What does it take to be wealthy in America?

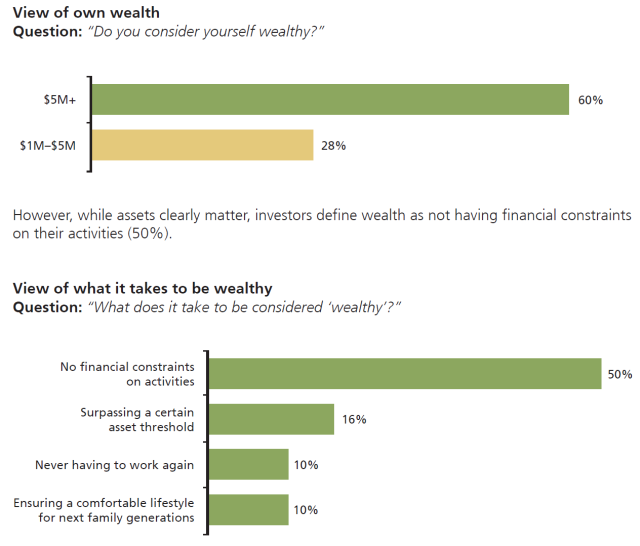

60 percent of people worth $5 million or more see themselves as wealthy. In the $1 million to $5 million bracket, only 28 percent feel wealthy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Wealth, while defined by Merriam-Webster as an "abundance of valuable material possessions or resources," is not so clear cut in its definition among investors, though that explanation is certainly close.

UBS surveyed an array of investors and found some interesting facts about what it means to be wealthy in America, namely, differences in the amount needed to feel wealthy, priorities, and planning. Americans are a diverse lot, and while there is some consensus on the questions posed, there was no shortage of perspectives.

What that in mind, here's a look at five ways Americans view wealth.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

1. What is "wealthy"?

Most fundamentally, Americans are not united in this concept, and as the chart below shows, the percentage of people who consider themselves wealthy differs drastically by income. According to UBS's data, most people consider being wealthy as the freedom from financial constraints on what they are able to do, and $5 million seems to be the number to get there.

[Source]

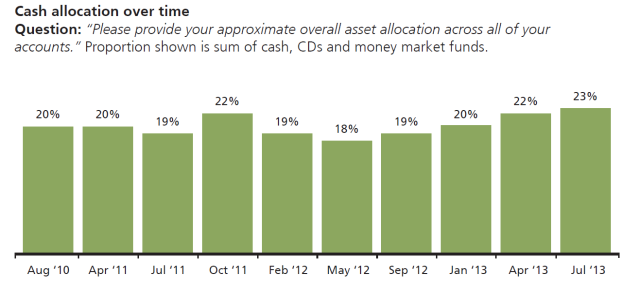

2. Cash rules everything around investors

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Data has consistently shown that cash is the most important factor in feeling financially secure. Twenty percent allocation seems to be the magic number, as this much gives investors the confidence in their situation they need to live life the way they want. Moreover, UBS notes that cash holdings give investors the confidence they need to get more aggressive with other investments while not exposing themselves to financial ruin.

[Source]

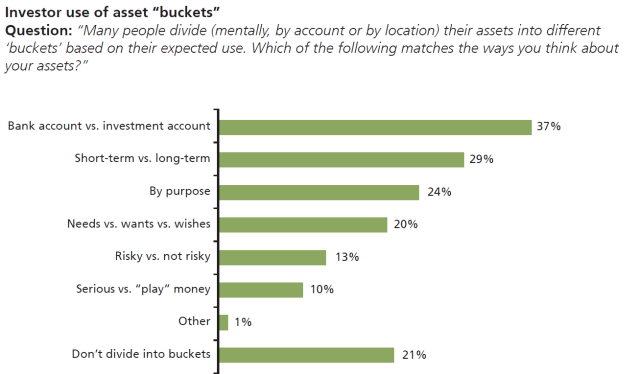

3. "Buckets"

This method of thinking about money seems to help investors stay more organized, though a very reasonable 21 percent don't categorize their assets in this fashion. Buckets allow investors to think of their money as having different objectives, helping to differentiate risk and keeping their goals in line with their investment allocation.

[Source]

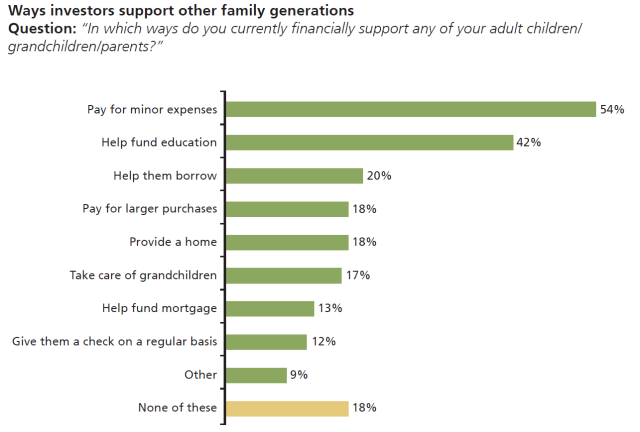

4. Looking out for loved ones

Most uplifting from the survey is this: The second-most pressing concern for investors is the well being of their children and grandchildren — it represents a substantial way in which investors are still taking care of their family. But Americans don't mind. In fact, the majority of people are happy to look out for their families, with 82 percent enjoying looking out for their grandchildren and 76 percent enjoying taking care of their adult children. Even 59 percent are happy to look after their parents.

[Source]

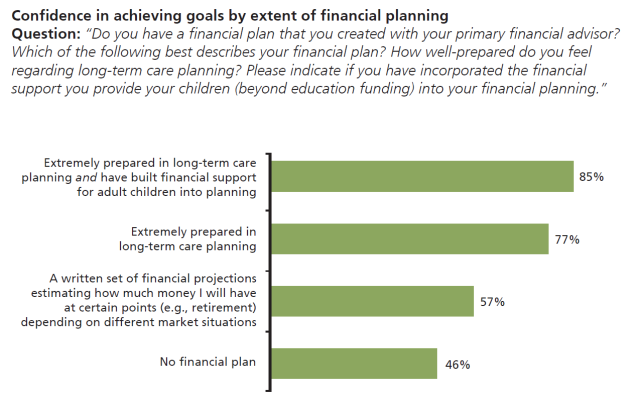

5. Being prepared

While most investors feel prepared in looking after their retirement, only a fraction feel that they have readily prepared to take care of their children and provide for their own long-term care. Thirty-six percent of investors are not prepared for long-term planning, according to UBS, and only 41 percent have taken measures to support their adult children, while 57 percent feel they should do so.

[Source]

More from Wall St. Cheat Sheet...

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years