias explains the conundrum the Fed faces going forward:

The punchline is that the tightening of financial conditions in recent months was caused by ... rumors that the Fed was going to taper. There's a bit of a Möbius Strip problem here. If markets think the taper is imminent, you get tight financial conditions and then those conditions become a reason not to taper. [Slate]

The about-face has led some to question whether Bernanke has made a mistake in telegraphing the Fed's moves, a hallmark of his tenure that is intended to increase transparency and bring stability to financial markets. Others, however, see Bernanke following through on his promise. "Fed does what it said it would do — make its decisions based on the data," says Scott Sumner at The Money Illusion. "Good for them, and good for policy credibility."

Naturally, markets are reacting favorably to the news that the easy money will keep flowing at full blast — even though the decision was arrived at because the economy is still too weak to take care of itself. Indeed, the Dow Jones Industrial Average and the S&P 500 blew past record highs in the immediate aftermath of the FOMC's statement.

That's what happens when you give investors another round at the punch bowl.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the Royal Family from his disgraced brother but a ‘fit of revolutionary disgust’ could still wipe them out

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?