Making money: Keeping cooling costs down, and more

3 top pieces of financial advice — from insuring a teenage driver to prioritizing financial goals

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Keep cooling costs down

Summer is heating up, said Regina Lewis at USA Today. But before you "crank up the AC," think about how to lower your energy bill along with the temperature. Creating shade by planting trees and dressing your windows will "add to your home's curb appeal" and provide "eco-friendly" cooling by blocking out sunlight. You should clean your air conditioner's filter once a month to improve its efficiency and your home's air quality. Consider installing a programmable thermostat, too; they can save you up to $180 a year. And try supplementing your air conditioner with simple, inexpensive fans. Circulating the air in your home can allow you to set the AC's temperature higher. According to the Environmental Protection Agency, just "a 2-degree increase can lower cooling costs by up to 14 percent."

Insuring a teenage driver

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If you have a teenager who's getting behind the wheel, steel yourself for higher insurance costs, said Ann Carrns at The New York Times. A married couple with two cars pays an average $2,000 more per year just by adding a teenager to their policy. While insurers use many factors to calculate premiums, "there are some ways to manage the cost" of adding a young driver to your plan. One is to just wait: "As teenagers get older, the financial impact on premiums lessens." Adding a 16-year-old to your policy costs much more than adding a 19-year-old. Look for discounts, too — many insurers offer lower premiums if young drivers demonstrate their responsibility by earning good grades or taking safe-driving courses.

Financial goals prioritized

Are you torn over which money goals to tackle first? asked Melanie Hicken at CNN.com. "Retirement savings should be at the top of your list." Even if you're young, aim to put away 10 percent of your annual income each year, using employer-sponsored plans and Roth IRAs. If you're saddled with student loan debt, that comes next. "Despite a recent hike in student loan rates," Stafford loans carry a rate of just 6.8 percent — that's half the average rate on credit cards. So try to plan a budget that lets you pay them off without sacrificing on retirement and other savings goals. And before you consider big-ticket items, such as a car or house, make sure to build "a sizable cash reserve" — at least three months' worth — for surprise situations, such as a lost job or a medical emergency.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

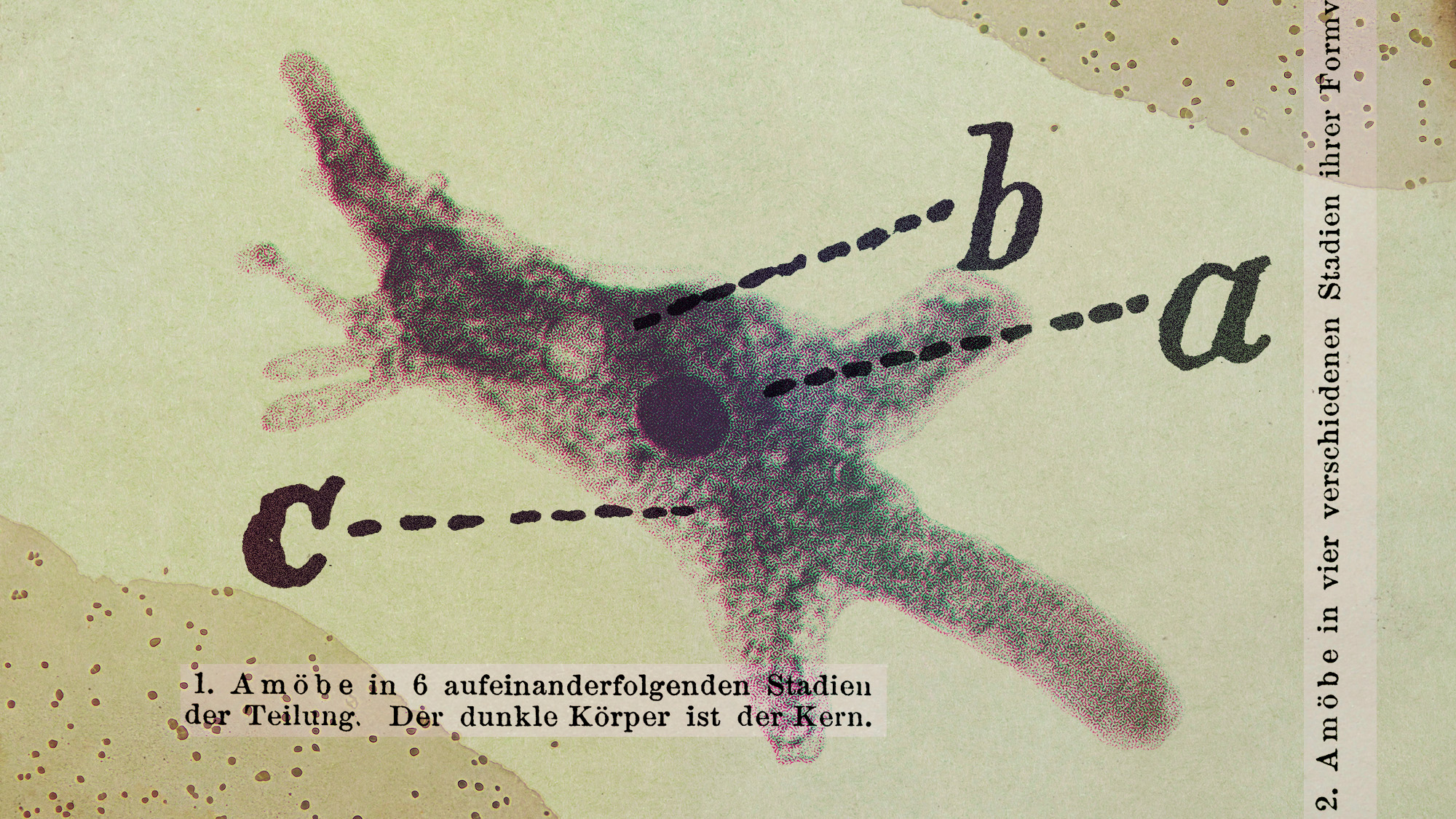

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’